Behold! The new Warren Buffett?

With Warren Buffett retiring six weeks ago, value investors are looking for a new talisman. Step forward, Mohnish Pabrai.

As of Tuesday (10 February), the Pabrai Wagons ETF (NYSE:WAGN) is traded on the New York Stock Exchange. But who exactly is Pabrai and should investors consider buying in?Â

Mohnish Pabrai

A lot of investors model themselves on Warren Buffettâs investment principles â taking a long-term view, looking for undervalued stocks, and so on. But Mohnish Pabrai has a better claim than most.

Followers of the Berkshire Hathaway annual shareholder meetings will be familiar with Pabrai as someone whoâs asked questions on more than one occasion. But thereâs more to it than this.

After winning a charity lunch auction in 2008, Pabrai maintained a strong relationship with Buffett and his investing co-pilot Charlie Munger. So thereâs a closer connection than most can point to.

So the connection to Warren Buffett is more than just a marketing slogan. With that in mind, what can investors expect from the Wagons Fund â Pabraiâs newest investment vehicle?

The Wagons Fund

With exchange-traded funds (ETFs), investors need to be careful to not pay management fees for something that closely resembles an index. The Pabrai Wagons ETF definitely doesnât do this.

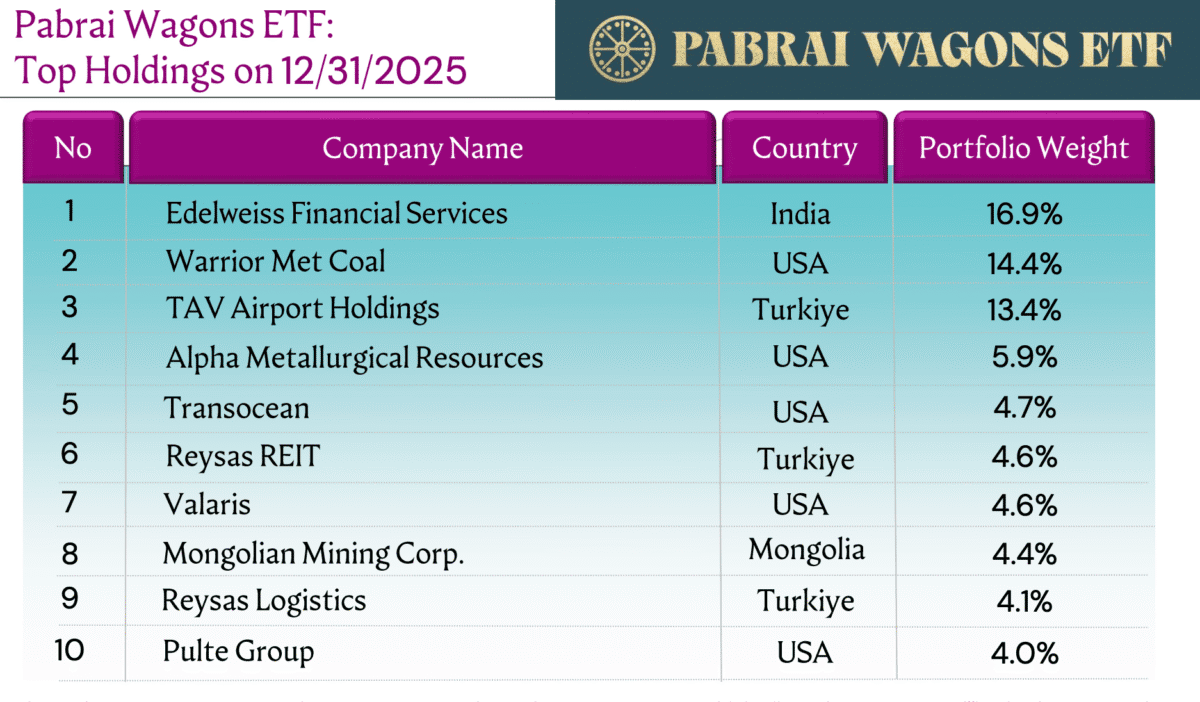

Source: Pabrai Wagons ETF Investor Presentation

Itâs a concentrated fund of specific opportunities that donât get much coverage from analysts at all. These include businesses based in Turkey, metallurgical coal, and airports.

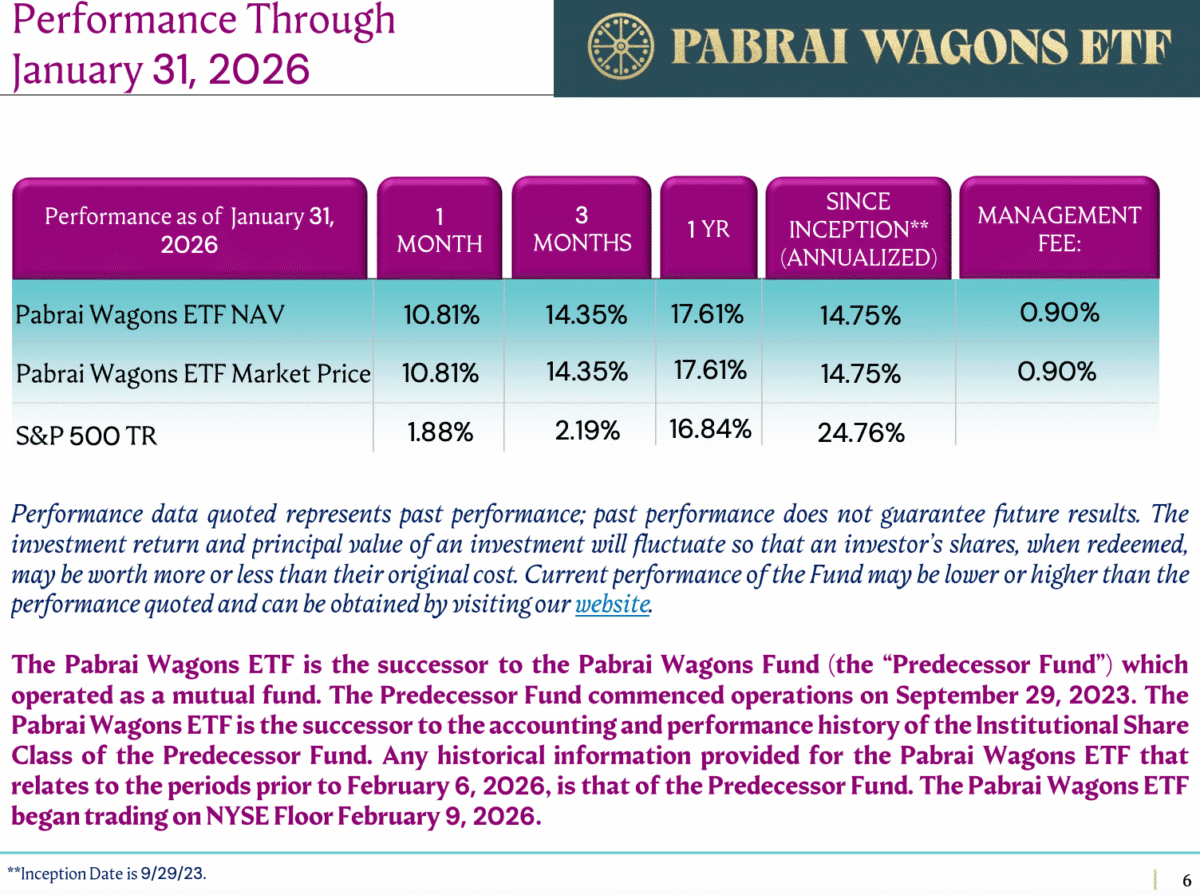

The fundâs record reveals it has underperformed the S&P 500 since its inception (it has existed as a mutual fund since 2023). But investors shouldnât be too quick to write it off on those grounds.

Source: Pabrai Wagons ETF Investor Presentation

It doesnât take a long memory to recall critics writing Warren Buffett off when interest rates went to zero. And the last few years have been tough for a lot of investors, not just Pabrai.

Reservations

I think the Pabrai Wagons ETF could be an interesting idea for an investor whoâs looking to diversify a portfolio thatâs mostly based on passive indexes. But I do have some reservations.Â

One is the concentrated nature of the fund. I donât mind that by itself, but it raises the question of why investors would want to pay a 0.9% management fee instead of buying the stocks themselves.

The Pabrai Wagons ETF is also importantly different to Berkshire Hathaway. Being smaller means it can consider opportunities that arenât big enough for Berkshire, but there is a downside.

Specifically, itâs limited to shares in publicly traded companies. The kind of private deals that Warren Buffett has managed to do over the years arenât likely to be available for the fund.Â

The new Warren Buffett? Or the old one?

The Pabrai Wagons ETF aims to focus on firms with strong growth prospects â in line with Buffettâs later approach. But its largest holding looks much more like an old-style Buffett holding to me.

The investment thesis behind Edelweiss is that itâs set to raise four times its market value through a series of divestitures. That might be true but doesnât make the firm a long-term compounder.

My overall view is that the Pabrai Wagons ETF is a welcome addition to the value investing universe. But in terms of my own portfolio, I still prefer Berkshire Hathaway.

The post Behold! The new Warren Buffett? appeared first on The Motley Fool UK.

Should you invest £1,000 in Professionally Managed Portfolios – Pabrai Wagons Fund right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Professionally Managed Portfolios – Pabrai Wagons Fund made the list?

More reading

- How much does it really cost to build a big enough SIPP for retirement?

- £1,000 buys 1,869 shares in this red-hot penny stock thatâs tipped to rise 64% and has a 6% yield

- 2 top-notch ETFs to consider right now for a Stocks and Shares ISA

- Palantir stockâs crashed 26% already in 2026. Time to buy the dip?

- Be ready for a violent stock market crash

Stephen Wright has positions in Berkshire Hathaway. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.