I just dumped Fundsmith Equity from my Stocks and Shares ISA and SIPP. Here’s why

The Fundsmith Equity fund has been a core holding in my Stocks and Shares ISA and pension accounts for a long time. And over the long term, it’s been a good investment for me.

Recently however, I decided to offload the fund and redeploy the capital into other investments. Hereâs why I made this move.

Terrible performance in 2025

Iâve been concerned about the performance of this fund for a while now. That’s because it hasnât kept up with the market in recent years.

Last yearâs performance was the final straw for me. In a year in which pretty much every major index went up significantly (the MSCI World index returned 12.8%), this fund only returned 0.8%.

| 2025 | 2024 | 2023 | 2022 | |

| Fundsmith Equity | 0.8% | 8.9% | 12.4% | -13.8% |

| MSCI World | 12.8% | 20.8% | 16.8% | -7.8% |

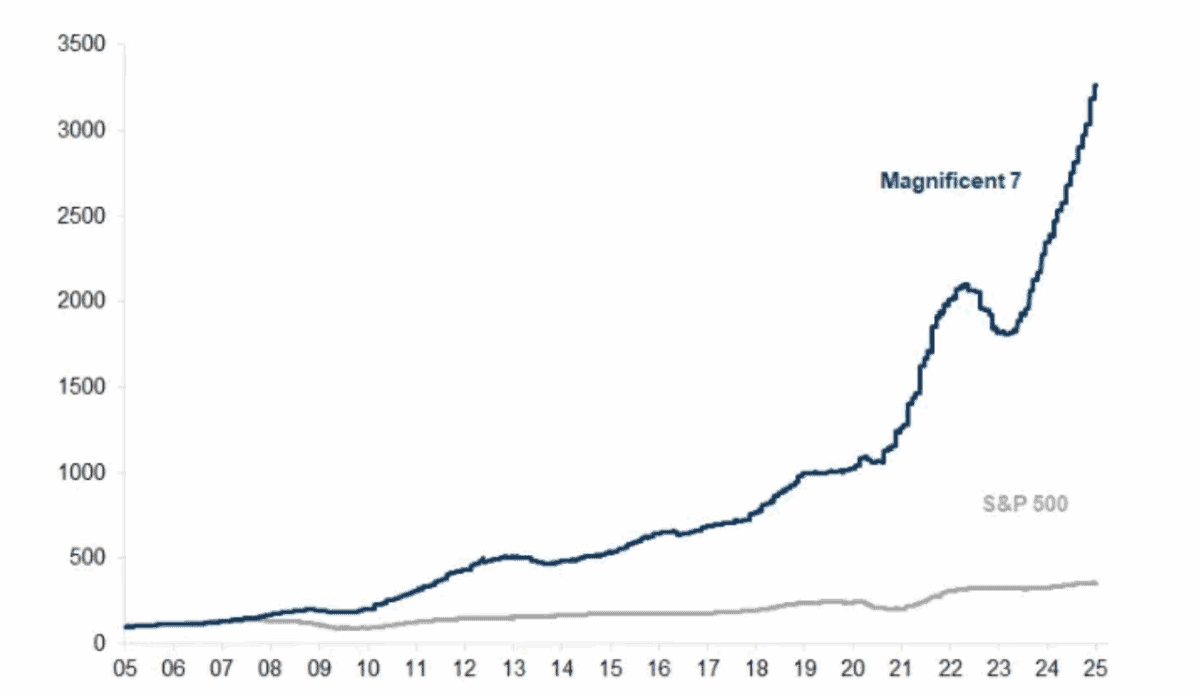

What’s gone wrong? Well, one issue is that the fund hasnât fully participated in the tech stock boom.

In his annual letter, fund manager Terry Smith highlighted the current market concentration in Magnificent Seven stocks as a risk. Thereâs a reason the market’s concentrated in these names however, and thatâs because their earnings have soared in recent years.

2026 outlook

Now, I do like Smithâs âqualityâ style of investing â itâs similar to my own. However, looking ahead, Iâm unconvinced the fund has the potential to beat the market in 2026.

Hereâs a look at the top 10 holdings in the fund at the start of the year versus the top 10 of the Vanguard FTSE All-World UCITS ETF (LSE: VWRP).

| Fundsmith Equity | Vanguard FTSE All-World UCITS ETF |

| Waters | Nvidia |

| Stryker | Apple |

| IDEXX | Microsoft |

| Visa | Amazon |

| Marriott | Alphabet Class A |

| LâOreal | Broadcom |

| LVMH | Alphabet Class C |

| Unilever | Meta |

| Alphabet | Tesla |

| Automatic Data Processing | Taiwan Semiconductor |

Looking at Fundsmithâs top holdings, theyâre not bad companies. In fact, theyâre all world-class companies. However, right now, many are just as expensive as the Mag 7 tech stocks in the Vanguard fund. Waters, for example, trades on a price-to-earnings (P/E) ratio of about 28.

Iâd expect the stocks in the Vanguard fund to generate more growth in the near term however. This year, Nvidiaâs revenues are forecast to rise 54% versus 6% growth expected for Waters.

High fees

A third reason Iâm bailing on Fundsmith is the fee structure. Ultimately, itâs too high given the lack of performance. Currently, annual fees through Hargreaves Lansdown are 0.94%, compared to 0.19% for the Vanguard fund above.

I donât think Smith and his team are doing enough to justify the high fee. For that fee, Iâd want to see better stock-picking ideas.

Where have I put the money?

As for where Iâve redeployed the capital, Iâve put it into two different tracker funds. One is the Vanguard fund mentioned above.

With this fund, I get exposure to over 3,600 different stocks for a very low fee. And the beauty is, winners can run and run (like Nvidia has in recent years).

The other fund Iâve gone with is the Legal & General Global 100 Index Trust. This is a low-cost tracker that provides exposure to the 100 largest companies in the world.

Itâs worth noting that these funds also have their risks. If the Technology sector has a meltdown, these products are likely to underperform.

Iâm bullish on technology however, so Iâm comfortable with the risks (and believe the funds are worth considering).

Iâll point out that I may come back to Fundsmith at some point in the future. As I said, I like Smithâs quality approach. I just feel that right now, there are better investments.

The post I just dumped Fundsmith Equity from my Stocks and Shares ISA and SIPP. Hereâs why appeared first on The Motley Fool UK.

Should you invest £1,000 in Vanguard Funds Public Limited Company – Vanguard FTSE All-World UCITS ETF right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Vanguard Funds Public Limited Company – Vanguard FTSE All-World UCITS ETF made the list?

More reading

Edward Sheldon has positions in Apple, Amazon, Alphabet, Nvidia, Visa, Legal & General Global 100, and the Vanguard FTSE All-World UCITS ETF. The Motley Fool UK has recommended Alphabet, Amazon, Apple, Idexx Laboratories, Meta Platforms, Microsoft, Nvidia, Taiwan Semiconductor Manufacturing, Tesla, Unilever, and Visa. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.