Why isn’t the promise of 1.5m more homes helping these FTSE 100 stocks?

It’s been a miserable time for shareholders in the FTSE 100’s builders. Following a dismal performance over the past three months or so, all four stocks are trading close to their 52-week lows.

Persimmon‘s (LSE:PSN) been particularly badly affected. Its shares have crashed nearly a third since early October.

In terms of market-cap, three of them are now in the bottom seven of Footsie stocks. Two of the other places are occupied by British Land and LondonMetric Property, further evidence that UK property shares are currently out of favour with investors.

And yet the government’s pledged to build 1.5m new homes during the lifetime of the current parliament. It wants to implement a series of planning reforms to increase the supply of housing.

The real issue

But in my opinion, this isn’t the problem. The emphasis needs to be on stimulating demand. When the final figures are tallied for 2024, Persimmon expects to have built 10,500 homes. This is 28.6% below its 2019-2022 average (14,712).

At 30 June 2024, the company owned 81,545 plots. Of these, 38,067 had “detailed planning”. If the demand was there, I’m sure the company would welcome the opportunity to build (and sell) more houses. Based on its current run rate, it has sufficient plots — with planning permission — to see it through the next 43 months.

But there aren’t enough people out there wanting to buy a new property. The government’s reduced the incentives available for first-time buyers, which is a particular problem for Persimmon with its houses costing less than its rivals.

And consumer confidence has been further dented by the government’s decision to increase employer’s National Insurance and borrow more to invest. The yield on 10-year gilts is at its highest level since 2008. This is the benchmark used by financial institutions to price mortgages.

Reasons to be optimistic

However, in my opinion, it’s important not to get distracted by short-term price volatility. And looking further ahead (three to five years), I believe there are may reasons why the sector will recover. That’s why I plan to hold on to my Persimmon shares.

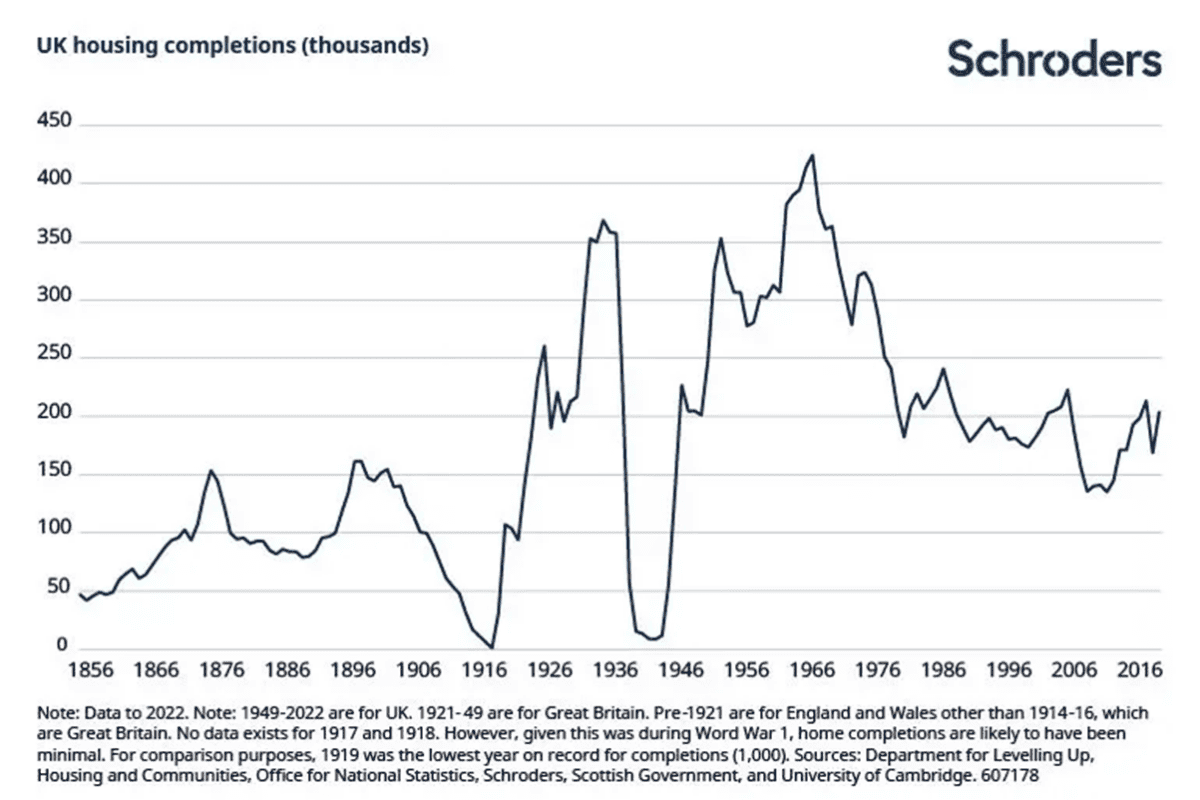

I know history isn’t necessarily a good guide but, in the absence of a crystal ball, it’s a useful indicator of future trends. And a look back at completions since 1856 shows there have been plenty of slumps — and subsequent recoveries — in the UK property market.

A recovery is dependent on the fortunes of the wider economy. And most ‘experts’ are expecting UK GDP to grow in 2025 — for example, KPMG (1.7%), International Monetary Fund (1.5%) and Goldman Sachs (1.2%).

Also, UK interest rates are expected to fall further over the next 12-24 months.

And looking more closely at Persimmon, despite its recent woes, it doesn’t have any debt on its balance sheet. What’s more, based on the anticipated dividend in respect of its 2024 financial year (60p), it’s currently yielding an impressive 5.6%.

I believe the government’s planning law changes are more likely to help the FTSE 100’s builders in the next parliament. Before then, I believe a recovery in their share prices will be driven by improved consumer confidence, lower interest rates and generous dividends. For these reasons, I plan to hold on to my Persimmon shares.

The post Why isn’t the promise of 1.5m more homes helping these FTSE 100 stocks? appeared first on The Motley Fool UK.

But there may be an even bigger investment opportunity that’s caught my eye:

Investing in AI: 3 Stocks with Huge Potential!

🤖 Are you fascinated by the potential of AI? 🤖

Imagine investing in cutting-edge technology just once, then watching as it evolves and grows, transforming industries and potentially even yielding substantial returns.

If the idea of being part of the AI revolution excites you, along with the prospect of significant potential gains on your initial investment…

Then you won’t want to miss this special report inside Motley Fool Share Advisor – ‘AI Front Runners: 3 Surprising Stocks Riding The AI Wave’!

And today, we’re giving you exclusive access to ONE of these top AI stock picks, absolutely free!

More reading

- With a 5.1% yield and huge growth potential, is this the best FTSE 100 stock out there?

- Could the FTSE 100 hit 9,000 in 2025?

- 2 UK shares investors should consider keeping on a tight leash

- £1,000 invested in Persimmon shares before the UK election is worth this much now

James Beard has positions in Persimmon Plc. The Motley Fool UK has recommended Barratt Redrow, British Land Plc, LondonMetric Property Plc, and Schroders Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.