Is now the time to buy BP shares? Here’s what the charts say

The BP (LSE:BP) share price has fallen 17% since the start of the year. That might be a sign for investors that now is a good time to consider buying shares.

In valuation terms, thereâs plenty for investors to like and the stock looks unusually cheap. But thereâs a lot more to investing in an oil company than just looking at what the charts say.

What the charts say

The falling share price has put BP stock in interesting territory. First off, thereâs a dividend yield above 6%, which is the highest itâs been in a while.

BP dividend yield 2015-24

Created at TradingView

The only time the stock has offered this kind of return in the last 10 years was in 2020. But that wasnât a particularly great time to be buying it.Â

Oil prices had just turned negative and BPâs dividend was about to get cut. It still hasnât fully recovered to its pre-pandemic levels, so investors were probably right to be wary.

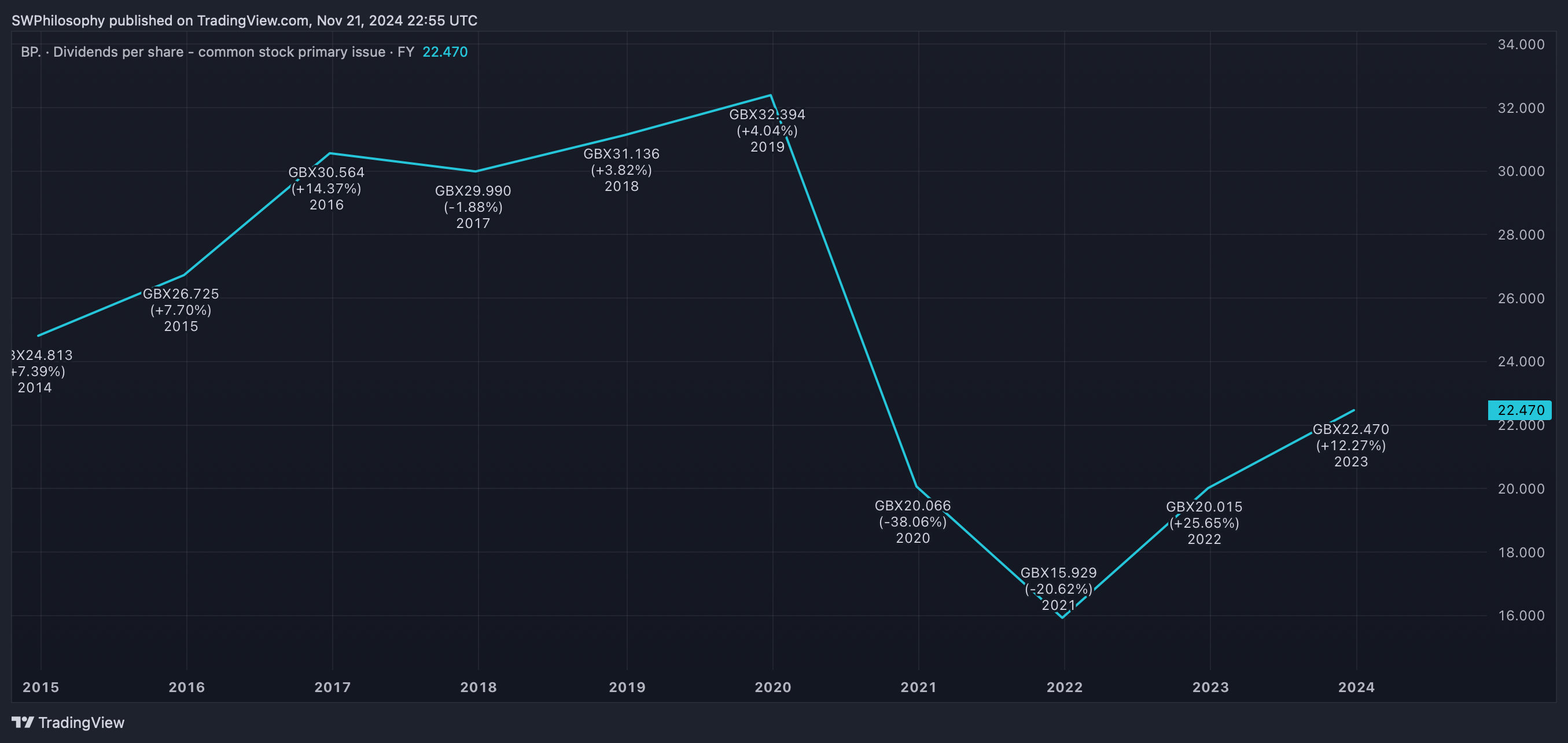

BP dividends per share 2015-24

Created at TradingView

Things donât look quite the same this time out. Oil production might well be about to increase, but I donât think this is about to cause the price to go negative in the near future.

What the charts donât say

The charts indicate that BP shares look unusually attractive from a passive income perspective. But they donât show some of the key risks the company is facing.

The UK government has decided to increase windfall taxes on oil and gas production. At the same time, the US is looking to lower corporate taxes.

That puts BP at a significant disadvantage to some of its US counterparts. And this is something that isnât reflected in a look at the dividend yield or the companyâs historic valuation metrics.

This is a significant issue. The biggest competitive asset an oil company can have is a cost advantage â and production just got much more expensive for BP.

One last chart: is it worth it?

BP shares are trading with an unusually high dividend yield, but the firmâs position relative to its US rivals just got weaker. The big question for investors is whether the discount is enough.

Comparing the stock with one of the US oil majors might be a useful way to think about things. ExxonMobil, which primarily operates in the Permian Basin, is a decent example.

BP vs. ExxonMobil dividend yield 2019-24

Created at TradingView

The difference is a 6.07% dividend yield against 3.15% (not including a potential withholding tax). And itâs worth noting that this the widest the difference has been in the last five years.

Whether or not this is enough to offset the risks is too close for me to call. But investors with an optimistic view on oil prices might well think this is an attractive opportunity to consider.

A stock at a discount?

The charts indicate that BP shares are historically cheap. The dividend yield is unusually high and the discount to ExxonMobil is wider than it has been in the last five years.

What the charts donât say, however, is what a higher windfall tax will mean for the business. And this is the big issue thatâs enough to put me off the stock at the moment.

The post Is now the time to buy BP shares? Here’s what the charts say appeared first on The Motley Fool UK.

Like buying £1 for 31p

This seems ridiculous, but we almost never see shares looking this cheap. Yet this Share Advisor pick has a price/book ratio of 0.31. In plain English, this means that investors effectively get in on a business that holds £1 of assets for every 31p they invest!

Of course, this is the stock market where money is always at risk — these valuations can change and there are no guarantees. But some risks are a LOT more interesting than others, and at The Motley Fool we believe this company is amongst them.

What’s more, it currently boasts a stellar dividend yield of around 10%, and right now it’s possible for investors to jump aboard at near-historic lows. Want to get the name for yourself?

More reading

- With a P/E ratio of 5.6, is the BP share price an unmissable bargain?

- Does the Shell or BP share price currently offer the best value?

- A 6.1% yield but down 31%! Is it time for me to buy more BP shares?

- Will the BP share price go gangbusters under President Trump?

- Is a Trump presidency my chance to earn a second income by investing in FTSE 100 oil stocks?

Stephen Wright has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.