I don’t care if the stock market crashes. I’m still buying cheap UK shares

On both sides of the Atlantic, there have been plenty of warnings of a stock market correction or, worse, a full-blown crash. Concerns that we’re in the middle of an artificial intelligence bubble are driving these fears.

But despite these worrying predictions, Iâm continuing to buy UK shares. Here are a couple that I recently bought.

Cheers!

Not to be confused with the US company, Coca-Cola HBC (LSE:CCH) holds the exclusive rights to distribute the American groupâs drinks in 28 countries in Europe and Africa.

Analysts are expecting strong earnings growth over the next five years with emerging markets being the biggest contributor. If these forecasts prove accurate, based on a current (19 January) share price of £39.16 (â¬45.16), it implies a forward (2029) price-to-earnings ratio of 11.8. This would be incredibly cheap for the sector, the FTSE 100, and — based on history — for the stock itself.

| Year | Forecast earnings per share (â¬) | Change (%) | Forward price-to-earnings ratio |

|---|---|---|---|

| 2024 | 2.28 (actual) | +9.5 | 19.8 |

| 2025 | 2.63 | +15.4 | 17.2 |

| 2026 | 2.86 | +8.8 | 15.8 |

| 2027 | 3.14 | +9.8 | 14.4 |

| 2028 | 3.48 | +10.8 | 13.0 |

| 2029 | 3.82 | +9.8 | 11.8 |

A 69% increase in its dividend is also predicted, lifting the stockâs yield to 3.9%.

These forecasts were compiled before the group announced its intention to acquire 75% of Coca-Cola Beverages Africa for $2.6bn. This will give the group access to another 14 countries accounting for approximately 40% of sales volumes on the continent.

Although it remains a highly competitive industry and there are fears that weight-loss drugs could affect demand, I like the groupâs policy of having a drink for every occasion round the clock. And itâs more than about Coca-Cola. Set alongside these impressive forecasts, that’s why I decided to add the stock to my portfolio and why others could consider doing the same.

A big reboot

After suffering a torrid time as a result of falling sales, distribution issues, and US tariffs, the Dr Martens (LSE:DOCS) share price has been on the back foot since its IPO.

Admittedly, the stockâs not cheap based on its current financial performance. But if it can achieve the March 2028 (FY28) forecast earnings per share of 6.1p, itâs a different story. The investment case therefore rests on whether this is achievable. I think it is.

Challenges remain. There are many cheaper alternatives out there. And it’s hard to remain relevant in the fashion industry.

However, the groupâs turnaround strategy of selling more directly to customers and entering into partnerships in new markets, show signs of working. Its half-year FY26 results revealed a 33% increase in shoe volumes compared to a year earlier.

I reckon the brand retains its iconic status. And despite its woes, itâs been reducing its debt and stock levels. More will be known when the group releases its next trading update on 27 January. But I think itâs one for patient long-term investors to consider.

Lots to choose from

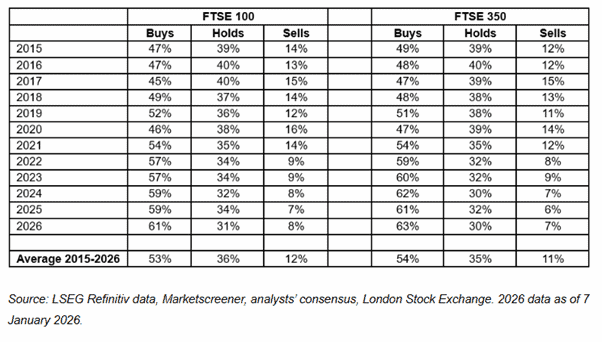

In my opinion, these are just two interesting UK shares. And as the table below shows, analysts appear optimistic about the prospects for the majority of stocks on the FTSE 100 and FTSE 350, with Buy recommendations of 61% and 63%, respectively.

I believe that the stock market will crash or, at the very least, experience a correction soon.

This isnât me being gloomy. Itâs an opinion based on the fact that there have been plenty in history. But the key is not to panic and keep seeking out those bargains. Taking a long-term view is essential when looking to build wealth.

The post I don’t care if the stock market crashes. I’m still buying cheap UK shares appeared first on The Motley Fool UK.

Should you invest £1,000 in Coca-Cola HBC AG right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Coca-Cola HBC AG made the list?

More reading

- I sold Diageo and Greggs. Should I dump this FTSE 100 stock too?

- I own these 5-star FTSE dividend stocks! Can you guess what they are?

- My ISA and SIPP stocks are off to a flyer in 2026!

- 3 top FTSE 100 investing ideas for 2026!

- Martin Lewis is talking about stocks and shares. Is it time to listen to the ‘most trusted man in Britain’?

James Beard has positions in Coca-Cola Hbc Ag and Dr. Martens Plc. The Motley Fool UK has recommended Aj Bell Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.