£100,000 invested in Tesla shares 10 years ago is now worth…

On paper, a £100,000 investment in Tesla (NASDAQ: TSLA) made a decade ago would now be worth approximately £2.4m, reflecting share price growth of 2,340%.

This growth trajectory masks significant turbulence, notably earlier this year as shares plunged 30% from their December peak of $488.54. Nonetheless, this growthâs huge.

However, it gets better. Thatâs because the pound has depreciated around 20% over the last decade. Essentially, £100,000 back then would have bought be $150,000 of Tesla stock. Today, that $150,000 of stock would be worth $3.5m, or £2.7m.

Should investors cash in?

Teslaâs decade-long ascent transformed early investors into millionaires, fuelled by its electric vehicle (EV) market dominance and cult-like shareholder loyalty. However, the company and its stock is at something of a crossroads.

So after such a bull run, why would investors consider selling? Well, Teslaâs financial metrics defy automotive sector norms, trading at 147 times trailing earnings â an 860% premium to the industrials sector median.

This premium is also present in forward metrics â those based on analystsâ forecasts â with the forward price-to-earnings-to-growth (PEG) ratio of 8.5 representing a 450% premium to the industrials sector average.

On paper, this looks like an opportunity to sell. The stockâs surged and the valuation metrics certainly arenât attractive. In fact, the stockâs value appears entirely disconnected with its fundamentals.

Of course, the value proposition lies in Elon Muskâs plans for Tesla. The boss sees the company dominating in self-driving and robotics. In short, it has a lot of cash, and grand plans, but so far it appears to be falling some way behind its peers.

Overreach and unpopularity

Whatâs more, Muskâs simultaneous roles as Tesla CEO, head of SpaceX, and Trump administrationâs Department of Government Efficiency (DOGE) chief have diluted focus, and this appears to be impacting shareholder conviction.

After all, he canât realistically run all these companies at once. And thatâs an issue given Musk has been so central to Teslaâs rise.

Concerningly, this role in the Trump administration doesnât appear to be bearing any fruit for Tesla shareholders either. In fact, the administrationâs cancellation of a $5bn EV charging initiative and new 25% steel/aluminium tariffs have disrupted Teslaâs China-dependent supply chain.

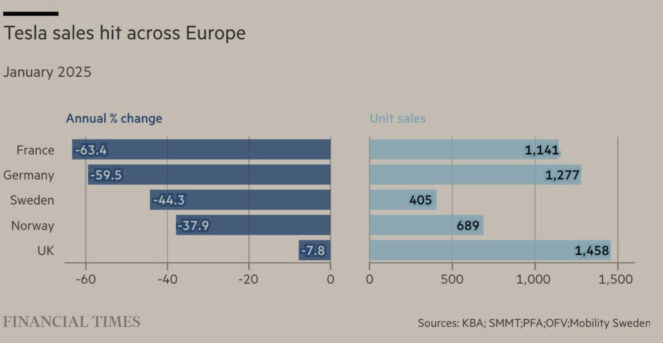

In addition, Morning Consult data shows Muskâs consumer favourability plummeting to 3% in early 2025 from 33% in 2018, eroding the brandâs cultural capital. This is particularly apparent when we look at recent sales data in Europe.

As the Financial Times data below highlights, Tesla sales fell 63.4% in France in January. Muskâs own image may have something to do with this. Sales in Germany also plummeted where heâs shown support for the more radical AFD party.

Of course, none of this will really matter if Tesla delivers a dominant product in self-driving and humanoid robots. However, thatâs a big âifâ given the lack of publicised progress.

Iâd love to be bullish on this Western technology leader, but I simply canât get behind the valuation and the speculative nature of investing in unproven technology. I won’t consider buying.

The post £100,000 invested in Tesla shares 10 years ago is now worth⦠appeared first on The Motley Fool UK.

But this isnât the only opportunity thatâs caught my attention this week. Here are:

5 Shares for the Future of Energy

Investors who don’t own energy shares need to see this now.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — sees 2 key reasons why energy is set to soar.

While sanctions slam Russian supplies, nations are also racing to achieve net zero emissions,

he says. Mark believes 5 companies in particular are poised for spectacular profits.

Open this new report — 5 Shares for the Future of Energy

— and discover:

- Britain’s Energy Fort Knox, now controlling 30% of UK energy storage

- How to potentially get paid by the weather

- Electric Vehicles’ secret

backdoor

opportunity - One dead simple stock for the new nuclear boom

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

- Down 16% in a month, is Tesla stock a falling knife?

- £10,000 invested in the S&P 500 the day before the presidential election is now worth…

- £10,000 invested in Tesla stock on 18 December is worth this much today!

- £1,000 invested in Tesla shares 2 months ago is now worthâ¦

- Is Tesla stock running out of road?

James Fox has no position in any of the shares mentioned. The Motley Fool UK has recommended Tesla. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.