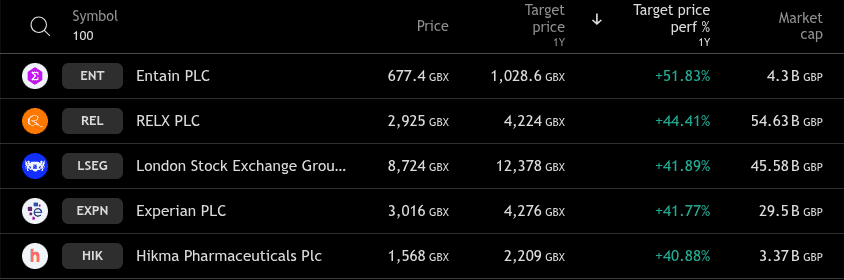

5 FTSE 100 stocks forecast to soar 40% (or more) in 2026

Established FTSE 100 stocks may sometimes seem like low-growth options. But I’ve identified five of them that are forecast to grow at least 40% on average in the next 12 months.

Let’s kick off with one of my favourite Footsie stalwarts — and the number one stock that I think is worth considering on this list.

RELX

RELX (LSE: REL) provides information-based analytics and decision tools, having transformed from a traditional publisher into a technology powerhouse. Operating across multiple technical and scientific segments, it offers proprietary data assets and workflows to help support businesses.

It delivered 7% underlying revenue growth in 2025, with Risk and Legal divisions growing in high-single to low-double-digits. Although its 2.1% yield is low, dividends have increased by over 7% year on year, which is encouraging news for income investors.

Recent AI integrations have helped it achieve 91% penetration among Fortune 100 companies, promising high-margin, mission-critical revenue streams.

But it faces intensifying competitive pressure from AI-native consultancies and data providers that are disrupting traditional market segments. Rivals like Thomson Reuters, along with tech start-ups, are increasingly challenging its historical monopoly position in research and risk analytics.

Currently trading at 2,925p, its average 12-month target is 4,223p — a 44.4% increase.

Entain

As a global leader in online sports betting and gaming, Entain owns popular brands such as Ladbrokes, Coral, and BetMGM. It offers sports betting, casino games and live gaming experiences globally and it benefits from growing digital adoption and regulatory expansion (particularly in North America). There it has established significant market presence through BetMGM.

Latest interim results showed pre-tax earnings up 11% year on year to £583m, with guidance forecasting a 5% higher 9.8p interim dividend.

At 677.4p, its average 12-month target is 1,028p — a 51.8% increase.

London Stock Exchange Group

Beyond managing the exchange, the London Stock Exchange Group builds financial market software and provides critical data to over 40,000 customers globally. It manages leading equity indexes and operates a comprehensive Data & Analytics solutions arm (previously Refinitiv).

Strategic partnerships with companies like Databricks have helped it become an essential infrastructure provider for market participants worldwide.

Trading at 8,724p, its average 12-month target is 12,378p — up 41.8%.

Experian

Experian is one of the world’s largest credit score providers but also provides comprehensive data and analytics solutions across multiple segments. It maintains the industry’s largest credit database, serving financial institutions, telecoms, insurance, utilities and government sectors.

H1 2026 results revealed a 12% boost in revenue from ongoing activities with 8% organic growth, pre-tax earnings up 14% and earnings per share up 12%.

Trading at 3,016p, its average 12-month target is 4,276p — a 41.7% increase.

Hikma Pharmaceuticals

The £3.37bn pharma giant Hikma develops and distributes injectable, generic and branded drugs, manufacturing across North America, Europe, and the Middle East/North Africa (MENA).

It’s in the top three in US generic injectables, ranking second-largest by sales in MENA. And $1bn worth of investments in the US along with expanding partnerships has helped strengthen its growth prospects.

Trading at 1,568p, its average 12-month target is 2,209p — a 40.8% increase.

Final thoughts

Forecasts should never be used alone to drive investment decisions. Well these are all strong, well-established companies, they are not immune to risk. Always conduct a comprehensive analysis before picking stocks — and stay tuned for more insightful commentary!

The post 5 FTSE 100 stocks forecast to soar 40% (or more) in 2026 appeared first on The Motley Fool UK.

Should you invest £1,000 in RELX right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if RELX made the list?

More reading

- Are these some of the best UK shares to buy now?

- This FTSE 100 stock could stand to gain a lot from increased AI adoption

- 3 top growth-focused stocks to buy in January 2026, according to experts

- These FTSE 100 stocks tanked in 2025. Consider buying before they rebound

- I’ve just added this under-the-radar FTSE 100 stock to my SIPP

Mark Hartley has positions in RELX. The Motley Fool UK has recommended Experian Plc, Hikma Pharmaceuticals Plc, London Stock Exchange Group Plc, and RELX. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.