£10,000 invested in Lloyds shares 1 month ago is now worth…

My conviction in Lloyds (LSE:LLOY) shares has been strong for several years. In fact, some of the early investments I made in the banking group have nearly doubled in value. This medium-to-long-term performance has been strong.

Some of these gains have been compounded over the past month, with the stock jumping 11%. However, I should add that the stock did trade higher in March only to be shaken by Trump’s trade policy announcement.

So, £10,000 invested in Lloyds shares one month ago would now be worth £11,100. That’s clearly a pretty good return for just one month. Of course, it may have felt like a rather risky investment at the time, given the uncertainty surrounding Trump’s tariffs.

Results pull Lloyds down from highs

Lloyds reported a mixed first-quarter update on 1 May, which caused shares to pull back. The lender increased its impairment charge to £309m, up sharply from £57m a year earlier, citing risks from newly announced US tariffs. The bank made a £100m adjustment to reflect these risks, which had not been fully captured in divisional forecasts.

Meanwhile, net income rose 4% to £4.4bn, supported by higher interest rates, but pre-tax profit declined 7% to £1.53bn, weighed down by rising costs. Despite these challenges, Lloyds reaffirmed its full-year guidance. The bank noted that modest improvements in house price and wage growth expectations partially offset the tariff-related pressure. Management described the early market response to US tariff news in April as “larger than expected”.

Still an attractive valuation

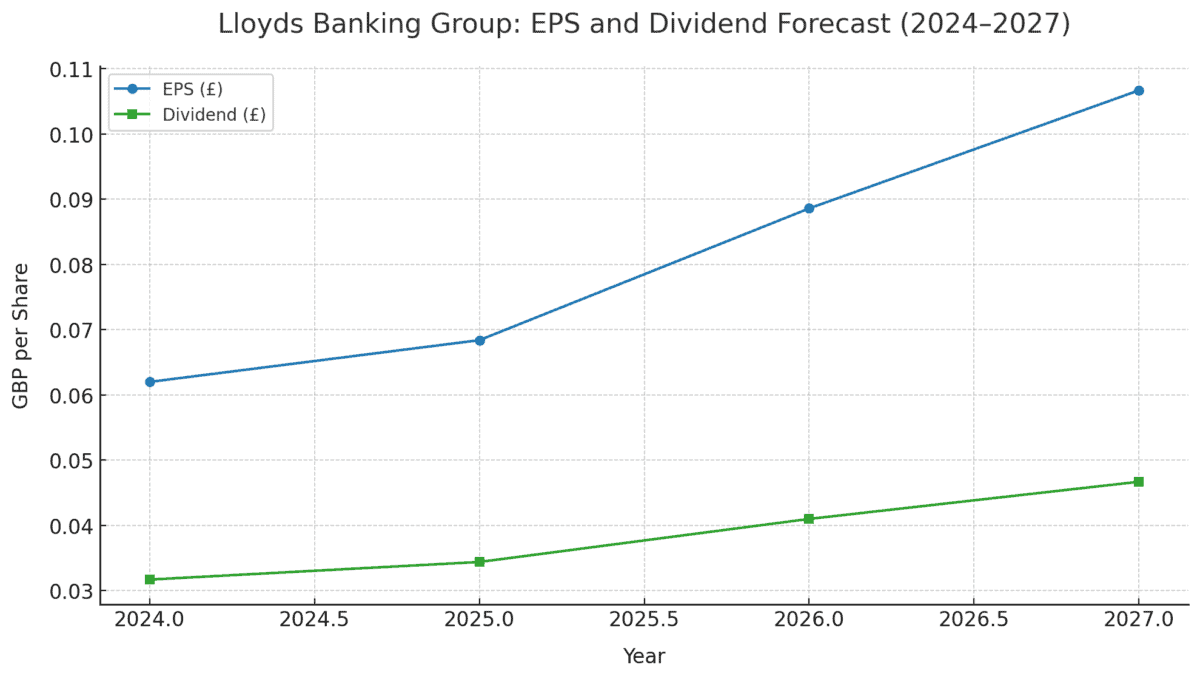

Lloyds shares are showing signs of sustained earnings momentum through the medium term. Earnings per share (EPS) are projected to rise from 6.2p in 2024 to 6.84p in 2025, 8.86p in 2026, and 10.67p by 2027. This reflects a compound annual growth rate of over 20%.

This growth trajectory supports a rising dividend, with the payout forecast to increase from 3.17p in 2024 to 4.67p in 2027. Despite a modest dip in yield to 4.87% in 2025 due to share price gains, the dividend yield is set to recover to 6.62% by 2027.

The improving EPS outlook also compresses the forward price-to-earnings (P/E) ratio from 10.3 times in 2025 to just 6.6 times by 2027. This suggests some valuation headroom — room for growth.

What’s more, I’d argue Lloyds’s disciplined capital return policy and stable revenue base further strengthen the investment case. This is especially true for income-focused investors seeking yield and improving fundamentals.

The bottom line

While guidance remains unchanged, some investors will remain wary of Trump’s trade policy. The general direction appears to be towards a negotiated outcome, but a worsening of global trade and economic forecasts simply wouldn’t be good for a bank.

However, the current forecast still looks appealing. It’s a little richly valued for 2025, but growth expectations are high. Personally, I’m being quite cautious throughout the volatile period, but I’ll keep a close eye on Lloyds. I do believe it could trade higher.

The post £10,000 invested in Lloyds shares 1 month ago is now worth… appeared first on The Motley Fool UK.

Should you invest £1,000 in Lloyds Banking Group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Lloyds Banking Group made the list?

More reading

- Here’s why I think the Lloyds share price could do well even if interest rates continue to fall

- 3 stocks Fools bought over 10 years ago and still hold

- Here’s the dividend forecast for Lloyds shares through to 2027!

- Lloyds share price outlook: see what £10k could be worth in a year

- £20,000 in savings? Here’s how an investor can generate a ton of passive income

James Fox has positions in Lloyds Banking Group Plc. The Motley Fool UK has recommended Lloyds Banking Group Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.