Why the FTSE 100 has smashed the S&P 500 this week

The FTSE 100 is up 1.36% this week, while the S&P 500 has fallen 0.7%. And this is just the latest update in what has been quite a run for UK stocks against their US counterparts.

A stopped clock is right twice a day. But the FTSE 100âs recent outperformance isnât just a case of being in the right place at the right time â thereâs a deeper structural reason to take note of.

Diversification

Itâs no secret that the S&P 500 has a much heavier concentration in tech stocks than the FTSE 100. And thatâs been a huge advantage over the last few years, but the situation has changed recently.

Artificial intelligence (AI) has been a big challenge for the US index. On the one hand, investors are concerned that demand isnât strong enough to justify the ongoing investments in data centres.

On the other hand, there are concerns that existing software companies are about to see their competitive positions threatened by AI startups. So thereâs been pressure here as well.

The FTSE 100 hasnât been entirely immune to this â itâs had its share of fallers. But nobodyâs complaining about the index having a relative lack of tech exposure at the moment.

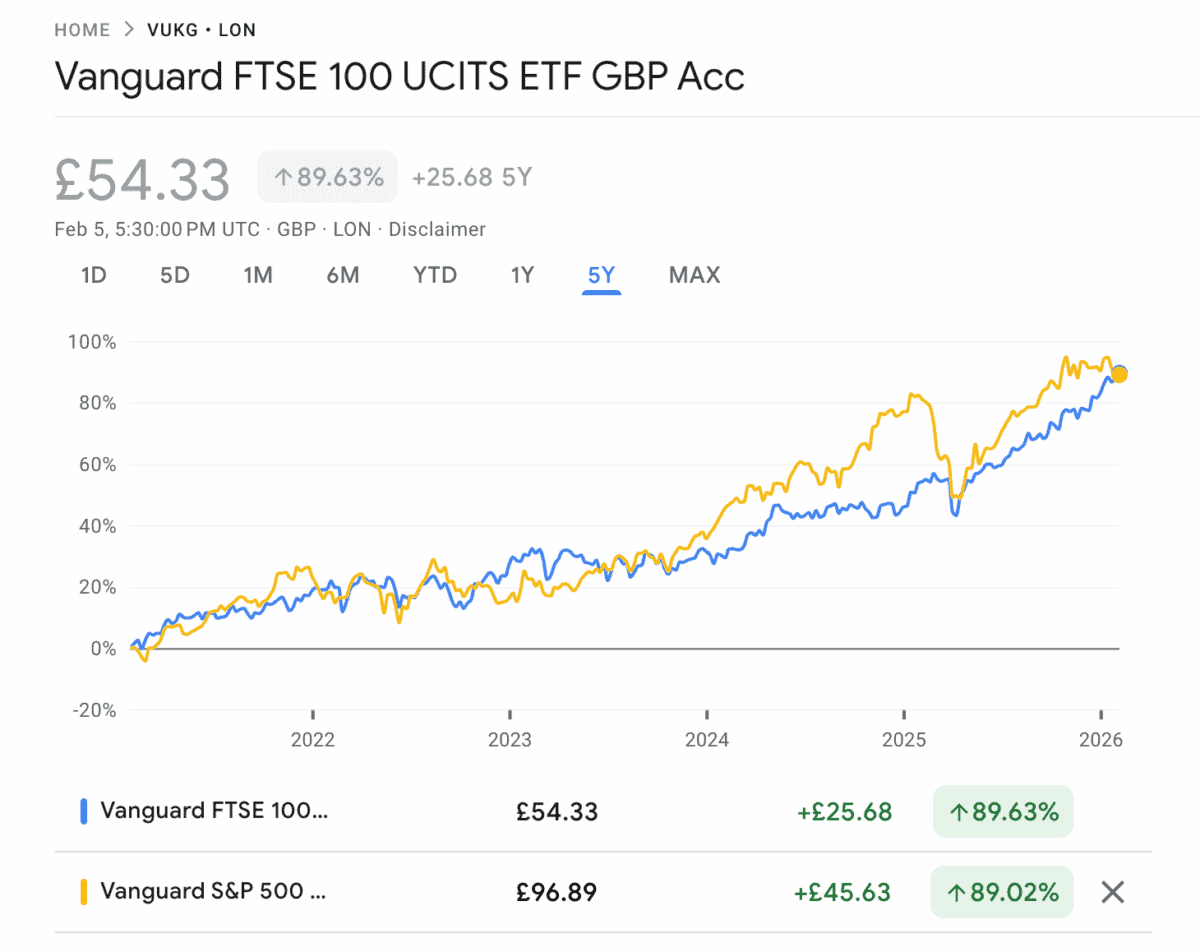

One good week doesnât make up for years of relative underperformance. The latest moves, though, mean the total returns from the FTSE 100 and the S&P 500 are roughly level over the last five years.

Source: Google Finance

So where should investors look for opportunities right now? Have US stocks fallen enough to become cheap, or are UK shares finally picking up some momentum?

Where to look?

I think there are opportunities on both sides of the Atlantic. And building a diversified portfolio means looking to take advantage of both when chances to do so present themselves.

One example is Bunzl (LSE:BNZL). The FTSE 100 company is a distributor of consumables such as coffee cups, cleaning supplies, and carrier bags.

It doesnât sound like an exciting business and organic growth has been limited recently, but the firm has an outstanding track record of growing through acquisitions. And itâs unusually good at this.

This can be risky â thereâs always a danger of paying too much in a deal and even the best investors have made mistakes. But Bunzl has an unusually strong investing discipline.

Where other firms have started paying higher multiples, Bunzl has stuck to valuations of around eight times EBITDA (earnings before interest, tax, depreciation, and amortisation). That doesnât guarantee good returns, but it gives the company the best chance.

Exposure to the weakest parts of the US economy combined with some unforced errors have caused the stock to crash 38% in 12 months. But I think itâs well worth considering at todayâs prices.

Long-term value

I think Bunzl is a great example of a fundamentally strong business dealing with some temporary challenges. But I expect the firm to fare much better over the long term.

If Iâm right, the current share price could be a really nice buying opportunity. And I also think there are similar opportunities in a number of US stocks that have fallen recently.

The post Why the FTSE 100 has smashed the S&P 500 this week appeared first on The Motley Fool UK.

Should you invest £1,000 in Bunzl plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Bunzl plc made the list?

More reading

- Which looks better value today, the FTSE 100 or S&P 500?

- After crashing up to 41%, are these the best UK stocks to buy?

- 3 dirt-cheap UK stocks to consider buying with massive recovery potential

- Down 25%+, are these FTSE 100 losers the best stocks to buy in 2026?

- Cheap UK growth stocks: a once-in-a-decade chance to go bargain-hunting

Stephen Wright has positions in Bunzl Plc. The Motley Fool UK has recommended Bunzl Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.