Want to try and become a Stocks and Shares ISA millionaire? Here’s how…

Latest figures suggest there are nearly 5,000 Stocks and Shares ISA millionaires in the UK. But how could someone go about trying to join them?

Here are a few ideas.

In the beginning…

Personally, I think it’s necessary to be disciplined and maximise as much of the annual ISA allowance as possible. Why? Well, the principal advantage of this particular investment vehicle is that all income and gains can be earned tax free. Thatâs an amazing benefit.

I also think itâs important to hold a diversified portfolio of stocks to help spread risk. If some holdings start to fall in value, hopefully, the others will more than compensate.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Keep calm and carry on…

Another tip is to take a long-term view. Shares go up and down. Itâs essential not to be disheartened if one falls rapidly and not get too carried away if another takes off. History suggests that the stocks of quality companies will deliver healthy long-term gains. They say patience is a virtue.

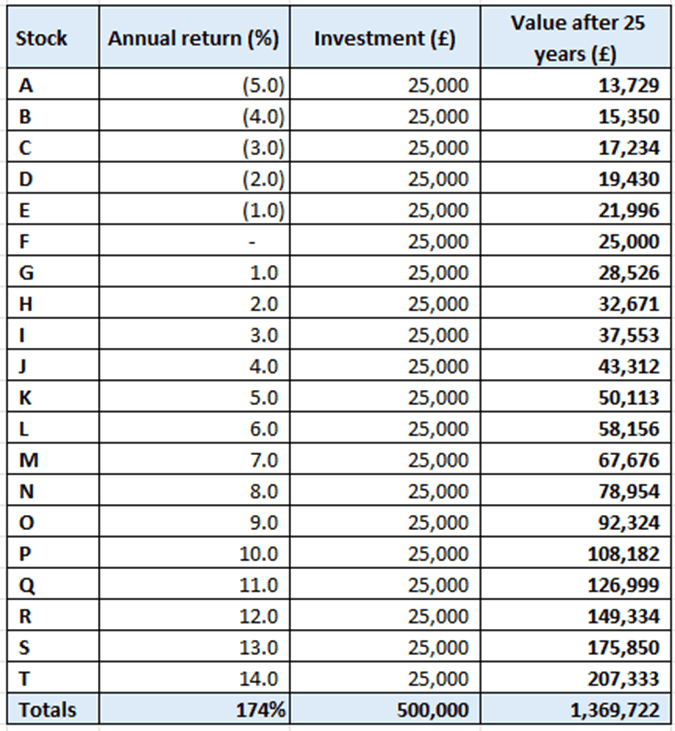

So letâs combine these three ideas and see what might be possible. The table below shows the impact of investing £1,000 a year into 20 stocks for 25 years. Iâve assumed that some of the holdings do better than others with annual returns ranging from -5% to +14%. The idea of having a mixture of winners and losers is a reminder that sometimes not everything goes to plan with the stock market.

After 25 years, the ISA would be worth £1,369,722. Thatâs an amazing 174% return on the £500,000 invested.

Another idea…

One stock I have in my own portfolio is Rolls-Royce Holdings (LSE:RR). Thatâs because I think itâs the sort of company that will continue to perform over decades to come.

Itâs regularly hit the headlines over the past five years or so for its amazing post-pandemic recovery. But this has been an exceptional period. The groupâs share price is unlikely to perform over the next five years as it has done over the past five.

Currently (13 February), its shares trade on nearly 30 times forward (2028) earnings so we’re unlikely to see further exponential growth. However, I still think it will outperform the wider market.

Its civil aviation business is likely to benefit from anticipated growth in passenger and cargo traffic. And its power systems division is growing thanks to more data centres. Also, its development of small modular reactors (SMRs) — mini nuclear power stations â seems to be gaining momentum with partners in the UK, Czech Republic and Sweden appearing enthusiastic.

And though not to everyoneâs liking, I expect the groupâs defence business will benefit from the commitment by NATO members to spend up to 5% of GDP on their militaries and wider security.

Of course, there are risks. Air travel could, once again, be affected by some sort of global crisis. And there are no guarantees that the group’s SMRs will be successful. According to the OECD, there are 127 different designs comprising five alternative cooling methods. We donât yet know whether the approach favoured by Rolls-Royce will be commercially viable.

Despite these possible challenges, I think the groupâs activities are diversified enough to give some protection should one particular division underperform. Thatâs why I reckon itâs a stock to consider for the long term.

The post Want to try and become a Stocks and Shares ISA millionaire? Here’s how… appeared first on The Motley Fool UK.

Should you invest £1,000 in Rolls-Royce Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Rolls-Royce Plc made the list?

More reading

- Prediction: Rolls-Royce shares could one day be the most valuable on the FTSE 100

- 5 reasons why the Rolls-Royce share price could hit £16.25!

- £15,000 invested in Rolls-Royce shares a year ago is now worth…

- Here’s how much £10,000 invested in Rolls-Royce shares could soon be worth

- What’s going on with the new “50-year growth opportunity” for Rolls-Royce shares?

James Beard has positions in Rolls-Royce Plc. The Motley Fool UK has recommended Rolls-Royce Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.