I asked ChatGPT for a once-in-a-decade FTSE 100 stock opportunity and it said this

History shows that there’s always at least one stock lurking in the FTSE 100 that will explode higher in future. Getting in early can obviously turbocharge portfolio returns.

The poster child for big gains is Rolls-Royce (LSE:RR) — it’s up more than 1,600% since September 2022.

But it’s not alone. Investors who bought shares of silver miner Fresnillo in September 2024 have seen them rise 625%! Meanwhile, Airtel Africa is up 258% since November 2024.

Here we have a UK engine maker on the brink of bankruptcy, a Mexican miner, and a telecoms firm operating in Africa. This shows how varied the opportunities can be across the FTSE 100.

Unfortunately, spotting the next Footsie stock that’s going to ‘do a Rolls-Royce’ isn’t straightforward. So, for assistance, I drafted in artificial intelligence (AI) by asking ChatGPT for a once-in-a-decade opportunity in the FTSE 100 today.

Here’s what it said.

An obvious pick

At first, the AI bot hedged its bets by offering multiple shares. But when pushed to name its best pick, it said Rolls-Royce.

Now, this was a somewhat surprising choice because the stock’s already close to a record high.

Yet ChatGPT tried to put my mind at ease, saying itâs “still not valued like a high-growth tech darling“, despite the share price surge. “If margins keep rising and cash keeps flowing, thereâs room for further multiple expansion“, it added.

With all due respect, I think the AI bot is talking nonsense here. Because after doubling in the past 12 months, Rolls-Royce stock is priced at a punchy 39 times forecast earnings for this year.

To put that in context, high-growth tech darling Nvidia is trading at 24 times forward earnings. So ChatGPT has got this back to front.

It rattled off the bullish investment case for Rolls-Royce, but these points are well-known (and regularly discussed at The Motley Fool). These include:

- Rolls-Royce gets paid on engine flying hours, so more long-haul travel equals more revenue.

- As a supplier of engines for military aircraft, the firm should benefit from higher defence spending.

- Small modular reactors (SMRs) â or âmini-nukesâ â could be transformational.

Looking elsewhere

Rolls-Royce being the next Rolls-Royce is too obvious (and confusing) at this point! In my opinion, better opportunities exist in high-quality stocks that have sold off heavily, leaving them looking cheap.

Down 45% in a year and trading at just 14 times next year’s forecast earnings, RELX (LSE:REL) strikes me as a good example.

The company provides information-based analytics, tools and subscription platforms for professionals in science, law, and risk management. It owns legal research platform LexisNexis, which some investors fear could be displaced by new AI tools.

However, analysts at UBS reckon this fear is overblown, with 88% of RELX’s business at little risk of AI disruption, in their opinion.

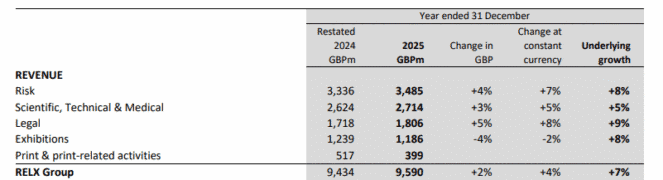

Last week, the FTSE 100 data firm said AI will continue “to add more value to our customers” for “many years to come“. It reported solid growth across its various businesses.

In a show of financial strength, RELX just announced a beefed-up £2.25bn share buyback programme for 2026. Equating to around 6% of the equity base, this should boost earnings per share, and probably won’t be the last buyback.

Rather than highly-valued Rolls-Royce, I think this cheap FTSE 100 stock is worth considering long term.

The post I asked ChatGPT for a once-in-a-decade FTSE 100 stock opportunity and it said this appeared first on The Motley Fool UK.

Should you invest £1,000 in Rolls-Royce Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Rolls-Royce Plc made the list?

More reading

- Should I buy Rolls-Royce shares before 26 February? Here’s what recent history says

- What on earth’s going on with RELX shares?

- Are these the best British shares to buy in February 2026?

- £10,000 invested in Rolls-Royce shares 5 years ago is now valued at…

- 4 things to remember in February’s nervous stock market!

Ben McPoland has positions in Rolls-Royce Plc. The Motley Fool UK has recommended Airtel Africa Plc, Fresnillo Plc, RELX, and Rolls-Royce Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.