Does the National Grid share price matter, as long as the dividends keep coming?

Over the past year, National Grid (LSE: NG) has moved up 2% on the London stock exchange. The National Grid share price is within 6% of where it stood five years ago.

Things could be worse. At least the share price has moved in the right direction.

For some investors, the share price may be irrelevant. National Grid is popular for its dividend. Its position in the utility industry is perceived to provide stable cash flows that can help a dividend the firm aims to grow in line with inflation.

As an investor though, ought I to take that approach and consider just the dividends?

Why a share price matters

if I invest money in a share and the price falls, I do not lose anything – unless I sell. At that point, a paper loss crystallises into an actual one.

So even if I bought National Grid shares today and the price fell (it is down 13% since May 2022, for example) I would only lose money if I sold at that price.

However, most investors sooner or later will consider selling shares. Even long-term shareholders may change their financial objectives or view of a company, for example.

So a falling share price can be a concern if it looks unlikely to recover. Tying money up for years in shares that have a paper loss can also bring an opportunity cost as those funds cannot be used for other things.

How secure is the dividend?

So I would certainly pay attention to the National Grid share price even if I expected the dividends to keep coming.

But utilities are not as secure as some shareholders believe when it comes to maintaining their dividends, let alone growing them regularly.

Want an example? Look at SSE. Last year’s dividend was 60p per share. Back in 2020, it was 80p. In 2015, it was 88.4p. So much for utilities being reliable long-term dividend payers. No dividend is ever guaranteed.

Increasingly alarming debt levels

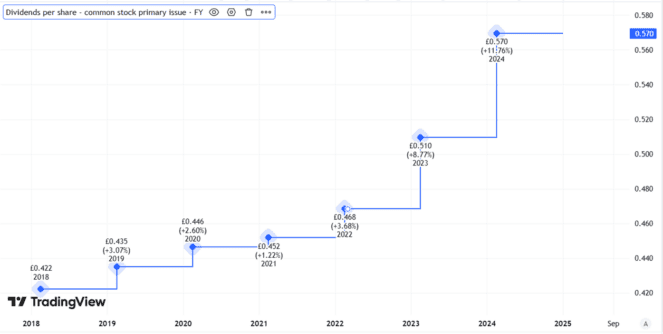

In fairness, National Grid has a good track record when it comes to annual dividend growth.

Created using TradingView

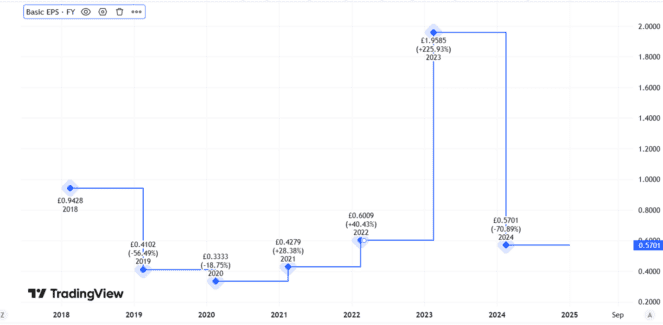

But look at the firm’s basic earnings per share.

Created using TradingView

They move around a lot – and do not always cover the dividend.

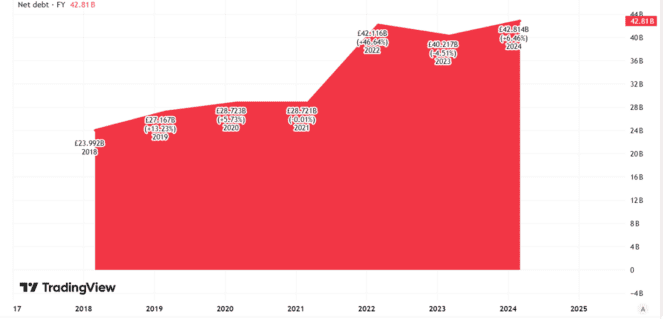

Owning and maintaining an energy network is costly business, especially now at a time when energy is being generated and where it is being consumed are in flux compared to historical norms.

That means National Grid has to spend a lot to keep its business running. So its net debt has grown over time.

Created using TradingView

Last year saw a rights issue designed to help boost funds available for items including capital expenditure. That diluted shareholders.

I see a risk of a similar move in future if National Grid wants to deliver on its goal of keeping the dividend growing annually in line with inflation. An alternative, at some point, is for the company to reduce the payout like SSE has repeatedly done. If that happened, it could send the share price tumbling.

So although its unique network assets can help generate sizeable cash flows, I have no plans to add National Grid shares to my portfolio.

The post Does the National Grid share price matter, as long as the dividends keep coming? appeared first on The Motley Fool UK.

5 Shares for the Future of Energy

Investors who don’t own energy shares need to see this now.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — sees 2 key reasons why energy is set to soar.

While sanctions slam Russian supplies, nations are also racing to achieve net zero emissions,

he says. Mark believes 5 companies in particular are poised for spectacular profits.

Open this new report — 5 Shares for the Future of Energy

— and discover:

- Britain’s Energy Fort Knox, now controlling 30% of UK energy storage

- How to potentially get paid by the weather

- Electric Vehicles’ secret

backdoor

opportunity - One dead simple stock for the new nuclear boom

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

- 3 high-yield dividend shares I’m considering buying this year

- Should I buy National Grid after its share price fall pushes the dividend to 5.7%?

- £5,000 invested in National Grid shares 5 years ago is now worth…

- Here’s how an investor could use £20,000 of savings to target £396 a month of passive income!

- Is it worth me buying National Grid shares for around £9 after a 14% drop?

C Ruane has no position in any of the shares mentioned. The Motley Fool UK has recommended National Grid Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.