Have investors left it too late to buy gold?

When investing, it’s critical to remember to remember that “time in the market is more important than timing the market“. Some investors may be reluctant to buy gold following recent strength, fearing they may have missed the boat. This could be a costly mistake.

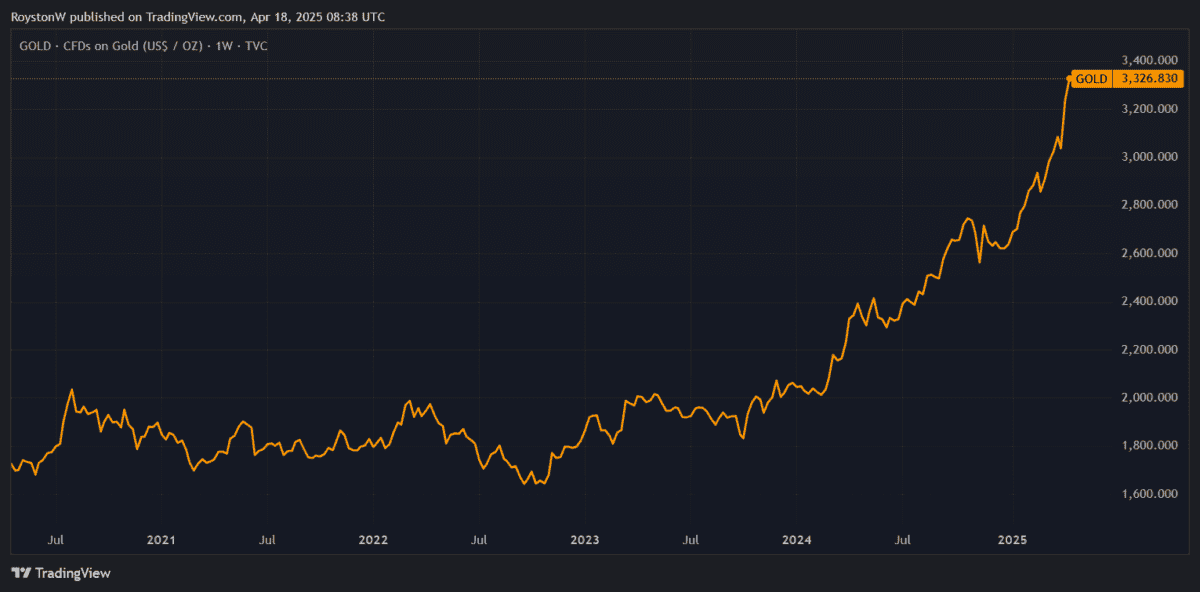

Gold’s current bull run stretches back to the second half of 2023 when it was trading below $1,800 per ounce. Today it’s dealing above $3,300, meaning anyone who considered buying bullion but ultimately held back may now be regretting their decision.

Commodity markets are nototiously volatile, where prices are influenced by a range of conflicting supply, demand and broader financial market factors. So it’s quite possible gold could reverse sharply in the weeks and months ahead.

Yet it’s also easy to envision gold prices sweeping still higher, driven by macroeconomic and geopolitical tensions, strong central bank buying, and a further deterioration in the US dollar.

I personally expect the yellow metal to surpass last week’s peaks of $3,357.40 per ounce. So buying gold remains an attratcive option to consider, in my view.

Getting physical

But what’s the best way to get yellow metal exposure? Today investors have a multitude of options, like the classic route of buying physical bars or coins.

This way, an investor owns the gold directly, thus eliminating third-party risk. But this can also throw up storage issues, and selling physical metal can be slow.

Individuals can also look at an exchange-tracker fund (ETF) that follows the gold price, which can be simpler and quicker. Investors pay the fund provider a management fee for this service, though such costs can be low. The iShares Physical Gold ETC (SGLN) for instance, has an ongoing expense ratio of just 0.12%.

Alternatively, investors can seek to ride the gold price indirectly by buying shares in gold mining companies.

Targeting better returns

This is a riskier approach as it exposes investors to the unpredictable business of metals mining. However, it can also lead to better returns as miners’ profits often rise faster that the metal itself. Investors can also get a passive income through company dividends.

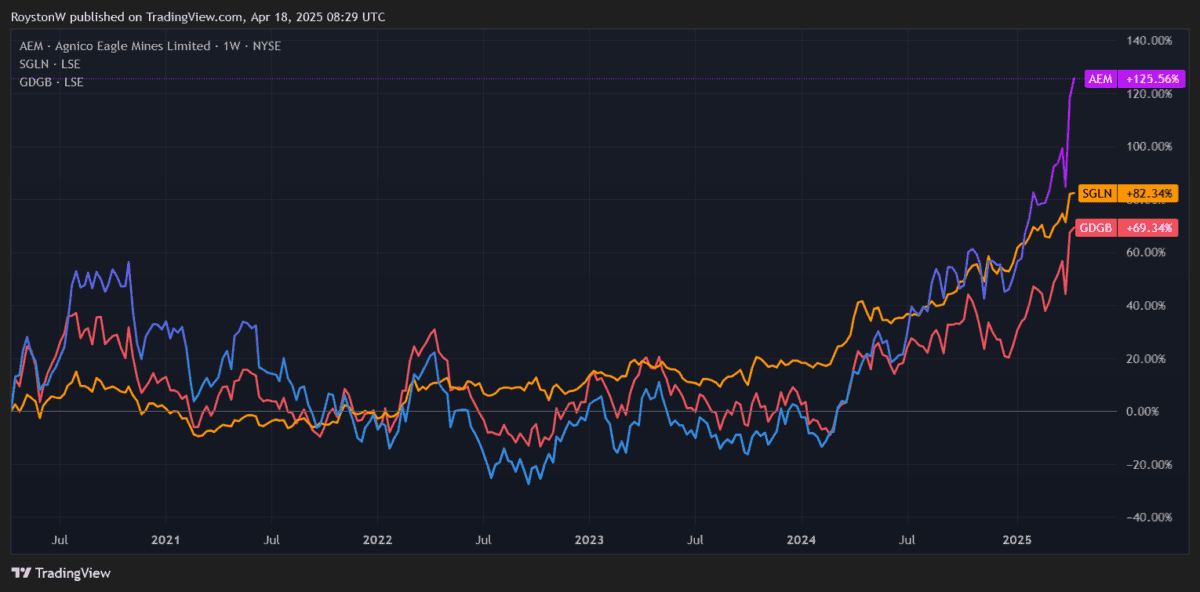

Again, investors can do this by considering an ETF that contains gold stocks. The VanEck Gold Miners ETF (GDGB) for example, holds shares in 57 different companies, a quality which in turn helps investors to spread out risk.

Another potential route is to buy individual gold stocks. I think Agnico Eagle Mines (NYSE:AEM) could be a great individual share to consider.

While past performance isn’t always reliable guide to future returns, Agnico’s strong operational track record has led it to outperform both gold ETFs and gold stock funds:

The Canadian company owns a raft of world-class assets in its home country and in Australia, Finland and Mexico. Not only are these super-stable places for miners to do business. Production from its projects are going from strength to strength.

In 2024, group output rose 1% to new record peaks of 3,485,336 ounces. What’s more, Agnico’s all-in sustaining costs (AISCs) were $1,239 an ounce, well below the current prices of gold.

Owning Agnico shares instead of a basket of gold stocks carries greater risk. But on balance, I think it’s a great way to consider tapping into the precious metal.

The post Have investors left it too late to buy gold? appeared first on The Motley Fool UK.

Should you invest £1,000 in Agnico Eagle Mines Limited right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Agnico Eagle Mines Limited made the list?

More reading

- Are REITs the best UK dividend shares on the stock market to consider right now?

- Here’s a 4-share ISA portfolio that could one day generate £1,500 a month in passive income

- Is now the perfect time to start buying shares?

- Is this FTSE 100 share a screaming buy to consider after recent falls?

- £10,000 invested in Tesco shares 10 years ago is now worth…

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.