Here’s the dividend forecast for Sage Group shares through to 2026!

I’m not a betting man. But I bet Sage Group (LSE:SGE) wouldn’t the first name on someone’s lips if I was to ask them to name great dividend shares.

This isn’t a poor reflection on Sage. Rather, it’s because growth-chasing stocks aren’t renowned for also being generous dividend payers. Any spare cash such companies have tends to be reinvested to generate more profit.

However, Sage — which develops accounting, payroll, and human resources software — is an exception to this rule. It’s committed to reliably raising shareholder payouts while still investing shedloads of capital into its operations.

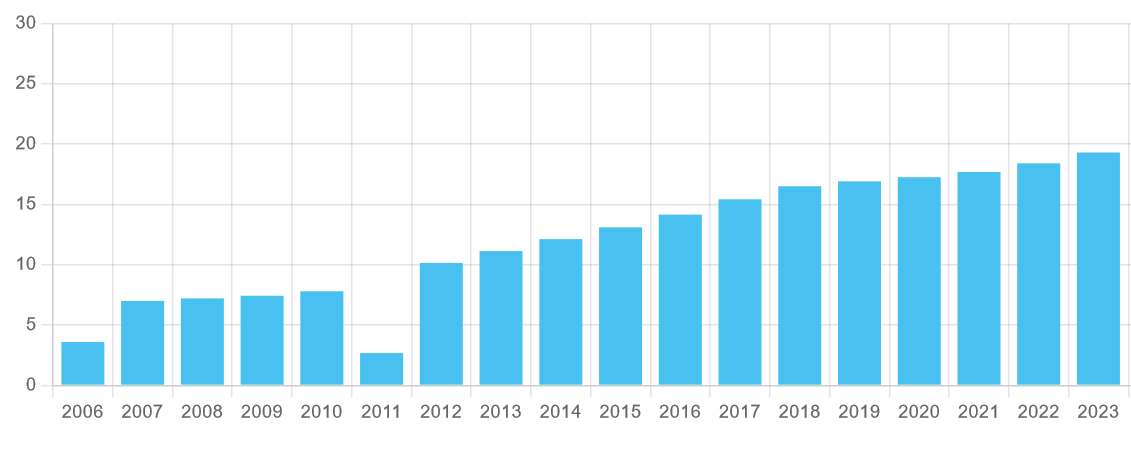

Indeed, dividends here have risen every year since 2012.

But what does the future hold for the FTSE 100 firm’s dividend policy? And should investors consider Sage shares for their portfolio?

Healthy forecasts

Keen followers of the stock may be unsurprised Sage’s dividends are tipped by City brokers to keep rising for the next two years, at least:

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| September 2025 | 21.85p | 7% | 1.7% |

| September 2026 | 23.32p | 7% | 1.8% |

These forecasts are supported by expected earnings growth of 10% and 13% in fiscal 2025 and 2026 respectively. However, dividends are never, ever guaranteed. So how realistic are these estimates?

The first, and simplest thing, to consider is dividend cover. This gauges how well predicted payouts are covered by expected earnings.

I’m ideally looking for a reading of 2 times or above to provide a margin of safety. And on this front Sage shares score well, with dividend cover between 1.9 times and 2 times for the next two years.

On top of this, Sage has a rock-solid balance sheet it can use to support future payouts. The success of its subscription-based model means excellent cash generation, and free cash flow rose 30% last financial year to £524m.

The firm also has very little debt on its balance sheet it needs to worry about. A net-debt-to-EBITDA ratio of 1.2 times as of September was well inside its target range of 1 to 2 times.

Sage’s plans to repurchase another £400m worth of its shares, as announced in last week’s full-year results, underlines its robust financial foundations.

Are Sage shares worth a closer look?

All things considered, Sage looks in great shape to meet dividend forecasts for its shares. But as with any share, I need to think about more than just cash rewards when contemplating whether to invest.

I also need to ponder the possibility that the share price could stagnate or even fall. In this case, a sharp economic slowdown that cools business software demand could hit profits and cause a price reversal.

Having said that, Sage’s resilience encourages me to think this is a top stock to consider. Its focus on cloud and artificial intelligence (AI) systems is paying off handsomely, driving underlying revenues and operating profit 9% and 21% higher respectively in the last financial year.

There’s scope for a lot more growth too, as companies continue to digitalise their operations, and Sage develops new products to take advantage of this.

Its shares are up 16% in the last year, and I expect the firm to keep rising despite its forward price-to-earnings (P/E) ratio of 31 times.

The post Here’s the dividend forecast for Sage Group shares through to 2026! appeared first on The Motley Fool UK.

But this isn’t the only opportunity that’s caught my attention this week. Here are:

5 Shares for the Future of Energy

Investors who don’t own energy shares need to see this now.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — sees 2 key reasons why energy is set to soar.

While sanctions slam Russian supplies, nations are also racing to achieve net zero emissions,

he says. Mark believes 5 companies in particular are poised for spectacular profits.

Open this new report — 5 Shares for the Future of Energy

— and discover:

- Britain’s Energy Fort Knox, now controlling 30% of UK energy storage

- How to potentially get paid by the weather

- Electric Vehicles’ secret

backdoor

opportunity - One dead simple stock for the new nuclear boom

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

- Here’s the growth forecast for Sage Group shares to 2026!

- This FTSE 100 tech share jumped 19% this morning! Here’s why

- Should I buy Sage Group as the share price jumps 20% on FY results?

- 2 FTSE 100 stocks that could soar while Donald Trump is US President

- 2 of my favourite, cheap FTSE 100 growth shares this November!

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has recommended Sage Group Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.