Why opening a SIPP for a baby may be a brilliant move

The Self-Invested Personal Pension (SIPP) is a vehicle for growing our retirement funds. Personally, all my pensions have been consolidated into this vehicle and are self-managed.

However, like many people my age — 32 — I’m already wondering whether my pension is going to be large enough to support me in my later years. Of course, I have plenty of time. However, my prospects could be better if I had started earlier.

In the UK, we can start a pension at any age. And that’s why my daughter, now one, has a few thousand pounds in her pension already. Let’s take a closer look at why we’re doing this.

Reducing the burden on her

I have to be honest, I’m not incredibly confident about the world I’m bringing my child into. On a very basic level, global resources are stretched and competition for these resources is becoming increasingly intense. Coupled with the rise of artificial intelligence (AI), like many parents before me, I wonder what the future holds.

With that in mind, it’s always good to have a nest egg, or a little more. By starting a pension today, there may be less onus on her to put more money aside when she starts working. People often talk about how hard it is to put money aside today… what if it’s more challenging in the future?

Compounding

Compounding’s key. This is when the money our investments make starts earning its own interest. It’s like a snowball getting bigger and drawing in more snow as it rolls. That’s how compounding works.

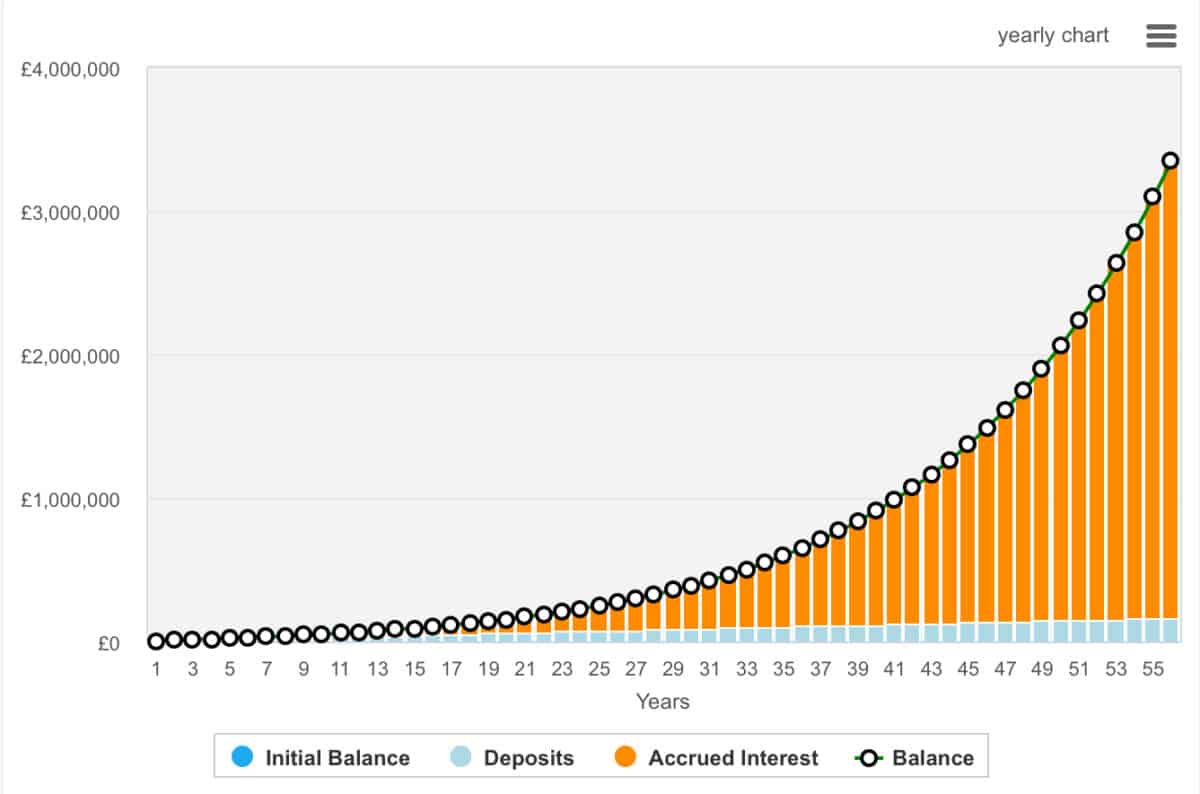

In this case, the current £3,000 in my daughter’s SIPP could grow to £425k by the time she’s my age. That’s assuming the maintenance of £240 of monthly contributions and an 8% annualised growth rate.

Of course, that’s too young to retire in the UK. But from 32 onwards, her SIPP will be growing extremely fast because of the aforementioned compounding. Just look at this graph and the pace of growth in the later years.

Where am I investing?

As it’s a relatively small portfolio, I’m preferring trusts, funds, and conglomerates. These provide diversification with a singular investment.

One of the investments is Berkshire Hathaway (NYSE:BRK.B). The Warren Buffett stock hasn’t performed too badly considering the recent volatility. It remains one of the most closely watched companies in global markets, largely due to its diversified portfolio and Buffett’s long-term investment philosophy.

The company owns a mix of wholly-owned businesses — including GEICO, BNSF Railway, and Berkshire Hathaway Energy — alongside significant equity stakes in public companies such as Apple, Coca-Cola, American Express, and Occidental Petroleum. As of 2025, Apple remains its largest holding, though recent disclosures show increased exposure to energy and financial services.

The company’s massive cash hoarding has also raised eyebrows. Buffett has amassed more than $330bn in cash, and now owns around 5% of all US treasuries. This has contributed to its recent resilience.

However, it remains very US focused. In the near term, at least, this represents something of a risk as President Trump’s trade policies appear to have rattled some business owners. Despite this, it’s one I’ll continue to buy for the long run.

The post Why opening a SIPP for a baby may be a brilliant move appeared first on The Motley Fool UK.

5 stocks for trying to build wealth after 50

The cost of living crisis shows no signs of slowing… the conflict in the Middle East and Ukraine shows no sign of resolution, while the global economy could be teetering on the brink of recession.

Whether you’re a newbie investor or a seasoned pro, deciding which stocks to add to your shopping list can be a daunting prospect during such unprecedented times. Yet despite the stock market’s recent gains, we think many shares still trade at a discount to their true value.

Fortunately, The Motley Fool UK analyst team have short-listed five companies that they believe STILL boast significant long-term growth prospects despite the global upheaval…

We’re sharing the names in a special FREE investing report that you can download today. We believe these stocks could be a great fit for any well-diversified portfolio with the goal of building wealth in your 50’s.

More reading

- Here’s billionaire Warren Buffett’s advice on surviving market meltdowns

- Why I prefer investing with Warren Buffett to a FTSE 100 or S&P 500 tracker

- Some wise investment advice (but Warren Buffett didn’t say it first)

- Warren Buffett’s warning to markets played out perfectly: the time to be greedy may be approaching

- 2 ‘safe-haven’ defensive shares to consider buying as tariffs hammer the stock market

American Express is an advertising partner of Motley Fool Money. James Fox has positions in Berkshire Hathaway. The Motley Fool UK has recommended Apple and Occidental Petroleum. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.