UK stock investors are piling into this under-the-radar share up 270%! Should I join them?

Out of curiosity, I like to check in on the top buys over at AJ Bell and Hargreaves Lansdown. Often their lists are made up of the usual UK stock suspects like Rolls-Royce, or Big Tech names such as Nvidia, Tesla, and Palantir.

However, you do get the odd exception. One that stood out recently was Hims & Hers Health (NYSE: HIMS). On 24 February, this was the sixth most-bought share among AJ Bell customers.

Now, I feel for some of these invested because Hims and Hers stock plummeted 26% yesterday (25 February)! Yet despite this drop, it’s still up 270% in the past year.

Here, I want to dig into this this under-the-radar US stock to see if it’s worth me buying.

Digital healthcare

Hims and Hers is an online healthcare company. It offers prescription medications, over-the-counter wellness products, and virtual consultations for conditions such as hair loss, mental health, and skincare.

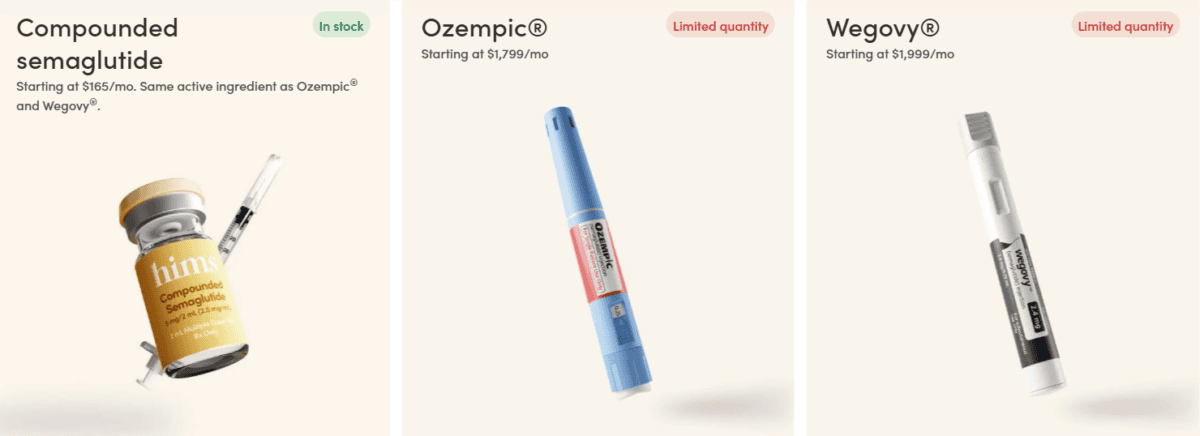

However, it has been compounded semaglutide products that have put rocket boosters under the share price. Semaglutide’s the active ingredient in Novo Nordisk’s blockbuster GLP-1 medications Ozempic and Wegovy. Compounded drugs are custom-made alternatives to branded versions.

In May, the company was allowed to start prescribing these copycat weight-loss products because there was a GLP-1 drug shortage due to massive demand. It’s been offering compounded versions of semaglutide at prices starting around $165 a month. By contrast, the list prices for Ozempic and Wegovy without insurance are way higher.

Unsurprisingly, this has driven huge growth at the digital health firm. However, regulators announced last week that the shortage in semaglutide injection products is over. As a result, compounding pharmacies like Hims and Hers will have to stop selling them in the next few weeks.

Still strong growth

On 24 February, the company posted its Q4 results. Revenue surged 95% year on year to $481m, while earnings per share skyrocketed to 11 cents from 1 cent. However, gross margin fell from 83% to 77% due to the higher costs and GLP-1 products that were “strategically priced to attract new customers“.

Co-founder and CEO Andrew Dudum said: “We continue to build a platform that leverages personalisation and technology unlike any traditional healthcare system. Over 2 million subscribers now entrust Hims & Hers to aid them in their journey to better health.”

The underlying platform’s growing nicely. Excluding GLP-1 drugs, full-year revenue increased 43% to over $1.2bn. This saw the firm reach its previous 2025 revenue target a year early!

Meanwhile, the company’s pursuing vertical integration. To this end, it recently acquired a peptide facility in California and blood-testing business Trybe Labs. This latter acquisition allows it to offer at-home blood testing services, providing customers with insights into various health markers.

Worth watching

For 2025, management expects revenue of $2.3bn-$2.4bn (roughly 60% year-on-year growth) and adjusted EBITDA of $270m-$320m. That puts the stock on a reasonable price-to-sales (P/S) multiple of about 3.5.

Nevertheless, the concern here is that earnings growth will drop sharply once compounded semaglutide products disappear. There’s also a lot of competition in the digital healthcare space.

I think it might be too risky to try and catch this falling knife right now. But this is a very interesting $8bn growth company. So I’ve put the stock on my watchlist.

The post UK stock investors are piling into this under-the-radar share up 270%! Should I join them? appeared first on The Motley Fool UK.

But there may be an even bigger investment opportunity that’s caught my eye:

Investing in AI: 3 Stocks with Huge Potential!

🤖 Are you fascinated by the potential of AI? 🤖

Imagine investing in cutting-edge technology just once, then watching as it evolves and grows, transforming industries and potentially even yielding substantial returns.

If the idea of being part of the AI revolution excites you, along with the prospect of significant potential gains on your initial investment…

Then you won’t want to miss this special report inside Motley Fool Share Advisor – ‘AI Front Runners: 3 Surprising Stocks Riding The AI Wave’!

And today, we’re giving you exclusive access to ONE of these top AI stock picks, absolutely free!

More reading

- £10,000 invested in Lloyds shares 20 years ago is now worth…

- How much would we need in a Stocks and Shares ISA for £1,000-a-month passive income?

- Prediction: this newly-promoted FTSE 100 firm will outperform Rolls-Royce shares

- Will the Ocado share price ever amount to more than a hill of beans?

- The Next share price is up 36% in a decade. Should I buy now for the next decade?

Ben McPoland has positions in Novo Nordisk and Rolls-Royce Plc. The Motley Fool UK has recommended Aj Bell Plc, Hargreaves Lansdown Plc, Novo Nordisk, Nvidia, Rolls-Royce Plc, and Tesla. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.