Here are the dividend stocks with the highest yields from the FTSE 100 and the S&P 500

When stocks come with 9% dividend yields, itâs almost always a sign investors are concerned about something. But the market isnât always right â and when itâs not, they can be huge opportunities.

Both the FTSE 100 and the S&P 500 have shares with eye-catching yields right now. And investors looking for long-term passive income should take a closer look at both.

LyondellBasell Industries

At 9.5%, LydonellBasell Industries (NYSE:LYB) has the highest dividend yield in the S&P 500. And itâs a classic one for investors â the yield is up because the stock is down, so is the dividend safe?

The firm is a chemicals business thatâs in a downturn. Weak demand due to faltering industrial activity has compressed margins, but the bigger issue has been supply competition from China.

Over the last 12 months, the companyâs free cash flow has been nowhere near enough to cover its dividend. And that means thereâs a real risk of lower distributions â and the market knows it.

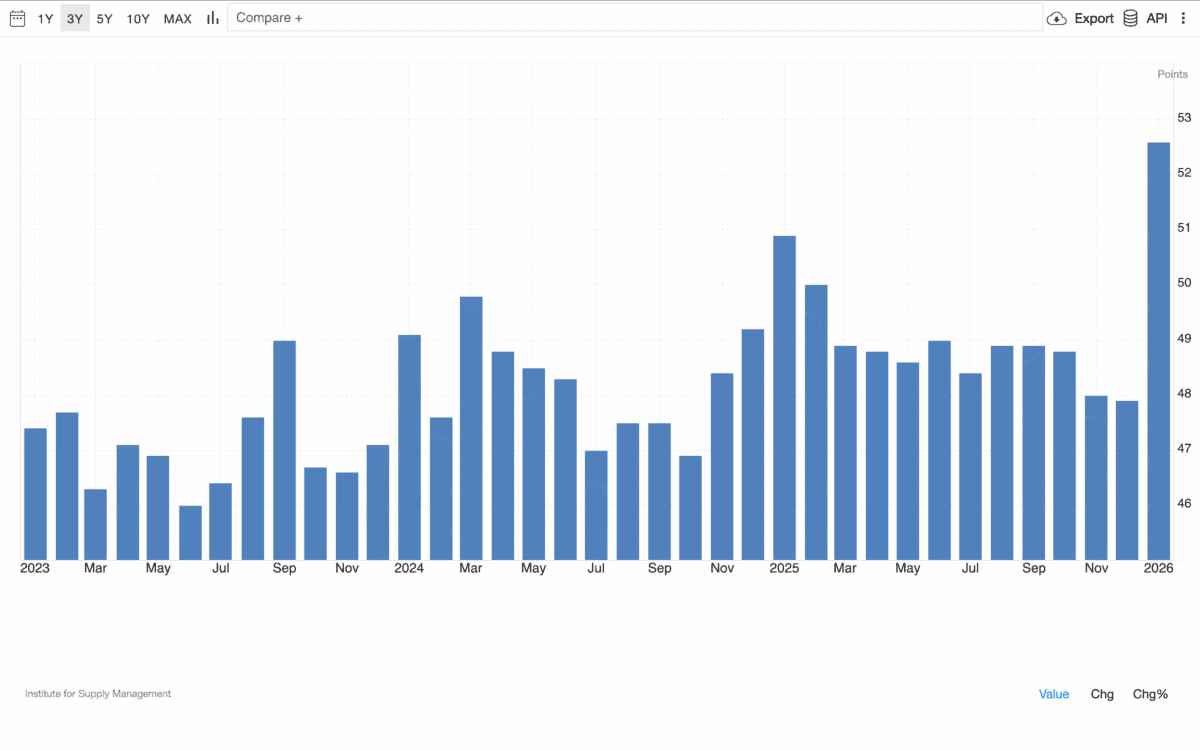

A dividend cut isnât guaranteed though, and there are reasons for positivity. One is that there are signs of a recovery in US industrial activity coming from Januaryâs ISM Manufacturing PMI data.

Source: Trading Economics

The figure came in at 52.6, which is its highest level in three years and a strong sign of growth. And to add extra weight to this, the supply side of the equation is starting to improve in China.

Tax policy has actually forced some of Chinaâs less efficient operations to shut down, reducing competition. Given this, I think the 9.5% dividend yield is definitely worth a closer look.

Admiral

From the FTSE 100, Admiral (LSE:ADM) is a very different case. The £2.36 per share the firm returned in 2025 is an 8.3% yield at todayâs prices, but thatâs definitely going to be lower in 2026.

The company has announced a shift in its capital allocation policy. Instead of issuing new shares to fund employee compensation, itâs going to use the special dividend to finance this.

Thatâs going to mean cash returns are lower going forward. But it doesnât represent a sense in which the business is fundamentally any worse â in fact, it might be the opposite.

Buying its own shares instead of paying dividends might be more tax-efficient for investors. And the companyâs core strength is the profitability of its underwriting, which isnât affected by the change.

One risk is that the UK car insurance industry is under pressure right now. Higher repair prices and lower premiums are set to weigh on margins, which is why analysts have been downgrading the stock.

They might be right, but I think Admiral is in a better position to cope with a downturn than most. And while income investors might want to look elsewhere, Iâve started buying the stock in my ISA.

High yields, high risk?

Warren Buffettâs point that investors pay a high price for a cheery consensus is absolutely true of dividend stocks. High yields almost always reflect concern about the underlying business.

Sometimes though, the concern can be unjustified due to a short-term issue that the market is unable to see past. And when that happens, investors can find rare and lucrative investment opportunities.

The post Here are the dividend stocks with the highest yields from the FTSE 100 and the S&P 500 appeared first on The Motley Fool UK.

Should you invest £1,000 in Admiral Group plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Admiral Group plc made the list?

More reading

- This 6.4%-yielding FTSE 100 stock is near a 52-week low! Time to buy?

- How much do you need in a SIPP to aim for a £31,700 pension income?

- FTSE 100 dividend yield below 3% for first time since Covid

- 2 FTSE 100 stocks to consider for passive income in 2026

- Iâm targeting an annual dividend income of £25,451 from my £20,000 holding in this 8.9%-yielding FTSE gem!

Stephen Wright owns shares in Admiral Group Plc. The Motley Fool UK has recommended Admiral Group Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.