Worried about a volatile stock market? 3 practical things to do now!

There has been a growing sense of fear in financial markets recently, with silver prices crashing and AI expenditure casting a shadow over many big tech shares. With the FTSE 100 having hit new all-time highs, the stock market is riding high â for now.

But some people are worried about whether we might see a stock market crash.

Spoiler alert â I can confirm that, yes, we definitely will. But, like everyone else, I cannot say with certainty when it will happen.

It could be tomorrow. Or decades down the road.

Here are three practical steps an investor could take now, to prepare for the next stock market crash — and even use it as an opportunity to try and build long-term wealth.

1. Review your portfolio

As a long-term investor, I aim to buy and hold shares with a timeframe of years. Along the way, I expect there to be ups and downs â maybe significant ones.

But in general I do not aim to time the market.

If a business really is as good as I hope it is, then hopefully its share price will grow over time even if there are some steep falls along the way.

Just because I think that, though, does not stop me from sometimes taking profits.

When a share I own looks wildly overvalued to me (either because the share price has soared, the business has got much worse, or both) then I may decide to sell it.

Periodically reviewing a portfolio can help focus an investorâs mind on whether any pruning â or indeed, dramatic weeding â might be useful.

2. Make sure youâre diversified

Not having all your eggs in one basket is obvious common sense. In the stock market it is called diversification.

But it can be harder than it looks even for someone who tries to stay diversified.

Why? Imagine you own 10 shares, initially putting the same amount into each.

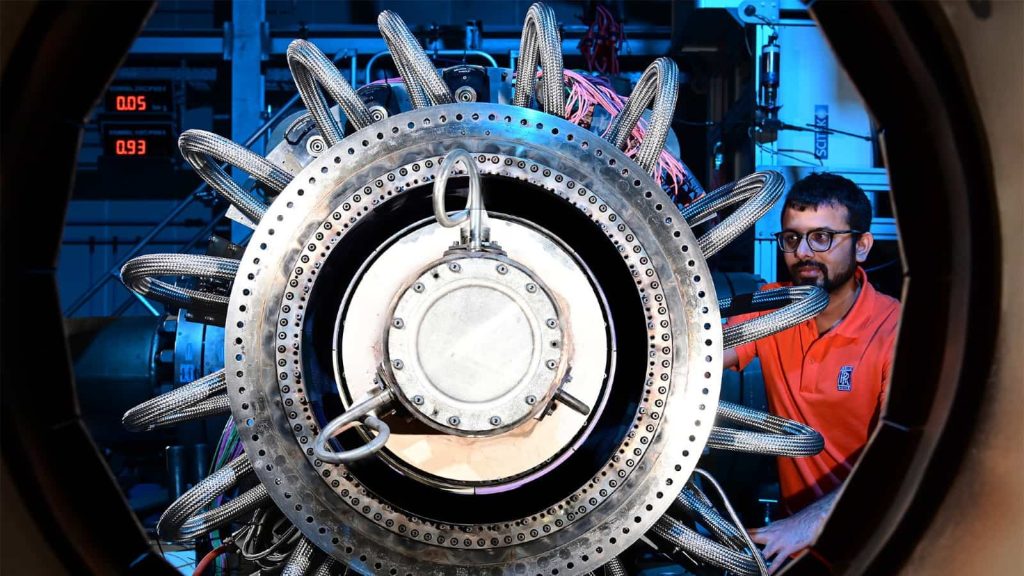

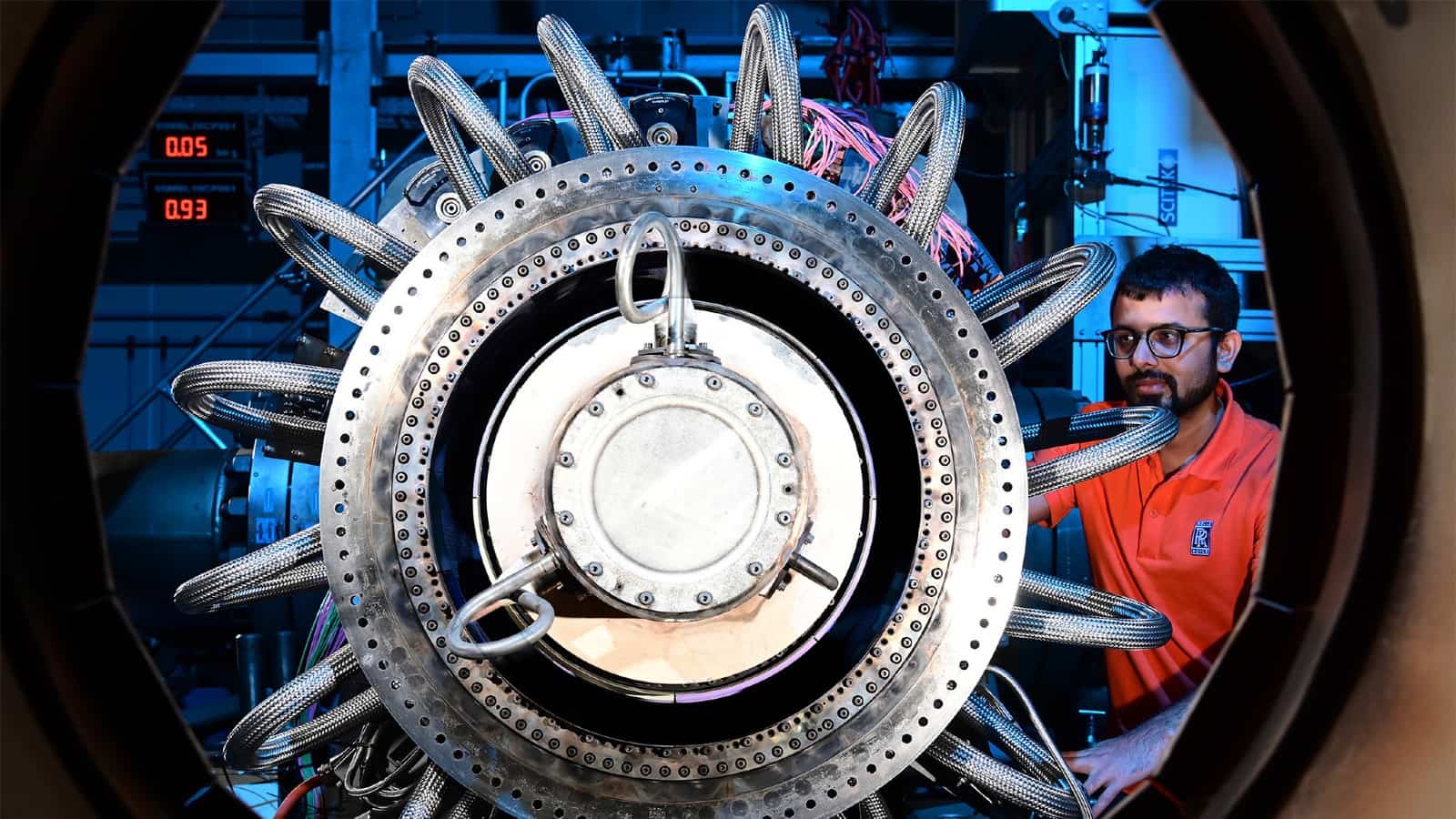

A couple basically go nowhere. Three or four do quite well, but three or four do quite badly â and one does brilliantly. It might be like Nvidia, for example, up 1,242% in five years, or Rolls-Royce (LSE: RR), up 1,199% over that period.

Having not touched it at all, your portfolio has become far less diversified. But while Nvidia or Rolls now has a very outsized role, does it make sense to sell your biggest winner?

Striking the right balance between smart investment and staying properly diversified can be tricky. But it matters.

If the stock market plummets, a lack of diversification can be very painful.

3. Prepare a crash shopping list

I have missed out on much of that soaring Rolls-Royce share price. I sold my stake years ago.

Rolls faces the risk that a sudden unexpected slump in civil aviation demand could hurt revenues and profits. I did not think that was properly reflected in its share price â and still do not.

At the right price, though, I would be happy to invest. Rolls has a large installed base of engines, powerful brand, and proprietary business model.

When the stock market plummets, some shares can suddenly be bargains. But that might not last for long.

So it can pay to prepare in advance a list of shares you would like to own, at the right price. Rolls is on mine!

The post Worried about a volatile stock market? 3 practical things to do now! appeared first on The Motley Fool UK.

Should you invest £1,000 in Rolls-Royce Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Rolls-Royce Plc made the list?

More reading

- Warren Buffett’s indicator is close to an all-time high. Does this mean a crash is coming?

- Dear Rolls-Royce shareholders, mark your calendars for 26 February

- Is it madness to bet against the Rolls-Royce share price?

- £20,000 invested in Rolls-Royce shares ago a year ago is now worthâ¦

- Up 1,660%, is Rolls-Royce still one of the best UK stocks to buy?

C Ruane has no position in any of the shares mentioned. The Motley Fool UK has recommended Nvidia and Rolls-Royce Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.