How a stock market crash could help set you up for lifelong financial freedom

A stock market crash might seem like an intimidating prospect. But for those who are prepared, it can be an opportunity to make life-changing investments.

Historically, the best returns come from buying shares when prices are low. So while itâs impossible to know when the next crash is coming, investors should probably be on the lookout.

Equity returns

Thereâs no magic formula that can tell you exactly when is the best time to buy shares. But that doesnât mean investors shouldnât try to make the most of the information that is available to them.

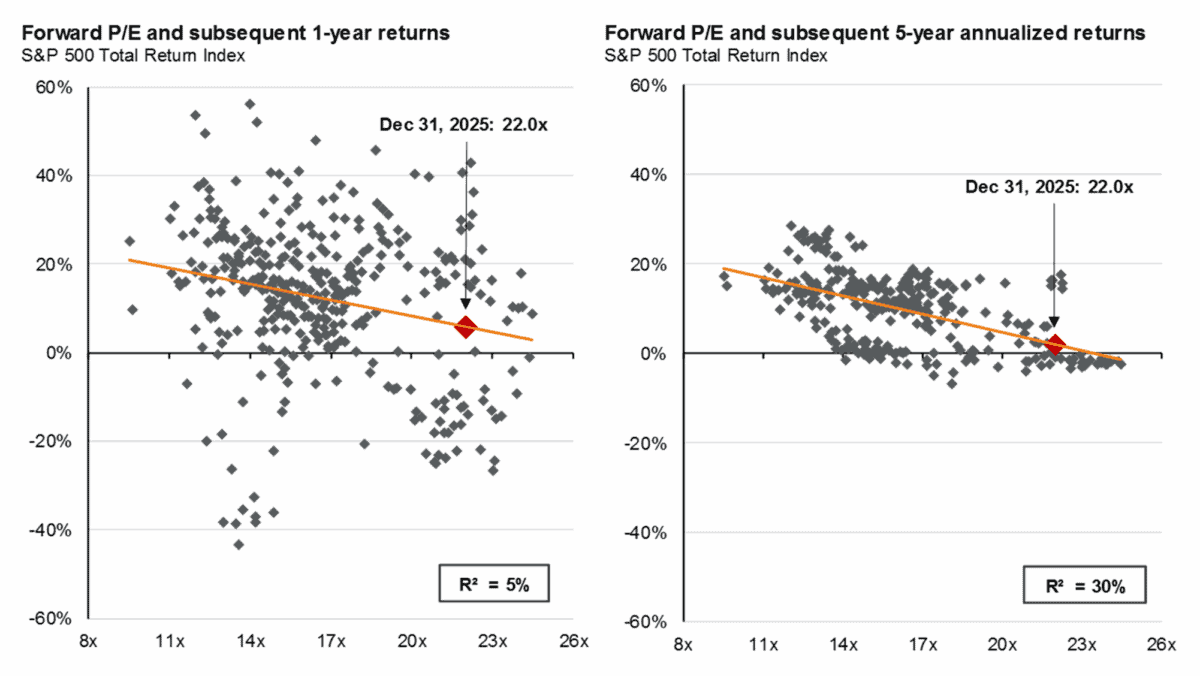

Data from JP Morgan Chase shows a strong negative correlation between valuations and returns. Put simply, returns have been best when the S&P 500 has traded at lower price-to-earnings (P/E) ratios.

Source: JP Morgan Guide to the Markets Q1 2026

The correlation isnât perfect â especially over a short timeframe. But it becomes much stronger over a five-year period and this is something investors should pay attention to.

At the start of the year, the S&P 500 was trading at a level corresponding to an average five-year return of around 3%. But if the multiple falls 20%, that historic figure doubles.

What to do?

This might make it look as though the best thing to do is to wait until a better buying opportunity presents itself. But I donât think thatâs a particularly good idea.

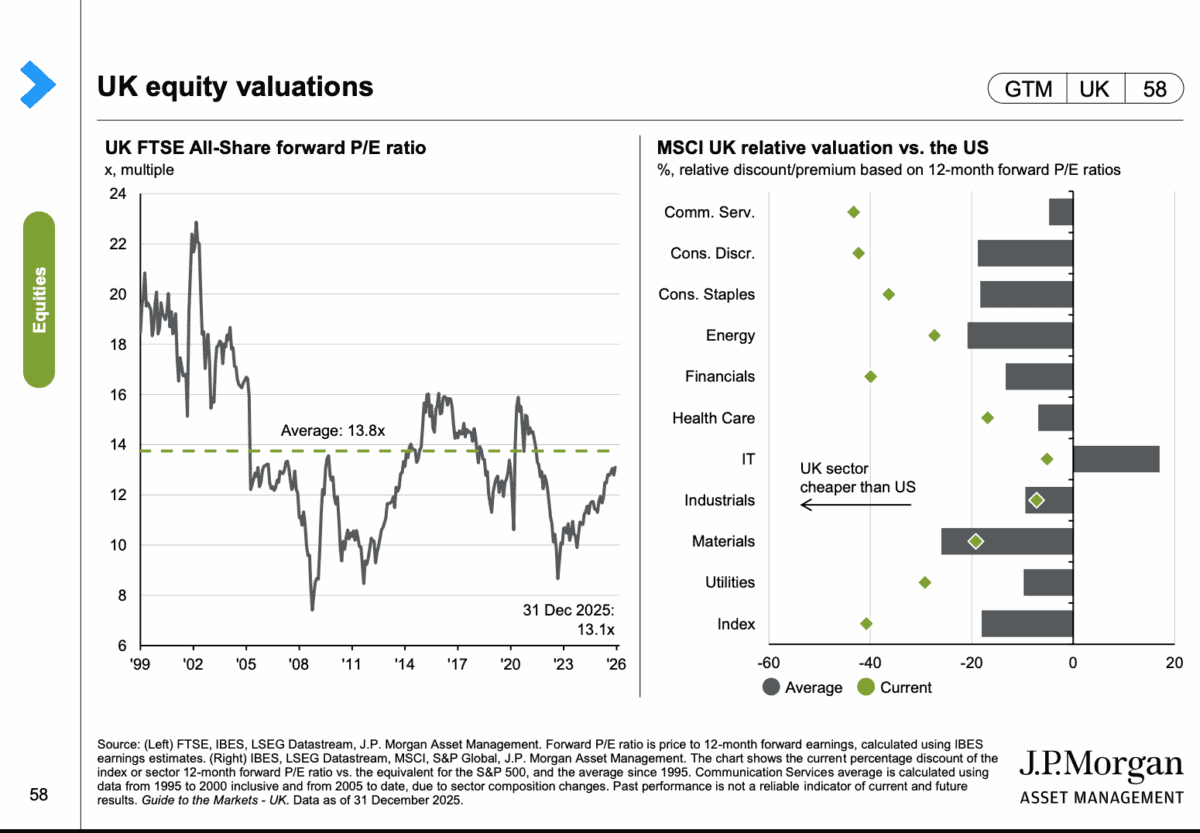

The S&P 500 as a whole might be historically expensive, but this isnât true of stocks around the world. UK shares, for example, are actually trading at unusually low levels at the moment.

Source: JP Morgan Guide to the Markets – UK Q1 2026

Itâs also worth noting that it isnât even true of every stock within the S&P 500. A lot are actually trading at historically low multiples right now.

The best opportunities might come from taking advantage of low prices. But investors don’t have to sit around and wait for a stock market crash.

Looking for opportunities

One example from my portfolio is Gamma Communications (LSE:GAMA). At a price-to-earnings (P/E) ratio of 13, the stock is trading at a level well below where itâs been in the past.

The reason I own it, though, isnât just because itâs historically cheap. I think the company is in a really nice position to benefit from the UKâs upcoming shift away from copper phone lines.

Thereâs a danger the UK might delay switching off its copper network (itâs happened once before) and this wouldnât be a good thing for Gamma. And thatâs the main risk with the stock right now.

Sooner or later, though, businesses are going to have to move to cloud communications â which is the firmâs speciality. So even if it doesnât come this year, I think the long-term picture looks good.

Financial freedom

Achieving financial freedom involves two things. The first is being able to put money aside and the second is finding ways to earn a good return on that capital.

When it comes to the second, the record of history is very clear. The best returns from the stock market come from buying when valuation levels are unusually low.

Given this, a stock market crash can present life-changing opportunities. But I don’t think investors have to wait for something dramatic to happen to find stocks to buy.

The post How a stock market crash could help set you up for lifelong financial freedom appeared first on The Motley Fool UK.

Should you invest £1,000 in Gamma Communications Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Gamma Communications Plc made the list?

More reading

- 3 cheap UK shares tipped to grow 104% (or more) in 2026!

- Here are the best dividend-focused stocks to buy right now, according to experts

- Here’s my top FTSE 250 pick for 2026

JPMorgan Chase is an advertising partner of Motley Fool Money. Stephen Wright has positions in Gamma Communications Plc. The Motley Fool UK has recommended Gamma Communications Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.