Down 37%, here’s one of my favourite FTSE 100 bargain shares to consider

Like billionaire investor Warren Buffett, I do love scouring the stock market for bargains to buy. Buying cut-price FTSE 100 shares gives me a chance to make juicy returns if they recover over time.

This Footsie share has fallen more than a third in value since the start of 2024. While it faces ongoing dangers, here’s why I think it’s a top recovery stock for long-term investors to consider.

Out of fashion

Weak consumer spending has hammered retailers like JD Sports Fashion (LSE:JD.) over the past year. And the tough times look far from over, given weak economic conditions and signs of stickier-than-expected inflation.

The sportswear giant slumped last Thursday (21 November) after it said like-for-like sales were down 0.3% in Q3. Corresponding sales were up 0.5% for the nine months to October, illustrating a recent worsening in trading conditions.

One reason is because of disappointing sales in the US, now the company’s largest single market. Uncertainty around this month’s presidential election have hit customer demand, with additional discounting also damaging overall takings.

Cheap valuation

Conditions could remain tough in 2025 and beyond too, with President-elect Donald Trump preparing fresh trade tariffs from January. Analysts at ING Bank think resultant inflation could push up US consumer costs by $2,400 a year.

Against this backdrop, JD shares might look unattractive to many investors. But I think the retailer’s troubling near-term outlook is baked into its rock-bottom valuation.

JD’s share price collapsed 16% following last week’s update. It’s now 37% lower in the year to date.

As a consequence, the company currently trades on a forward price-to-earnings (P/E) ratio of 7.9 times. To put this in context, that’s miles below the FTSE 100 average of 14.3 times.

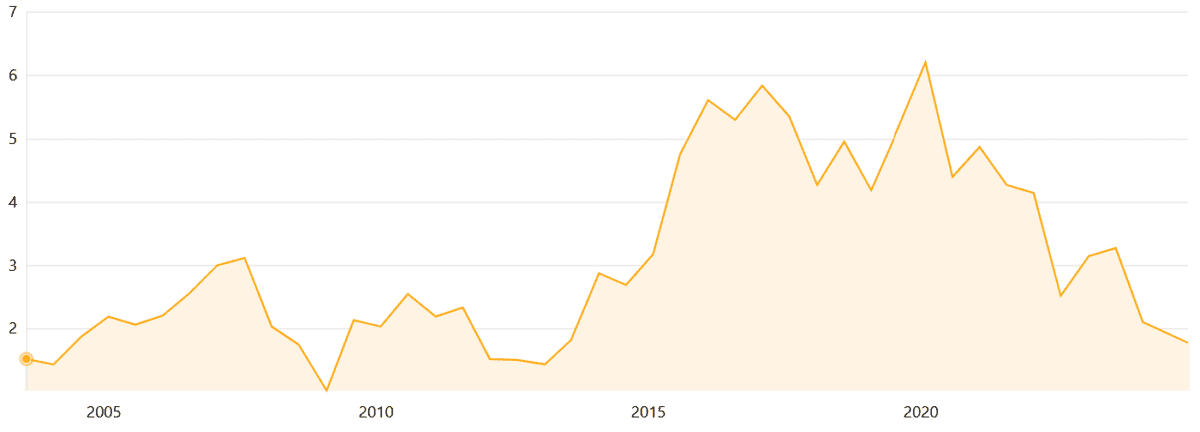

On top of this, JD’s price-to-book (P/B) ratio — which values the company relative to what its assets are worth — has toppled to just 1.8 times.

This is the lowest reading since 2013.

Room for a rebound

I think now’s a good time for long-term investors to consider opening a position. The athleisure market is tipped to grow strongly over the next decade, and especially at the premium end where JD is an industry leader.

The company expects the overall sports apparel market to grow to $544bn by 2028 from $396bn last year.

Furthermore, the retailer remains committed to global expansion to make the most of this opportunity. Ten years ago it had around 650 stores in the UK, Ireland and Europe. Now it has 4,506 criss-crossing its home continent alongside North America and Asia Pacific.

It’s on track to open another 200 stores this financial year alone. And its strong balance sheet — it had net cash of £40.8bn as of July — gives it scope to keep cutting the ribbon on new outlets, as well as execute fresh acquisitions. Its most recent purchase was that of US-based Hibbett over the summer.

The post Down 37%, here’s one of my favourite FTSE 100 bargain shares to consider appeared first on The Motley Fool UK.

Should you buy JD Sports now?

Don’t make any big decisions yet.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — has revealed 5 Shares for the Future of Energy.

And he believes they could bring spectacular returns over the next decade.

Since the war in Ukraine, nations everywhere are scrambling for energy independence,

he says. Meanwhile, they’re hellbent on achieving net zero emissions.

No guarantees, but history shows…

When such enormous changes hit a big industry, informed investors can potentially get rich.

So, with his new report, Mark’s aiming to put more investors in this enviable position.

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

- This FTSE 100 share looks like a Black Friday bargain for me!

- After plunging nearly 40%, I’m considering buying this bargain FTSE 100 stock

- After a 16% drop, FTSE 100 stock JD Sports Fashion looks like a steal to me

- Down 15% today, is this FTSE 100 share too cheap for me to miss?

- The JD Sports Fashion share price has just plunged another 16%! Buy or sell?

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.