This British oil giant just dropped to third place on the FTSE 100

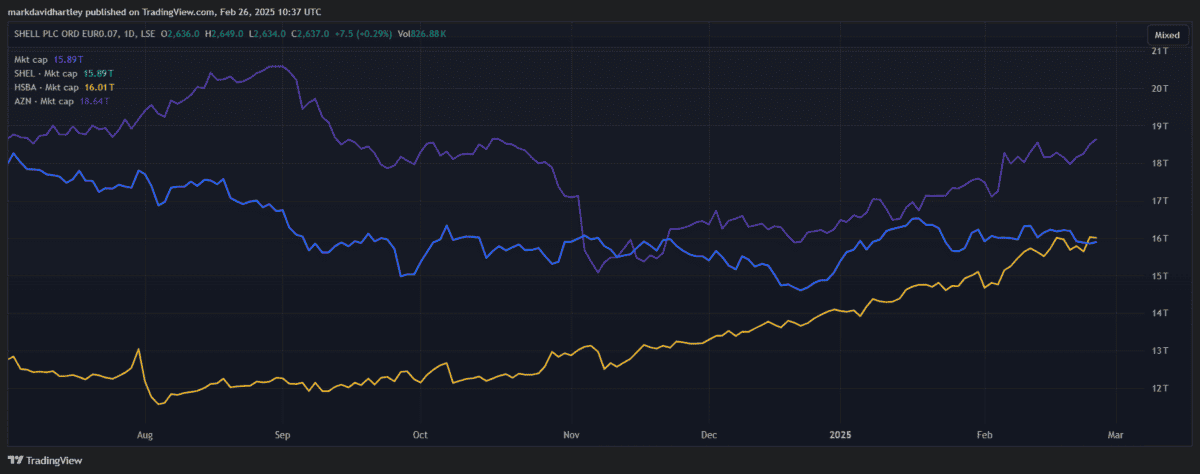

For years, Shell (LSE: SHEL) has been one of the largest and most influential energy stocks on the FTSE 100. But in a surprising turn, the leading UK oil stock has slipped to third place in the index, overtaken by HSBC in terms of market capitalisation.

Since August last year, it’s doubled from £80bn to £160bn, while Shell’s market cap has dropped from £175bn to below £160bn.

So, whatâs behind this shift and should investors be concerned about Shellâs future?

Letâs take a closer look at the key factors driving its share price, from global oil prices to the companyâs latest strategic moves.

Why did Shell drop?

Shellâs fall in the rankings has far more to do with HSBC’s growth than its own weaknesses. But why hasnât Shellâs market cap grown in a rising Footsie too? Could there be underlying issues worth examining?

For example, falling crude oil prices could be affecting revenue and earnings expectations. Shellâs profitability is directly tied to crude oil prices. When oil prices are high, the company enjoys soaring revenues, but when they fall, profits can take a hit.

Recently, Brent crude has hovered between $75 to $85 a barrel, down from highs above $100 in 2022.

OPEC+ production cuts have attempted to stabilise prices while demand concerns in China have weighed on market sentiment.

There are many reasons why Shell remains a good stock to consider but first, let’s look at the risks.

An industry in flux

Unlike some sectors, energy stocks are highly cyclical and susceptible to global market swings. This adds a degree of volatility to stocks that are dependent on oil prices. If the world economy weakens, energy consumption could decline, further pressuring Shellâs revenue and profit margins.

In recent years, this problem has been compounded by a growing desire to shift away from fossil fuel consumption. Governments worldwide are tightening climate policies, leading to higher costs and reduced demand for fossil fuels.

A full transition to renewable energy, while necessary, is proving to be costly and drawn out. This has become a key risk affecting its bottom line.

Prioritising profits

Shell may be suffering short-term losses but it remains a solid stock with a history of strong shareholder returns. With a dividend yield of around 4% and a dedicated share buyback programme, it offers good value for investors.

Despite oil price fluctuations, its diverse operations in refining, chemicals and renewables help maintain a steady cash flow.

But to continue turning a profit, it may need to rebalance its priorities.

While some renewable energy and carbon capture efforts remain, there’s been a notable weakening of emission reduction targets.

The high costs of these efforts threaten shareholder returns, pressuring it to prioritise fossil fuel profits over climate needs. While this could help revitalise short-term growth, it comes at a high cost for the environment.

Hopefully, a more beneficial long-term solution can be achieved.

For those bullish on oil prices rebounding, Shell may be a stock to consider. But for investors worried about long-term energy transition risks, it may be worth considering more diversified FTSE 100 stocks.

The post This British oil giant just dropped to third place on the FTSE 100 appeared first on The Motley Fool UK.

Should you buy Shell now?

Don’t make any big decisions yet.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — has revealed 5 Shares for the Future of Energy.

And he believes they could bring spectacular returns over the next decade.

Since the war in Ukraine, nations everywhere are scrambling for energy independence,

he says. Meanwhile, they’re hellbent on achieving net zero emissions.

No guarantees, but history shows…

When such enormous changes hit a big industry, informed investors can potentially get rich.

So, with his new report, Mark’s aiming to put more investors in this enviable position.

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

- Down 9% despite rising gas demand forecasts and new deals done, Shellâs share price looks a bargain to me

- At £26.46 Shellâs share price is down 10% from its 12-month traded high, so should I buy more now?

- £20,000 invested in Shell shares 4 years ago is now worth…

- Dividend rise and buyback help keep the Shell share price up. Time to buy?

- 2 super-cheap shares with dazzling dividends Iâm considering buying today, and one I’m sadly not

Mark Hartley has positions in HSBC Holdings. The Motley Fool UK has recommended HSBC Holdings. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.