£10,000 invested in Tesco shares 10 years ago is now worth…

An accounting scandal, a humilating withdrawal from the US, and a horsemeat-inspired PR crisis gave Tesco (LSE:TSCO) shares a rocky start to the 2010s. However, things started to turn around halfway through the decade, and the supermarket’s delivered a positive sharegolder return since then.

At 354.6p per share, the FTSE 100 company’s shares are 15.3% more expensive than they were in mid-April 2015. It means that £10,000 worth of stock bought back then is now worth £11,538.

When adding in paid dividends during that time, the return gets even better. Tesco shares have yielded total dividends of 65.22p per share over that time, meaning £10k worth of shares would have provided a total shareholder return of £13,659, or 36.6%.

Share prices can go up and down, so at least an investor a decade ago would have something to show for their investment. But the 3.2% average annual return that Tesco’s shares have delivered is far below the 6.4% average for FTSE 100 shares.

Can the UK’s largest retailer deliver better returns looking ahead? And should investors consider opening a position today?

Price gains forecast

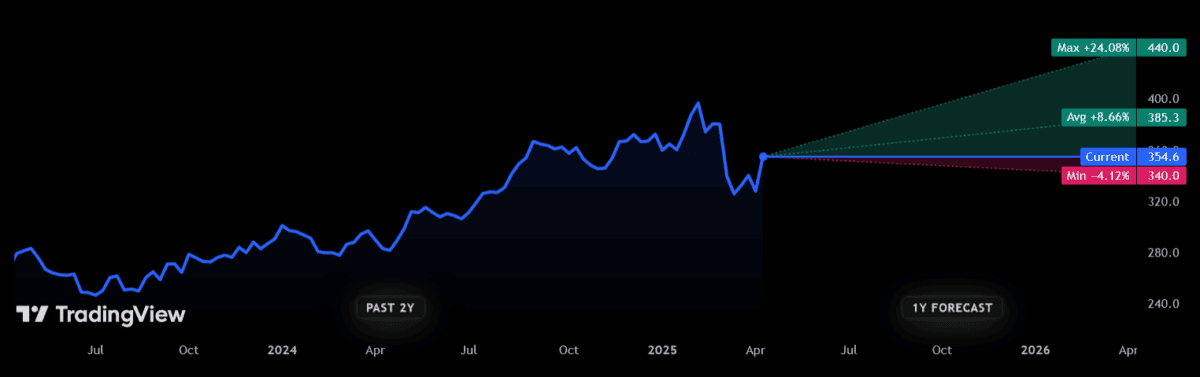

Unfortunately, forecasts for Tesco’s share price aren’t available for the next 10 years. But broker estimates do cover the next 12 months, and they are — broadly speaking — pretty upbeat.

The average price target among the 13 brokers with ratings on Tesco shares is 385.3p per share. That’s up almost 9% from current levels.

But it’s important to note that not all analysts are unanimous in their assessment. One especially bearish broker believes the retailer’s shares will backtrack to 340p in the next year. At the other end of the scale, the most optimistic number cruncher reckons Tesco shares will surge by almost a quarter.

Time to consider Tesco shares?

Tesco has a number of weapons in its locker that could help its share price rocket over the next 12 months and beyond. The most potent of these is the Clubcard loyalty scheme, which is the UK’s largest and most successful shopper incentive plan.

There are 23m Clubcard members today, which equates to roughly one in two UK adults. That’s an astonishing sign of brand loyalty. With the promise of instant discounts and money-off vouchers, it offers significant benefits that have gained traction during the cost-of-living crisis.

However, Tesco’s loyalty programme hasn’t been enough to drive profits (and by extension its shares) higher in the last decade. And I’m not sure anything has changed.

This is because the amount of competition the company faces remains significant. In fact, the business will have to paddle harder than ever before as discount chains Aldi and Lidl rapidly expand. Last week Sainsbury’s announced plans to open dozens of new supermarkets and convenience stores over the next year, too.

Sainsbury’s also indicated that, like fellow ‘Big Four’ grocer Asda, that it’s about to get down and dirty with a fresh price war. Tesco can join in at the expense of its already-poor margins (adjusted operating profit margin was just 4.5%). Or it can take the risk of seeing its customer base crumble, Clubcard or no.

Whichever path it chooses, I’m not expecting the FTSE company to deliver the sort of earnings to drive its shares higher. So I’d rather buy other UK shares right now.

The post £10,000 invested in Tesco shares 10 years ago is now worth… appeared first on The Motley Fool UK.

Investing in AI: 3 Stocks with Huge Potential!

🤖 Are you fascinated by the potential of AI? 🤖

Imagine investing in cutting-edge technology just once, then watching as it evolves and grows, transforming industries and potentially even yielding substantial returns.

If the idea of being part of the AI revolution excites you, along with the prospect of significant potential gains on your initial investment…

Then you won’t want to miss this special report inside Motley Fool Share Advisor – ‘AI Front Runners: 3 Surprising Stocks Riding The AI Wave’!

And today, we’re giving you exclusive access to ONE of these top AI stock picks, absolutely free!

More reading

- Down 15%! Should I snap up Tesco shares for a second income?

- After falling 17% in a month, Tesco shares yield 4.3% with a P/E of just over 11!

- A year ago, £10,000 in Tesco shares — at today’s price — is now worth…

- Are Tesco shares a screaming buy after sinking to 9-month lows?

- A rally could be coming for the UK stock market! Here’s how I aim to profit

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has recommended J Sainsbury Plc and Tesco Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.