Down 26% in 3 months! What’s going on with the Alphabet share price?

Ever since ChatGPT was released into the wilderness in late 2022, there has been an element of uncertainty hanging over Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL). Basically, some stock market investors worry that AI chatbots will disrupt Google’s search empire, which is still the cash cow for parent company Alphabet.

This fear was reignited with a vengeance yesterday (7 May) when an Apple executive revealed some worrying news relating to search. This sent the Alphabet share price down 7.5%, bringing the three-month decline to 26%

What happened?

It’s widely believed that Google pays Apple over $20bn annually for default status on iPhones and Safari browsers. But testifying in a federal antitrust case yesterday, Apple executive Eddy Cue said that the iPhone maker is exploring AI-powered alternative search options for Safari.

Therefore, this could see Google being replaced as the default search engine. Not ideal for Alphabet.

Second, the executive also revealed that searches on Safari declined in April for the first time ever! He attributed this to users increasingly turning to AI bots like ChatGPT and Perplexity to search for things.

A changing landscape

So, there are two main things here. The first is a move away from Google being the default search engine on iPhones, which seems likely to me given that the lawsuits specifically use this as evidence that Google is a monopoly. Offering more choices seems like an easy remedy.

Whether or not users will ultimately choose to use alternatives is another matter. Personally, I’m quite happy using Google on my iPhone for things like shopping and stock market news, while using chatbots like ChatGPT and Google’s Gemini for other things.

For example, ChatGPT helped me with a DIY problem the other day. I uploaded photos and it talked me through what I needed to do step-by-step. Previously I would have searched Google for that, and probably been sent to a lengthy YouTube video which might not have been very helpful.

This links to the second issue here, which is changing consumer behaviour. Last year, Gartner projected that there will be a 25% decline in the use of traditional search engines by 2026. So this recent drop in internet searches reported by Apple might be the tip of the iceberg.

Very cheap tech stock

The strange thing here though is that we’re seeing no evidence yet of disruption in Alphabet’s financials.

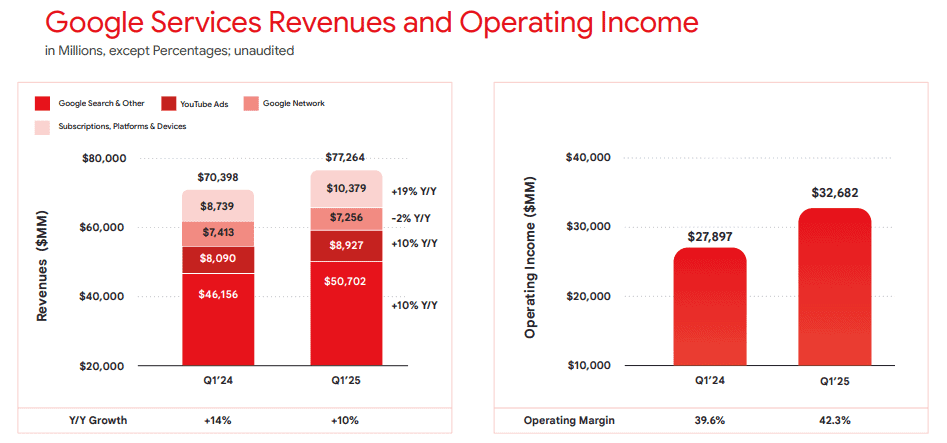

In Q1, total revenue rose 12% year on year to $90.2bn, with the Google Search category growing from $46.2bn to $50.7bn. Google has rolled out its AI Overview feature, which now has 1.5bn users per month and is even boosting engagement.

And while search was still responsible for approximately 56% of total revenue, that figure is far lower than in previous years. YouTube ads, subscriptions and Google Cloud continue to grow strongly and offer diversification and optionality.

Meanwhile, I expect its Waymo robotaxi business to grow substantially. It’s now doing over 250,000 paid trips every week, and that figure will probably be millions a day in future.

The stock is trading at just 15 times Alphabet’s expected earnings for 2026. Despite the ongoing risks from the antitrust probe and a changing search landscape, that looks far too cheap to me.

I think the stock is well worth considering at $152.

The post Down 26% in 3 months! What’s going on with the Alphabet share price? appeared first on The Motley Fool UK.

Like buying £1 for 31p

This seems ridiculous, but we almost never see shares looking this cheap. Yet this Share Advisor pick has a price/book ratio of 0.31. In plain English, this means that investors effectively get in on a business that holds £1 of assets for every 31p they invest!

Of course, this is the stock market where money is always at risk — these valuations can change and there are no guarantees. But some risks are a LOT more interesting than others, and at The Motley Fool we believe this company is amongst them.

What’s more, it currently boasts a stellar dividend yield of around 10%, and right now it’s possible for investors to jump aboard at near-historic lows. Want to get the name for yourself?

More reading

- Billionaire Bill Ackman has 100% of his FTSE 100 fund in under 15 stocks. I think these are the best of them

- Here’s how I’d aim to turn a £10k ISA into £10k of annual passive income

- On a P/E ratio of 17, is Alphabet the best growth stock to consider buying in 2025?

- £10,000 invested in Alphabet stock on 2 April is now worth…

- 3 world-class investments to consider for a Stocks & Shares ISA while they’re on sale

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Ben McPoland has no position in any of the shares mentioned. The Motley Fool UK has recommended Alphabet, Apple, and Gartner. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.