The red-hot Helium One share price has exploded 43% in a month! What’s going on?

The Helium One Global (LSE:HE1) share price is on fire at the moment. At the time of writing (20 February), the stockâs changing hands for over 40% more than it was a month ago.

Whatâs causing this sudden interest in the relatively unknown gas explorer? Letâs take a closer look.

A finger in two pies

Helium One has two projects on the go.

The most advanced is its Galactica-Pegasus joint venture in Colorado. And this appears to be the catalyst for much of the £19m increase in the groupâs market cap over the past four weeks or so.

The company recently said that âintegrated plant operationsâ have been scheduled for the end of the month as it gears up for production later in the year. Significantly, it also said: âArrangements have been made for spot sales of helium and discussions in respect of long-term contracts with both helium and CO2 off-takers are progressing.â

But this is a relatively small operation. In March 2025, the group said it expects âan average of approximately US$2m per annum will accrue to the company over a period of five years.â This is a revenue figure, not profit. For context, during the year ended 30 June 2025, the groupâs total administrative expenses were $4.1m.

However, the estimate excludes any benefit from the sale of carbon dioxide (CO2). And there could be further undiscovered deposits of both gases.

But I suspect shareholders believe a potentially bigger prize lies elsewhere.

Miles away

Thatâs because the group owns 83% of the Southern Rukwa Project in Tanzania.

Here, further testing using an electrical submersible pump has resulted in water flow rates âexceeding expectationsâ. This is important because the helium isnât conventional dry gas. Instead, itâs found in water aquifers, which the group acknowledges is âuniqueâ. And I think this casts some doubt on its recoverability.

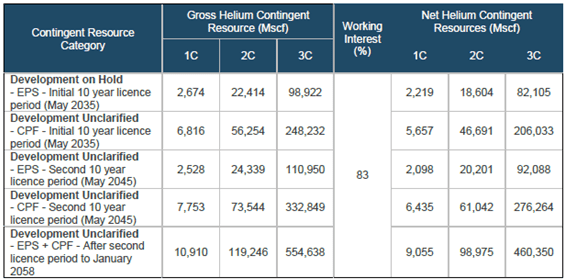

However, if itâs able to overcome this challenge, thereâs enormous potential according to an independent estimate of reserves. But given the uncertainty typical of the industry, it’s normal to quote a wide range of figures.

For context, although there isnât a spot price for the gas, Iâve seen reports suggesting helium sells for up to $1,000 per thousand standard cubic feet depending on its grade. Due to its special characteristics, in particular its cooling properties, demand for helium is rising, which could drive prices higher.

The last time I wrote about Helium One I was contacted by an industry expert claiming that itâs not âtechnically or financially possibleâ to transport compressed helium by sea from Africa using ISO tanks. I put this to a representative of the company who agreed. But they told me that âhelium can also be transported as a compressed gas in tube trailers by shipâ.

No thanks!

But I donât want to invest.

The company says around $100m will be needed to commercialise production. I suspect shareholders will, therefore, be further diluted. This isn’t a criticism. Itâs a fact of life for pre-revenue companies. From June 2020 to June 2025, Helium One increased its number of shares in issue by over 6bn (3,417%).

There are loads of mining companies that are already successfully producing and, more importantly, fully funded. On this basis, I think there are less risky opportunities to consider elsewhere.

The post The red-hot Helium One share price has exploded 43% in a month! What’s going on? appeared first on The Motley Fool UK.

Should you invest £1,000 in Helium One Global right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Helium One Global made the list?

More reading

- Is the only way up for Anglo American shares, after potentially pivotal results?

- I just bought some Palantir stock while itâs 35% below its highs

- How much do I need in an ISA for a £1,000 monthly passive income?

- Are Tesco shares a safe bet in a stock market crash?

- Hereâs how much £5,000 invested in Lloyds shares two years ago is now worth

James Beard has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.