FTSE 100: could the boring become fashionable?

With the S&P 500âs three most valuable companies each worth more than the entire FTSE 100, itâs easy to see why UK shares are often overlooked. But with uncertainty over how artificial intelligence (AI) will affect our lives, could the lack of tech stocks among Britainâs index of leading blue-chip companies actually be its strength?

And has the time come to consider a company thatâs operating in an industry thatâs been around for over 10,000 years? Letâs take a closer look.

Ups and downs

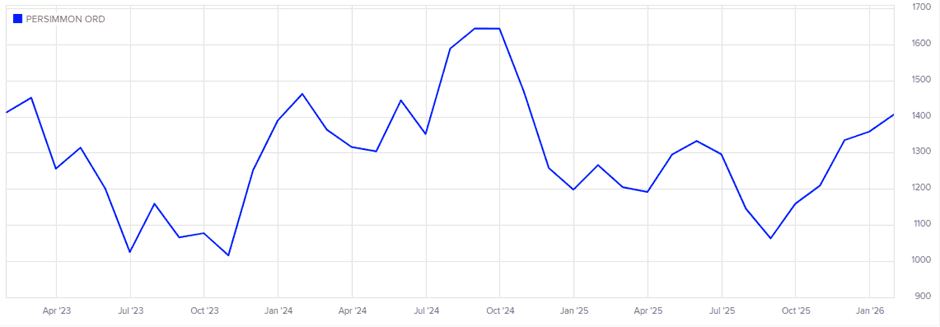

Suffering from post-pandemic supply chain inflation, rising mortgage rates, and a squeeze in consumer incomes, Persimmonâs (LSE:PSN) share price has been on the ropes.

And over the past three years, there have been a number of false dawns in the new-build housing market. A combination of stubborn inflation, interest rates failing to fall as fast as hoped, as well as general economic uncertainty, has quickly delayed the green shoots of a recovery. Â

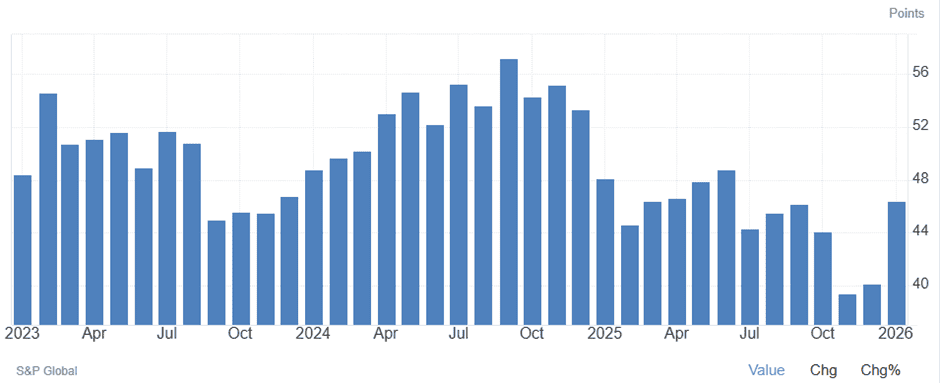

The topsy-turvy nature of the sector is best illustrated by the S&P Global UK Construction PMI (Purchasing Managersâ Index), a monthly survey of over 150 companies. A figure above 50 indicates expansion. The last time it was above this level was in December 2024.

Unsurprisingly, Persimmonâs share price has broadly matched movements in the PMI since January 2023.

Uncertain times

However, although Iâm not going to predict when, I think the housing market will recover. Thatâs because history suggests it will.

Indeed, thereâs a chronic under-supply of properties at the moment. And the desire for first-time buyers to get on the housing ladder appears to be as strong as ever. If disposable incomes grow and consumer confidence starts to pick up, I reckon Persimmon will be one of the first to benefit because it has a lower average selling price than its closest FTSE rivals.

| Company | Average selling price (£) |

|---|---|

| Persimmon | 278,000 |

| Vistry Group | 283,000 |

| Taylor Wimpey | 313,000 |

| Bellway | 316,412 |

| Barratt Redrow | 343,800 |

| The Berkeley Group Holdings | 570,000 |

And the recent turbulence affecting data and software stocks reminds us that the winners and losers from artificial intelligence (AI) might not be as obvious as we first thought.

Until the picture becomes clearer, now could be a good time to consider investing in old-fashioned industries such as mining, banking, utilities, and construction. The sort of stocks that dominate the FTSE 100 and, a bit like Persimmon, have established a reputation for paying healthy dividends. At the moment (9 February), the housebuilderâs yielding 4.3%.

Could AI be a problem?

But Iâm not naïve. I know the construction industry isn’t immune to the impact of AI. However, it looks to me as though itâs going to be one of the net beneficiaries.

When it comes to building, AI’s likely to lead to back-office efficiencies, the optimisation of project planning, safer sites, and better build quality. Further evidence that the technology might not be as disruptive as feared is that jobs in the sector often appear among the lists of careers that are least likely to be impacted.

Final thought

With its healthy balance sheet (it has no debt) and large land bank, I reckon Persimmonâs a stock to consider. In my opinion, it looks well positioned to benefit from a housing market recovery.

But even if it’s delayed or stalls once more, the stockâs above-average dividend (no guarantees, of course) could appeal to income investors. Suddenly, an âold-fashionedâ stock could become trendy.

The post FTSE 100: could the boring become fashionable? appeared first on The Motley Fool UK.

Should you invest £1,000 in Persimmon Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Persimmon Plc made the list?

More reading

- How much do you need in an ISA to aim for a second income of £11,341?

- Hereâs how investors could aim for £9,039 in annual dividends from £20,000 in this FTSE 100 income share

James Beard has positions in Persimmon Plc. The Motley Fool UK has recommended Barratt Redrow, London Stock Exchange Group Plc, Persimmon Plc, and Vistry Group Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.