Down 33% in 2024 — can the UK’s 2 worst blue-chips smash the stock market this year?

I’ve been looking at last year’s UK stock market returns and two FTSE 100 companies leap out at me. Sadly, for the wrong reasons.

They’re the two worst performers on the blue-chip index, both having fallen around 33% over the last 12 months. But one year’s loser can turn out to be next year’s big winner. So do they have serious comeback potential?

I actually considered buying one of the stocks in September: international sports betting and gambling company Entain (LSE: ENT).

It caught my attention after jumping more than 18% in a month following a successful Euros football tournament, as results went in its favour.

Should I entertain Entain shares?

Investors had another reason to feel upbeat as gaming industry veteran Gavin Isaacs took over from CEO Jette Nygaard-Andersen, whose acquisition spree hadn’t yet paid off.

Thankfully, I didn’t part with my money. Although Chancellor Rachel Reeves didn’t tighten gambling regulation in her autumn Budget, Brazil and the Netherlands did.

Then on 16 December, Australian regulators hit Entain with a money-laundering lawsuit and the shares went down under. Its price is down 33% over 12 months and 60% over three years.

I’m no fan of the gaming industry but I can see there’s an opportunity here. The 17 analysts offering one-year share price forecasts have produced a median target of just over 955p. If correct, that’s a bumper increase of more than 50% from today.

Entain has a huge opportunity in the US via its 50:50 BetMGM joint venture with MGM Resorts International. I can’t imagine President-elect Donald Trump announcing a gaming crackdown. The shares look decent value with a price-to-earnings ratio of 14.7, although not dirt cheap. The yield is a modest 2.83%.

The Entain share price could suddenly rocket but with regulators marauding at every turn, it could go either way. It’s one for gamblers. Not for me.

Will Spirax shares spiral in 2025?

Last year’s second big flop is a stock I’ve never considered buying. Spirax (LSE: SPX) specialises in niche products such as industrial and commercial steam systems. It’s flown completely under my radar.

As well as falling by a third over the last year, the Spirax share price has slumped ped 55% over three years. I’m glad I overlooked it.

Sales have been hit by the global industrial slowdown, with falling Chinese demand hitting the group’s Steam Thermal Solutions division.

Yet once again, analysts are upbeat. The 17 brokers offering one-year forecasts produce a median target of 7,825p, up 18% from today’s 6,630p.

The shares look expensive despite their recent dismal run, with a P/E of 21.46 times. That’s well above the FTSE 100 average of 15 times.

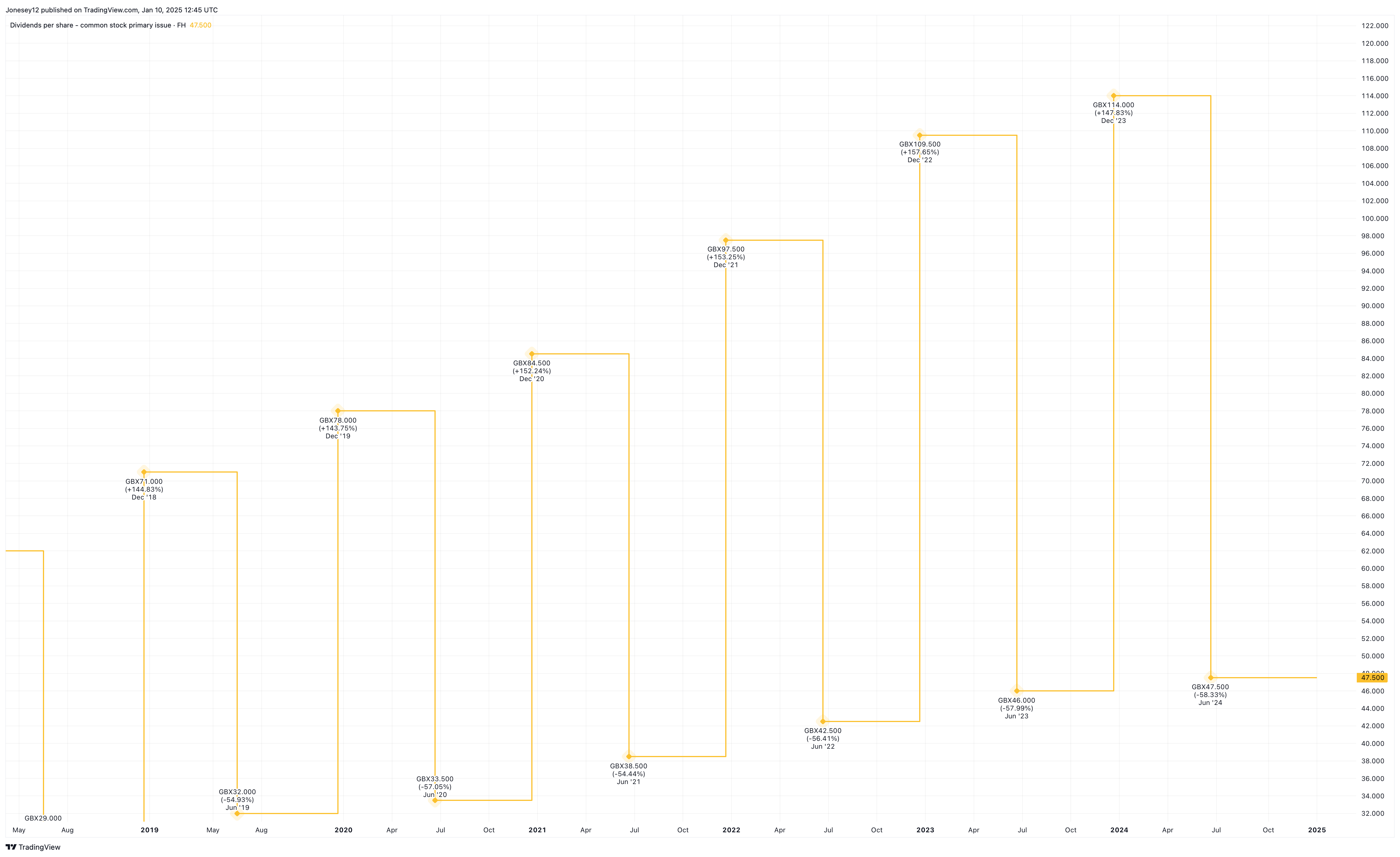

The big attraction is the group’s excellent dividend track record, with 55 years of consecutive annual dividend growth. It’s a true Dividend Aristocrat. The growth continues as this chart shows.

Chart by TradingView

Today the shares are forecast to yield a modest 2.6%, covered 1.8 times by earnings.

Yet I’m not convinced. Especially when I see net debt of £1bn. That’s pretty steep given the £5bn market cap. Spirax should fare better in 2025 as some of its more profitable end markets recover, but I think I can find better value on the FTSE 100 right now.

The post Down 33% in 2024 — can the UK’s 2 worst blue-chips smash the stock market this year? appeared first on The Motley Fool UK.

Should you buy Entain now?

Don’t make any big decisions yet.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — has revealed 5 Shares for the Future of Energy.

And he believes they could bring spectacular returns over the next decade.

Since the war in Ukraine, nations everywhere are scrambling for energy independence,

he says. Meanwhile, they’re hellbent on achieving net zero emissions.

No guarantees, but history shows…

When such enormous changes hit a big industry, informed investors can potentially get rich.

So, with his new report, Mark’s aiming to put more investors in this enviable position.

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

Harvey Jones has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.