Searching for passive income? Here are 2 top dividend growth shares to consider!

Searching for top dividend shares to buy? Here are two that are worth a look — their shareholder payouts are tipped to grow steadily in the coming years.

BAE Systems

Defence spending has risen sharply in recent times, hitting repeated record peaks in the process. This is a trend that looks set to continue as, unfortunately, the world becomes increasingly dangerous.

According to a World Economic Forum (WEF) survey, “state-based armed conflict” is — with 23% of the vote –the biggest threat facing the planet in 2025. This is according to a panel of 900 experts in politics, business, and academia.

These views are hardly surprising amid rising tensions between global superpowers on trade and foreign policy. Regardless of whether new conflicts emerge or current hostilities escalate, demand for weaponry is likely to keep rising.

Just yesterday (14 January), BAE Systems (LSE:BA.) announced a new $85m contract with the US Navy to supply Network Tactical Common Data Link (NTCDL) systems. As a critical supplier of defence hardware to NATO members including the US, UK, and Australia, orders tend to rise strongly during times like this.

At £74.1bn, its order backlog rose to record peaks as of June last year. It also recorded sales growth of 11% in the first six months of 2024.

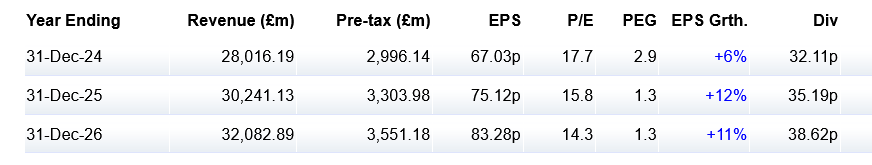

City analysts are expecting revenues and earnings to continue rising in the next couple of years at least, leading to predictions of further dividend growth. BAE Systems has raised the annual payout every year since 2012.

As a consequence, the FTSE 100 company’s dividend yield is a healthy 3% and 3.3% for 2025 and 2026 respectively.

This is not to say that robust earnings growth is guaranteed, however. Supply chain problems could derail project delivery in the short term and beyond, while new spending efficiency programmes under the returning President Trump could impact future profits.

But on balance, I think BAE Systems could produce strong profits and dividend growth over the forecasted period.

The PRS REIT

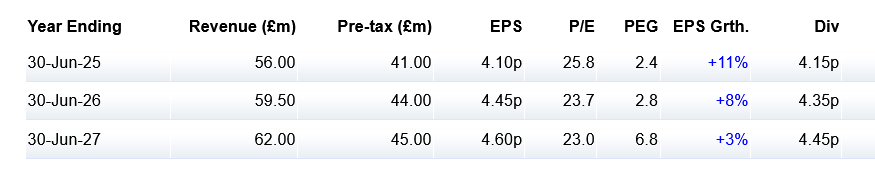

Residential landlord The PRS REIT (LSE:PRSR) has kept annual dividends unchanged so far this decade. But City analysts think this could be about to change as earnings rise and interest rates (likely) continue to fall.

As a result, the dividend yields on the company’s shares rise to 3.8% for this year, and 4% and 4.1% for fiscal 2026 and 2027.

It’s understandable to me that analysts are so bullish on PRS REIT’s growth and dividend prospects. Private rents in the UK continue to soar as the country’s chronic housing shortage continues. Rents increased 9% in the year to November, according to the Office for National Statistics (ONS).

Real estate investment trusts (REITs) can be excellent picks for passive income. This is because they pay a minimum of 90% of rental profits out in dividends in exchange for tax benefits.

It’s not certain that interest rates will continue to fall in 2025. If this happens, the pressure on PRS REIT’s borrowing costs will remain above recent norms, impacting profits in the process.

That said, I think the FTSE 250 business still looks in good shape to keep growing earnings and delivering market-beating dividends.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

The post Searching for passive income? Here are 2 top dividend growth shares to consider! appeared first on The Motley Fool UK.

But there are other promising opportunities in the stock market right now. In fact, here are:

5 stocks for trying to build wealth after 50

The cost of living crisis shows no signs of slowing… the conflict in the Middle East and Ukraine shows no sign of resolution, while the global economy could be teetering on the brink of recession.

Whether you’re a newbie investor or a seasoned pro, deciding which stocks to add to your shopping list can be a daunting prospect during such unprecedented times. Yet despite the stock market’s recent gains, we think many shares still trade at a discount to their true value.

Fortunately, The Motley Fool UK analyst team have short-listed five companies that they believe STILL boast significant long-term growth prospects despite the global upheaval…

We’re sharing the names in a special FREE investing report that you can download today. We believe these stocks could be a great fit for any well-diversified portfolio with the goal of building wealth in your 50’s.

More reading

- Looking for ISA dividend shares? 2 passive income heroes to consider today

- £5,000 invested in BAE Systems shares at the start of 2023 is now worth…

- After slumping 12% is BAE Systems now a screaming buy for my Stocks and Shares ISA?

- Down 19% to a near 12-month low, does BAE Systems’ share price look an unmissable bargain to me?

- 3 UK dividend growth shares to consider in 2025 for rising passive income

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has recommended BAE Systems. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.