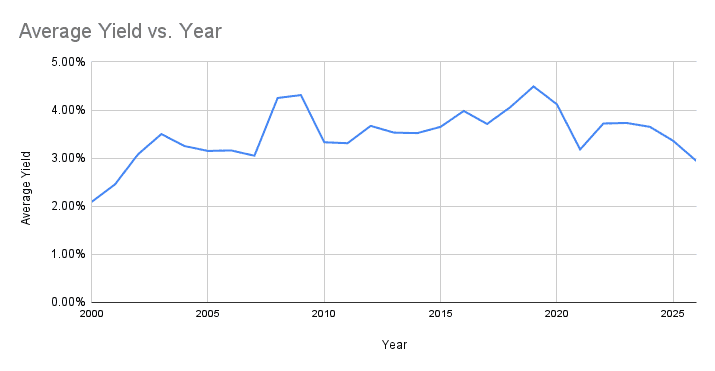

FTSE 100 dividend yield below 3% for first time since Covid

The FTSE 100‘s average dividend yield has dipped below 3% for the first time since Covid, according to data from dividenddata.co.uk. For short periods in 2020 and 2021, the yield fell below 3% — but has largely remained above that average since 2002.

That’s a wake-up call for income-hungry retirement investors. With the Consumer Prices Index (CPI) at 3.4%, interest rates at 3.75%, and the FTSE at highs over 10,200, is it the end of UK stocks as reliable income machines? Or is it a healthy sign of capital growth?

Why yields are falling

Low yields don’t signal weakness â they’re actually a sign of strength. When share prices rise faster than dividends grow, the yield naturally compresses. In 2025, mining, defence and finance helped the Footsie surge nearly 20%, ramping up valuations. While payouts remain robust (forecast 3.4% in 2026), index yields shrink as prices climb.

Zooming out, the macro picture is encouraging. The OECD just upgraded UK growth to 1.2% for 2026, retail sales surprised to the upside (+0.4%), and consumer confidence hit its highest level since August 2024. Inflation sits at 2.1%, the Bank of England base rate is 3.75% (with cuts expected through the year), and gilts yield around 3.5%.

Most importantly, total returns (dividends plus price growth) have historically beat inflation by a country mile. So anyone still holding cash savings is probably losing purchasing power.

So is income dead?

I wouldn’t give up on dividend investing just yet. Even with index yields compressed, individual UK stocks still offer mouth-watering income. Consider Admiral Group (LSE:ADM), the insurance and price comparison giant. It yields around 6.7% with dividend cover of 1.8 times — meaning payouts are safely covered by earnings. Better yet, it boasts over 20 years of uninterrupted dividend payouts.

A £100,000 holding in Admiral would generate £5,500 annually, 100% tax-free inside an ISA. So it’s still an appealing stock to consider for long-term dividend income. Plus, the company’s digital moat keeps costs competitive, adding defensive prospects for an income-focused portfolio.

My only concern would be regulatory scrutiny. In the past, the Financial Conduct Authority (FCA) has flagged concern around premium finance products — a key source of revenue for Admiral. If the FCA tightens regulation, or bans these practices outright, insurers could take a profit hit, threatening dividend coverage.

Balance it with growth

For retirement savers with a 20-25-year outlook, growth could compound harder than income. For example, a 1%-yielder with 12% annual NAV growth beats a 6%-yielder with no growth, full stop.

Dividend shares still hold a critical place in a portfolio aimed at passive income but growth stocks could speed up the journey. Those hoping to capture the best of both worlds may consider a tech-heavy growth vehicle like Scottish Mortgage Investment Trust.

This highly-diversified trust invests in companies around the world, including top S&P 500 names, private equity firms and emerging market leaders.

So while yields may look low these days, my strategy remains the same: accumulate quality dividend stocks supported by defensive plays and powered by compounding growth.

The post FTSE 100 dividend yield below 3% for first time since Covid appeared first on The Motley Fool UK.

Should you invest £1,000 in Admiral Group plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Admiral Group plc made the list?

More reading

- 2 FTSE 100 stocks to consider for passive income in 2026

- Iâm targeting an annual dividend income of £25,451 from my £20,000 holding in this 8.9%-yielding FTSE gem!

- I missed my chance to buy this FTSE 100 stock last year. Now it’s back at the same price…

- Down 22% with a P/E of 9, is Hikma one of the best passive income picks right now?

- How much do you need to invest to make a £650 monthly second income?

Mark Hartley has positions in Admiral Group Plc and Scottish Mortgage Investment Trust Plc. The Motley Fool UK has recommended Admiral Group Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.