Is now the perfect time to start buying shares?

The best time to buy shares is when nobody else wants to. That’s when prices are lowest and investors get the most for their money, which leads to the highest long-term returns.

While share prices have been coming down, there’s absolutely nothing to say they can’t fall further. Despite this, I think right now does look like a good time to start investing.

Stock market momentum

The stock market makes investors do unusual things. Normally, people gravitate towards buying when prices are low – that’s why events like Black Friday are so popular.

The opposite’s true with stocks. When things start turning down, investors often begin selling the shares they were previously buying, even though the prices are now lower than they were.

It’s easy to see why this happens – share prices change more often and more dramatically than the price of consumer electronics. And investors naturally worry about downward momentum. If a stock’s going to be cheaper tomorrow, selling it at today’s prices can look like it makes sense. But the best investors are the ones who are able to buy when stocks are falling.

Where are we now?

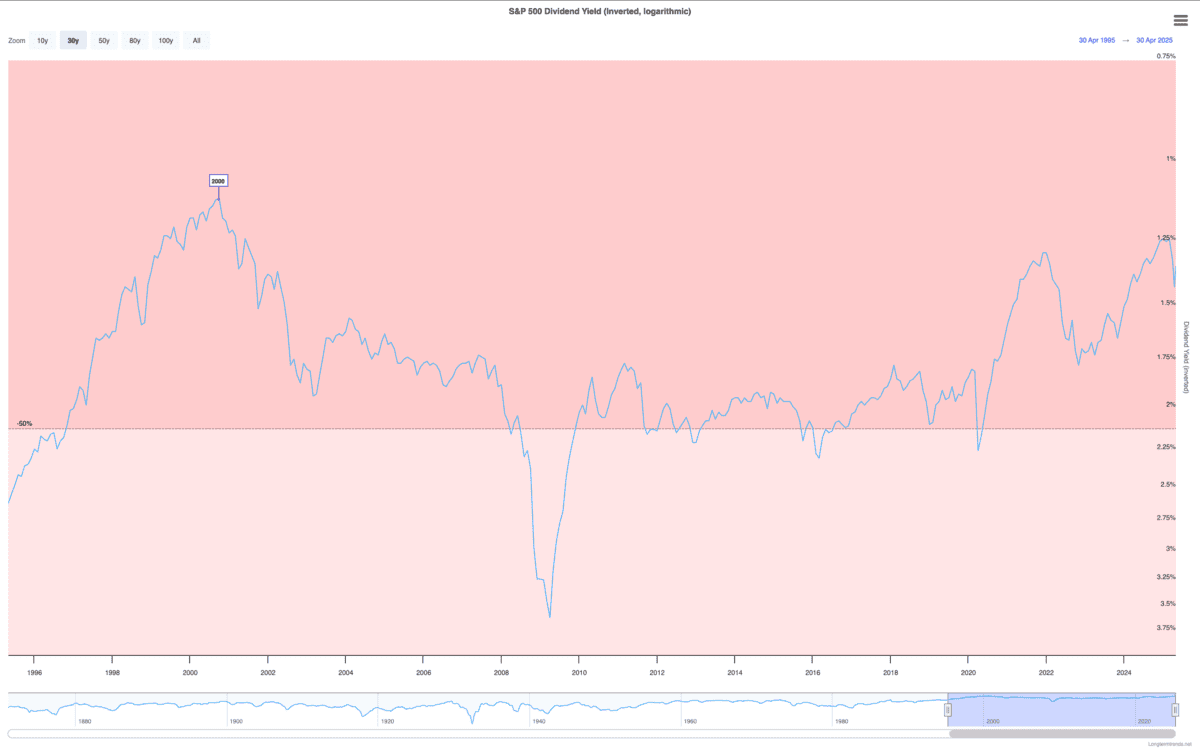

Share prices as a group have been volatile over the last couple of weeks. But while the FTSE 100 has recovered from its losses, the S&P 500 continues to keep working its way lower. Investors however, shouldn’t be too hasty when it comes to buying US shares. Despite the recent downturn, the S&P 500’s dividend yield is still historically low.

Source: Longtermtrends

The current 1.2% dividend yield’s also around a third of what investors might get from the FTSE 100. So there’s still a lot to be said for UK stocks from a value perspective.

On both sides of the Atlantic, I think the best strategy is to look for individual opportunities. In each index, there are stocks the market might be underestimating.

Finding value

Diageo‘s (LSE:DGE) a good example. The stock’s been falling steadily for the last three years, driven by short-term uncertainty and lower alcohol consumption among Millennials.

These are genuine issues, but there are also positive trends that shouldn’t be ignored. Despite declining alcohol consumption, spirits have been taking market share from beer and wine.

Furthermore, the stock looks unusually good value at today’s prices. The dividend yield’s around 4% and the price-to-earnings (P/E) ratio’s around 16.

Investors haven’t had the chance to buy the stock at these levels in a long time. And I think Diageo’s scale should give it a big advantage when it comes to adapting to shifting preferences.

Getting started

Could Diageo shares fall further from their current levels? Absolutely – historically low metrics are no guarantee the stock’s going to go up any time soon. Right now though, investors get a lot for their money. The strength of its brands is a unique asset that should give it a big advantage over competitors.

Finding the perfect time to start investing is nearly impossible. But for anyone thinking about it, I don’t believe there’s been a better time to consider buying Diageo shares in the last decade.

The post Is now the perfect time to start buying shares? appeared first on The Motley Fool UK.

But there may be an even bigger investment opportunity that’s caught my eye:

Investing in AI: 3 Stocks with Huge Potential!

🤖 Are you fascinated by the potential of AI? 🤖

Imagine investing in cutting-edge technology just once, then watching as it evolves and grows, transforming industries and potentially even yielding substantial returns.

If the idea of being part of the AI revolution excites you, along with the prospect of significant potential gains on your initial investment…

Then you won’t want to miss this special report inside Motley Fool Share Advisor – ‘AI Front Runners: 3 Surprising Stocks Riding The AI Wave’!

And today, we’re giving you exclusive access to ONE of these top AI stock picks, absolutely free!

More reading

- £20,000 in savings? Here’s how it could potentially unlock £888 of passive income each month

- Analysts are calling Diageo shares a strong buy! Are they mad?

- Is the stock market going to crash when the tariff window expires?

- Considering a Stocks and Shares ISA this April? Avoid these mistakes!

- I asked ChatGPT for the best safe havens in the FTSE 100 amid Trump’s tariffs

Stephen Wright has positions in Diageo Plc. The Motley Fool UK has recommended Diageo Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.