Could a mix of FTSE 100 and FTSE 250 shares help investors retire comfortably?

With the noise around trade tariffs threatening to run and run, holders of FTSE 100 and FTSE 250 shares should be braced for further volatility.

Yet I don’t believe there’s reason for long-term investors panic. Past performance isn’t always a reliable guide to the future. But both index’s have proven ability to recover from past macroeconomic ordeals.

The FTSE 100’s risen 76% over the last 20 years, and the FTSE 250‘s gains have been even more impressive at 216%. This is a period in which once-in-a-century pandemics, sovereign debt crises, a global banking crash and the biggest European conflict since World War Two have tested markets to their core.

What can we expect?

Make no mistake, a new era of economic protectionism would present far-reaching challenges for UK large-and mid-cap shares. Reduced export demand, supply chain disruptions and soaring input costs could all follow crushing trade tariffs.

However, I’m confident that — even if global trading rules undergo a comprehensive shake-up — the FTSE 100 and FTSE 250’s sectoral diversity and broad geographical exposure (spanning developed and emerging markets) should allow them to help investors build wealth for retirement.

In fact, I believe they could deliver better returns than in years gone by as investors begin to switch away from US assets (like S&P 500 companies) and into overseas shares.

A FTSE 250 fund

Optimistic inidividuals such as myself have two ways to gain exposure to these UK share indices. They can consider selecting individual shares to buy to target a market-beating return. Games Workshop, Ashtead Group and JD Sports are just a few major names to have delivered stratospheric returns over the last two decades.

Alternatively, investors can consider plumping for investment trusts or exchange-traded funds (ETFs) that can contain hundreds of stocks. This may be a sound strategy to consider today given the major uncertainties that trade wars pose to individual companies and sectors.

The iShares FTSE 250 ETF (LSE:MIDD), for instance, spreads investors’ capital across the 200+ members of the mid-cap index. Some of its largest holdings include real estate investment trust (REIT) British Land, financial services provider IG and general insurer Direct Line.

Financial services companies make up the largest portion of this ETF, more than any other sector. In total, more than 43% of its capital is devoted to this cyclical sector. This represents a double-edged sword, as while it provides enormous growth potential, it also has the potential to perform poorly during economic downturns.

However, defensive sectors like property, consumer staples and utilities are also represented, helping to smooth out weakness in economic-sensitive industries. It also provides decent geographic diversification, with roughly 60% of earnings coming from overseas.

Making a retirement income

Whether or not investment in this ETF will create enough wealth for someone to retire on will depend on how much they will have to invest and how long they leave their money to build.

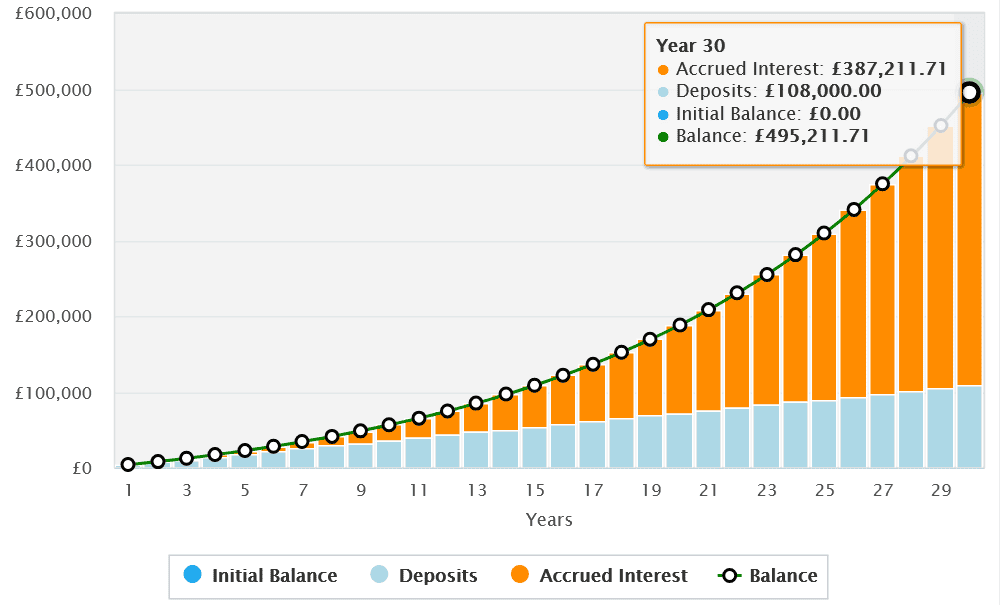

But based on the index’s performance since 2004, a FTSE 250 ETF like this could — for someone investing £300 a month for 30 years — build a £495,212 nest egg. A retirement fund at this level could deliver an £29,712 yearly income if it was then invested in 6%-yielding dividend shares.

The post Could a mix of FTSE 100 and FTSE 250 shares help investors retire comfortably? appeared first on The Motley Fool UK.

5 Shares for the Future of Energy

Investors who don’t own energy shares need to see this now.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — sees 2 key reasons why energy is set to soar.

While sanctions slam Russian supplies, nations are also racing to achieve net zero emissions,

he says. Mark believes 5 companies in particular are poised for spectacular profits.

Open this new report — 5 Shares for the Future of Energy

— and discover:

- Britain’s Energy Fort Knox, now controlling 30% of UK energy storage

- How to potentially get paid by the weather

- Electric Vehicles’ secret

backdoor

opportunity - One dead simple stock for the new nuclear boom

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

Royston Wild has positions in Ashtead Group Plc and Games Workshop Group Plc. The Motley Fool UK has recommended Ashtead Group Plc, British Land Plc, and Games Workshop Group Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.