£15,000 yearly passive income: how big an ISA do you need?

When coupled with the State Pension, £15,000 passive income â or about £1,250 a month â can make a real difference in retirement. But being in a position to withdraw that amount every year for the rest of oneâs life is a different challenge.

Crunching the numbers

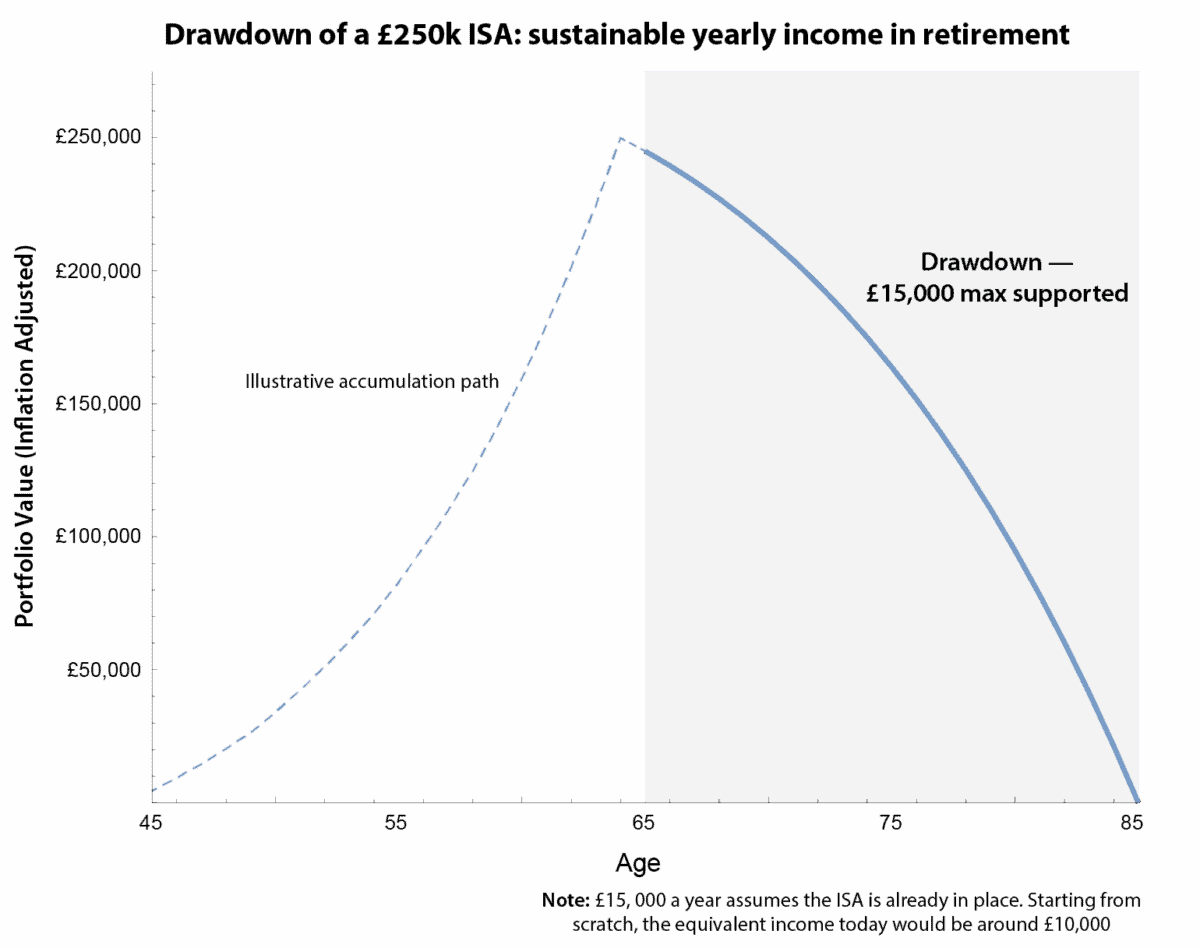

My calculations show that a £250,000 ISA today is the minimum portfolio needed to sustain this level of income. This assumes the portfolio grows at 4% in retirement and inflation sits at 2%. Thatâs money you can count on to cover spending, travel, or simply enjoy retirement with confidence.

For those starting from scratch, the income you can safely withdraw today is closer to £10,000 a year in todayâs terms. The reason is simple: itâs all about when the capital is in place. More money upfront means more income immediately; building it gradually over 20 years means you also need to account for inflation along the way.

The chart illustrates this clearly. It shows the single sustainable withdrawal line for a £250,000 ISA balance. Crucially, this line doesnât change whether the pot is already in place or youâre still building it. What changes is how that income translates into todayâs spending power.

Chart generated by author

Sustainable withdrawals

The chart also tells an important story: thereâs no room for overconfidence. Withdraw too much, or assume the portfolio will grow faster than is realistic, and the money could run out sooner than expected.

That is the key lesson: the line gives a baseline for planning. From there, you can adjust withdrawals to suit different phases of retirement, cope with market ups and downs, or leave a small cushion for longevity or inheritance purposes.

With careful planning, the ISA provides flexible, dependable income, letting you enjoy retirement on your own terms without complex calculations or risky assumptions.

High-income stock

If youâre thinking about generating passive income from your ISA, Legal & General (LSE: LGEN) is worth a look. The sustainability of its 8.2% dividend yield remains constantly in focus, but I think many investors miss a much bigger point.

What makes the insurer stand out is the predictability of its cash flow. The business takes in long-dated pension and annuity liabilities, invests them conservatively, and steadily returns capital to shareholders through dividends. That means the income is supported by underlying cash generation rather than short-term market moves.

For investors building a £250,000 ISA, reinvested dividends maximises compounding advantages. For those already in drawdown, those same dividends reduce the need to sell shares, smoothing withdrawals through volatile markets. In other words, the insurer’s dividends can supplement the sustainable withdrawals you plan from your ISA.

There are risks. Should high levels of inflation become the norm, that could put significant pressure on the value of its £86bn bond portfolio, thereby threatening future dividend payments.

Bottom line

Legal & Generalâs share price has struggled for momentum over the past couple of years. But despite this it continues to reward investors with marketing-leading returns. With an adjusted price-to-earnings (P/E) ratio of just 13, Iâm very comfortable holding it in in my Stocks and Shares ISA. Indeed, I recently topped up my holdings.

The post £15,000 yearly passive income: how big an ISA do you need? appeared first on The Motley Fool UK.

Should you invest £1,000 in Legal & General Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Legal & General Group Plc made the list?

More reading

- £5,000 put into the FTSE 100âs top 3 dividend shares today could earn this much in 5 yearsâ¦

- Here’s how much passive income £10,000 in Legal & General shares could generate

- With an 8.6% yield, is this FTSE 100 income stock an amazing bargain or a value trap?

- How much do you need in the stock market to earn a £500 weekly second income?

- 10,000 Legal & General shares could net passive income of £8,637 a year!

Andrew Mackie has positions in Legal & General Group Plc. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.