At a 52-week low, is this under-the-radar UK stock now an unmissable opportunity to consider?

It’s unusual to find a UK stock that has outstanding potential for both growth and dividend investors. And it’s almost impossible to find it trading at a bargain price.

Tristel (LSE:TSTL) however, might be such a stock. It’s at a 52-week low, but the business is growing well and the company just increased its dividend by 8% – with more to come.

What is Tristel?

Tristel’s a stock that investors probably aren’t paying much attention to. But I think they could be missing out if they don’t at least take a closer look.

The company makes disinfectant products for medical equipment. And what sets it apart is its use of chlorine dioxide – rather than chlorine – in its products.

Source: Tristel Investor Presentation February 2025

Chlorine dioxide (CIO2) has a few advantages over chlorine (CI2). Microorganisms can’t build resistance to CIO2, it’s more efficient than CI2, and it doesn’t produce harmful by-products.

In short, Tristel’s products are both effective and require a lot of technical knowledge. And I think this could be a powerful combination going forward.

Outlook

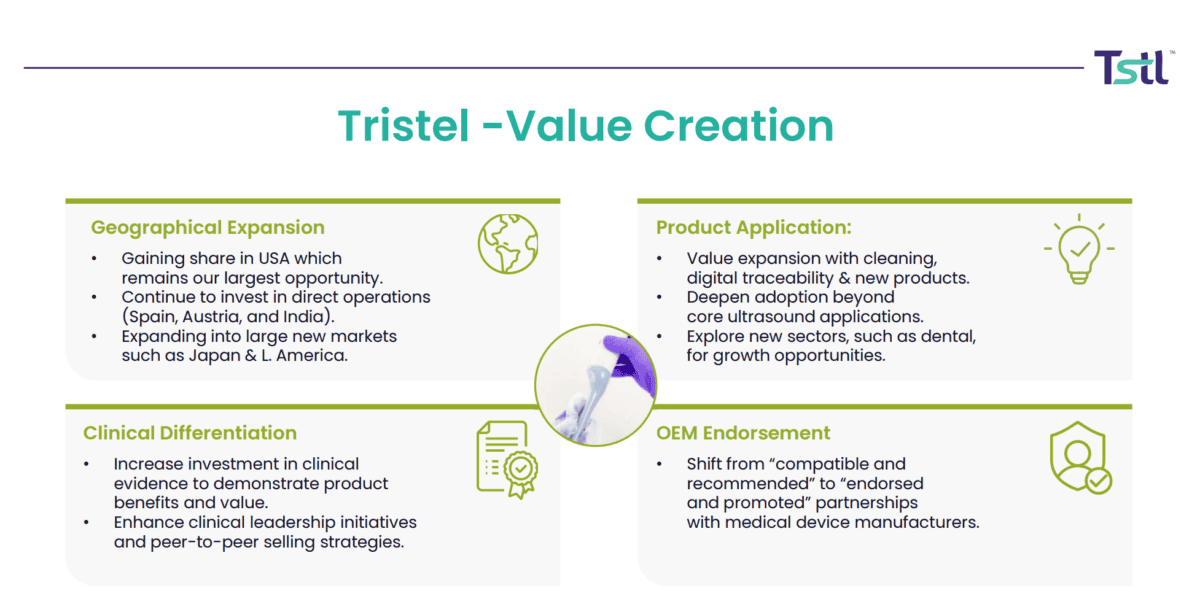

Tristel’s been successful in the UK disinfection market. But the big opportunity is it’s trying to make progress with is the US, which could be huge for a business currently valued at £165m. This however, isn’t straightforward.

The company’s solutions are expensive and convincing hospitals to change from trusted suppliers offering cheaper products might be difficult. Despite this, Tristel’s made progress. Its disinfectant for ultrasound probes has been given regulatory approval and the firm has issued a filing for its ophthalmic devices treatment.

It’s worth noting that, while the US is a huge potential market, it’s not the only growth avenue. The company has also identified Spain, India, and Austria as potential opportunities for 2025.

Dividends

With several international expansion possibilities in progress, it’s natural to think Tristel isn’t likely to be returning cash to shareholders any time soon. But that would be a big mistake. The company currently distributes just under 14p per share in dividends – a yield of 4% at today’s prices. And it’s committed to increasing this by 5% a year going forward.

Given the uncertainty around its international expansion, that might seem somewhat cavalier. If its plans go as hoped, Tristel will have to invest cash to support its growth.

The company however, has no debt and the cash on its balance sheet‘s growing. And its latest 8% increase in its interim dividend is in line with the growth from the underlying business.

Risks and rewards

Over the last five years, Tristel’s share price has been all over the place as pandemic-driven demand gave way to unusually high inventory levels. But that volatility should be in the past.

With the stock at a 52-week low, I think investors should consider it. Expansion into the US brings a lot of uncertainty, but the share price offers good value for the risks involved.

If things go well, a £10,000 investment in Tristel today might be generating significant passive income 10 years from now. And the stock could be worth a lot more as well.

The post At a 52-week low, is this under-the-radar UK stock now an unmissable opportunity to consider? appeared first on The Motley Fool UK.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

More reading

- My favourite FTSE 250 stock doubled my money in 15 months and still looks cheap to me!

- Up 85% from its one-year low to around £3 now, can Barclays’ share price still be significantly undervalued?

- This FTSE investment trust offers exposure to Nvidia, Apple, Alphabet, and other tech stocks (at a discount)

- Could these former penny stocks continue soaring in March?

- Down 50% in a year, could this be the FTSE 250’s best recovery stock?

Stephen Wright has no position in any of the shares mentioned. The Motley Fool UK has recommended Tristel Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.