Surging Glencore shares jump 145% in 10 months – but could this red-hot rally just be starting?

Glencore (LSE: GLEN) shares have surged since bottoming last April after the so-called Liberation Day sell-off. Now the business has swung back to profit and unveiled bold plans to become the worldâs largest copper producer. So could the stock be on the verge of a major market re-rating?

2025 results

Full-year results from the mining giant suggest a cycle turning rather than a business weakening. Adjusted EBITDA fell 6% to $13.5bn â below the $34bn peak during the 2022 energy shock â but statutory profit for the year swung back to a modest $0.4bn, marking a return to official profitability.

Momentum improved markedly in the second half. EBITDA jumped 49% versus H1 as metals prices strengthened, gold rallied and copper production surged nearly 50%.

The drag remains coal, with thermal and steelmaking prices down more than 20% in 2025, weighing on profitability.

Shareholders are still being paid to wait. The 10¢ base distribution is unchanged, but a 7¢ top-up â  funded by the recently listed Bunge stake â  lifts the payout in 2026 to $2bn, and translates into a dividend yield of 3.4%.

Energy transition

What continues to stand out is Glencore’s position at the crossroads of legacy fuels and transition metals. Coal prices may be weak now; but in the mining industry the cure for low prices is low prices.

Mining is cyclical, and supply is already responding. In Australia, producers are cutting output as margins vanish. Meanwhile, demand isnât disappearing â itâs shifting. Developed markets may be phasing down coal, yet emerging economies still need abundant, low-cost power to grow.

If supply is tightening while developing-world demand stays firm, could todayâs weak coal prices actually be setting up tomorrowâs rebound?

Copper

More than $10trn has poured into renewables over the past two decades, yet fossil fuels still supply roughly three-quarters of global energy.

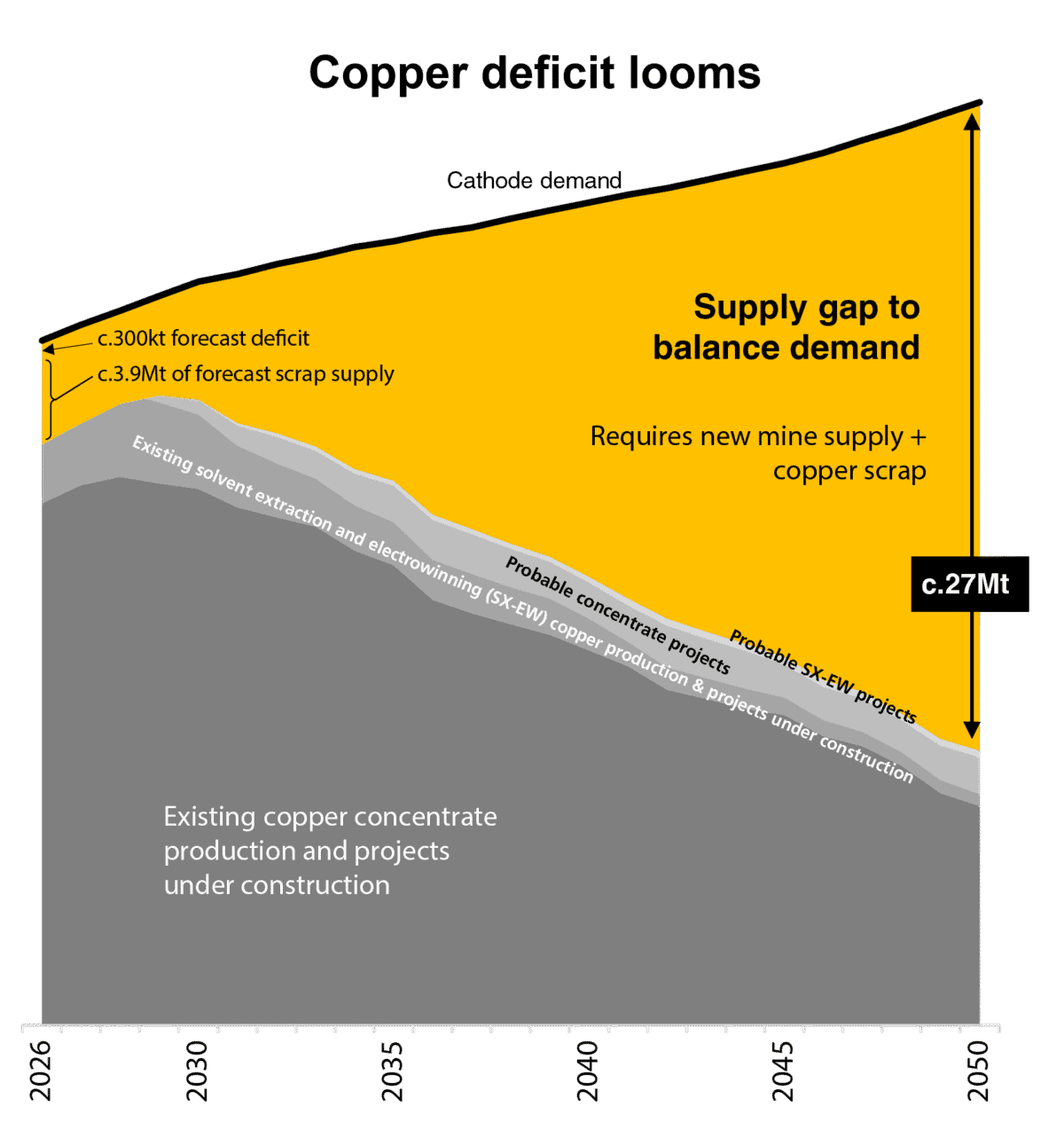

What comes next is even bigger. Around $300trn could be spent over the next 20 years electrifying transport and power, upgrading grids and scaling AI â all of which will require staggering quantities of copper.

There’s no shortage of copper in the ground. The bottleneck is extracting it. Permitting delays, labour shortages and industry caution mean new supply is struggling to keep pace with future demand.

The chart below shows just how tight the market could become: internal estimates suggest the global copper deficit may reach 27m tonnes by 2050.

Source: Glencore

Risks

Execution risk, not commodity prices, may prove the bigger test for Glencore. Its recent withdrawal from a proposed mega-merger with Rio Tinto after failing to agree terms shows how difficult it is to judge long-term value in a deeply cyclical industry.

At the same time, future growth depends on bringing major copper projects online. To manage that risk, itâs seeking joint-venture partners for longer-dated greenfield developments. The balance is delicate: expand too fast and returns suffer; move too slowly and structural supply shortages could pass it by.

Whatâs the verdict?

Iâve long believed the best opportunities appear during peak pessimism.

The past few years have tested shareholdersâ patience, but throughout that stretch Glencore itself was aggressively buying back its own undervalued shares. Now profits are recovering, metals momentum is building, and strategy is aligned with the next commodity cycle. If sentiment shifts even slightly, the re-rating potential could be substantial. Worth considering? I think so.

The post Surging Glencore shares jump 145% in 10 months â but could this red-hot rally just be starting? appeared first on The Motley Fool UK.

Should you invest £1,000 in Glencore plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Glencore plc made the list?

More reading

- How much income would an ISA need to match the State Pension?

- The Glencore share price is up 23% in a month! What’s going on?

- 2 top shares to consider stuffing in an ISA and holding until 2036!

Andrew Mackie has positions in Glencore Plc. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.