Here’s how you could retire on £1,000,000 with dividend shares!

Investors looking to create wealth for retirement could do a lot worse than to consider buying UK dividend shares. Don’t just take my word for it — passive income investing with London-listed companies has been delivering enormous returns for decades.

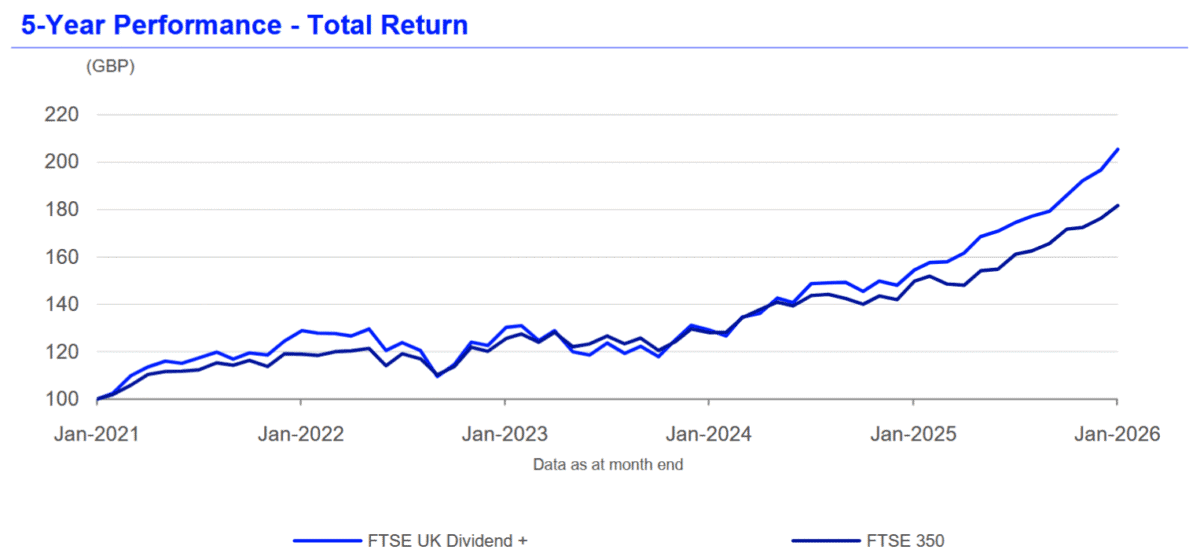

According to data provider FTSE Russell, investors in the FTSE UK Dividend+ index have enjoyed a total return of 105.5% since early 2021. For FTSE 350 investors, the figure sits at 81.7%.

The FTSE UK Dividend+ comprises the 50-highest-yielding stocks from the FTSE 100 and FTSE 250, excluding investment trusts. We’re talking, then, about mature companies with rock-solid balance sheets. Many also have diverse revenue streams and market-leading positions that provide dependable dividends from year to year.

The question is, can UK dividend shares continue delivering market-beating returns? And could investors target a £1m retirement fund with high-yield stocks?

A FTSE 100 dividend hero

Past performance isn’t a reliable guide to what individuals can expect in the future. However, I remain confident in the excellent wealth-building power of UK income stocks. By paying large and reliable dividends, these shares provide money that can be reinvested to magnify the compounding effect.

Legal & General (LSE:LGEN) is one top share investors need to consider in my view. It’s a market leader across the life insurance and asset management markets, and its wide product portfolio protects against weakness in any one product area. With operations spanning Europe, North America, and Asia, too, the business is also well diversified by geography.

As the financial services industry booms, I expect the company’s profits and dividends to follow.

That’s not to say Legal & General is a ‘no brainer’ buy. I own shares in the FTSE 100 firm myself. And I’m concerned about growing competition and what this could mean for revenues and margins. This is especially problematic in the British pension risk transfer (PRT) segment.

However, on balance, I think it will remain an excellent long-term dividend provider. The firm’s cash rewards have risen almost every year since the early 2010s.

Oh, one final thing: the dividend yields on Legal & General shares are a stunning 8% and 8.2% for 2026 and 2027 respectively. Considerable capital reserves put the company in great shape to hit current dividend forecasts too. Its Solvency II ratio was an impressive 217% as of June.

Building a million pound portfolio

Over the last five years, the FTSE UK Dividend+ index has delivered an average annual return of 15.5%. Someone who can replicate this sort of return with their own diversified portfolio would turn a £300 monthly investment into £1,068,431 over 25 years. This assumes that all dividends are reinvested for growth.

What sort of retirement income could this provide? If invested in 8%-yielding dividend shares, our investor could expect a £74,791 in dividends each year. As you can see, buying UK income stocks is a great strategy to consider for building long-term wealth.

The post Here’s how you could retire on £1,000,000 with dividend shares! appeared first on The Motley Fool UK.

Should you invest £1,000 in Legal & General Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Legal & General Group Plc made the list?

More reading

- At 52-week highs, I think the Legal & General share price is heading higher still

- 3 FTSE 100 shares I own for pumped-up passive income!

- With a yield of 8%, is this one of the best stocks to consider buying for passive income?

- Could the stock market hold the secret to a comfortable retirement?

- £1,000 in passive income! Is this top dividend stock the secret?

Royston Wild has positions in Legal & General Group Plc. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.