Are Rolls-Royce shares still a once-in-a-decade opportunity?

If an investor put £10,000 into Rolls-Royce (LSE:RR.) shares on 30 September 2022, at just 69.59p apiece, they would have £174,091 today.

The companyâs shares exploded by a phenomenal 1,640.9% in that period. Thatâs an incredibly impressive run-up, which would have changed the lives of many investors.

However, while it certainly was then a once-in-a-decade opportunity, is it still so?

Letâs be realistic

The market capitalization of the aircraft engine manufacturer when its shares started this great run was around £5.8bn. The market cap now is £99.5bn.

Even if it didnât match its previous performance, and its shares just went up 10 times, the firm would almost be a trillion-pound company.

Its price-to-earnings (P/E) ratio of 36.8 on 2026âs projected earnings is already very expensive. But even if it were to match that high P/E as a trillion-pound company, it would still need to make £27.2bn in profit.

With trailing 12-month revenue of only £19.5bn in comparison, thatâs a very big ask for the firm right now. And with its 29.6% profit margin over the same period, it would need to generate £91.7bn in revenue to make this profit. This is almost five times the current amount.

A compounded annual growth rate of 16.7% is required to achieve this over the next decade. With revenue up by 7% in its latest half-year results, itâs nowhere close to making this happen.

And its profit margin has been boosted recently by significant financing income, meaning the growth rate needed from operations may be much higher.

At the same time, it needs to maintain the same expensive valuation.

I believe itâs highly unrealistic for the company to do all of this.

Thatâs why I donât believe the companyâs shares are a once-in-a-decade opportunity anymore. However, I still believe Rolls-Royce shares could be a great investment in the long term.

Still plenty to like

There are still plenty of reasons to like the aircraft engine manufacturers’ shares, though.

These include the continued strong performance of its civil aerospace division since the pandemic, and the unfortunate reality that global conflicts seem to be on the rise, which will be beneficial to Rolls-Royceâs defence division.

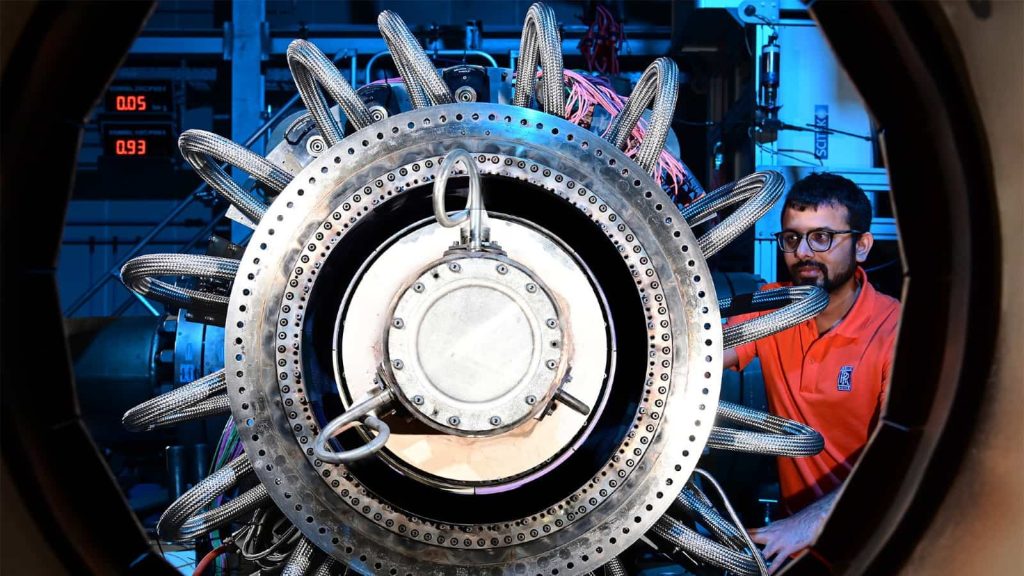

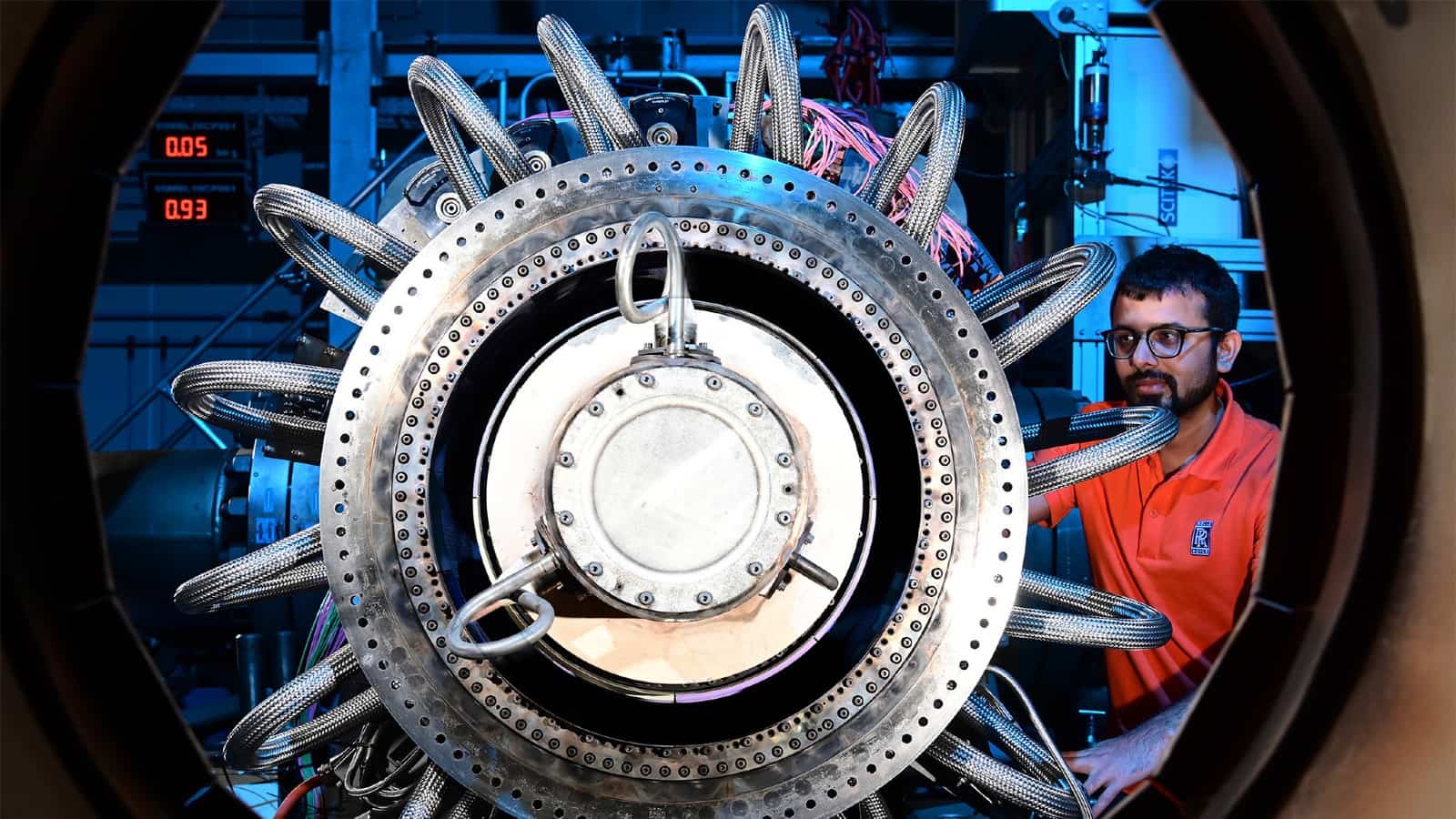

But the one area on which I want to focus my discussion on is the companyâs potential with small modular reactors (SMRs).

SMRs are a technology that could revolutionise the way nuclear energy is deployed. It turns the power source into a commoditised factory-built product. This is much cleaner for the environment than traditional nuclear energy plants.

It should be noted that SMR technology is untested in its effectiveness, so it would be very bad for the companyâs share price if it were found to be ineffective.

However, this aside, the opportunity is anticipated to be massive. With 400 SMRs expected to be needed by 2050, costing $3bn each, this could be a trillion-dollar industry.

Rolls-Royce is already making huge strides in this space. It already has agreements with the UK and the Czech Republic to supply them with SMRs.

Ultimately, while no longer a once-in-a-decade opportunity, if the company continues executing well in this industry, its shares could be a big winner for investors over the long term. Therefore, they should consider buying them.

The post Are Rolls-Royce shares still a once-in-a-decade opportunity? appeared first on The Motley Fool UK.

Should you invest £1,000 in Rolls-Royce Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Rolls-Royce Plc made the list?

More reading

- The paradoxical nature of Rolls-Royce shares in 2026

- The good, the bad, and the unknown for Rolls-Royce shares

- Down 7.5% since the peak, has the Rolls-Royce share price collapse started?

- Get ready for a Rolls-Royce share price crash

- £15,000 invested in Rolls-Royce shares at the start of 2025 is now worthâ¦

Muhammad Cheema has no position in any of the shares mentioned. The Motley Fool UK has recommended Rolls-Royce Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.