Tesla vs Ferrari: which stock is leading the race in 2025?

Tesla (NASDAQ: TSLA) and Ferrari (NYSE: RACE) are two of the most recognisable car brands on earth. They’re also listed stocks that can be bought by people who want to invest in either — or both — companies.

Over the long term, both have been cracking investments. The Tesla share price is up 1,651% across a decade, while Ferrari has delivered a 746% return since it went public in late 2015.

In my own portfolio, I own Ferrari stock but not Tesla (though I have been a shareholder in the past). Here, I want to take a look at how both firms have been doing recently.

Recent share-price performance

Let’s start with the share prices so far this year. Tesla’s is down 31.6% while Ferrari’s is up 12.2%. So, over this short time frame, the latter is easily winning the race.

However, it hasn’t been a totally smooth ride for the Italian carmaker as its shares fell nearly 22% between late February and early April. This was largely due to President Trump’s on-off tariff policies, which have sent shockwaves of uncertainty through the stock market.

Results

Next, let’s consider how both firms got on financially in the first quarter (Q1). This is where some major differences emerge.

For Tesla, it has been contending with weak sales, fierce competition, and some brand damage from CEO Elon Musk’s outspoken views on various issues. These challenges were reflected in the results.

Revenue fell 9% year on year to $19.3bn, with global deliveries dropping 13% to 336,681 vehicles. Operating profit slumped 66% to $399m, resulting in a 2.1% margin as Tesla continued to invest heavily in robotics and artificial intelligence (AI). All these figures were worse than expected.

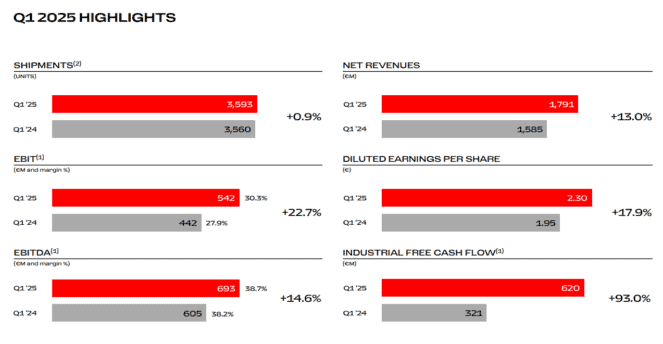

By contrast, Ferrari posted some impressive Q1 numbers earlier this week (6 May). Revenue increased 13% to €1.8bn, while net profit jumped 17% to €412m. Both figures were slightly higher than expected. The operating margin came in at 30.3%!

What’s amazing is that Ferrari achieved this growth without really increasing production. Shipments edged up just 0.9% to 3,593 cars, yet there was double-digit growth across the board.

This small shipment increase was deliberate rather than due to weak demand. In fact, Ferrari’s order book now extends into 2027!

The secret sauce is incredible pricing power combined with continued high demand for lucrative vehicle personalisations. Unfortunately, Tesla’s pricing power has waned significantly as it competes with low-priced Chinese EV makers worldwide.

Different beasts

In reality, neither is valued as a bog-standard car stock. Tesla’s massive $865bn market value is based on future growth potential in AI-powered robotaxis and humanoid robots. Therefore, while it’s struggling now, its growth could accelerate in future.

The risk is that the stock’s trading at 152 times earnings, meaning it may fall substantially if its AI/robotics ambitions don’t start bearing fruit over the next couple of years.

Meanwhile, at 47 times earnings, Ferrari is valued as a leading ultra-luxury goods company. But it has warned that US tariffs on EU-made cars could hurt profitability this year. So this is a risk.

Tesla stock is only suitable for investors with a very high tolerance for risk. Ferrari is less risky but still a bit pricey.

Personally, I’m happy with my choice and intend to keep holding Ferrari for years.

The post Tesla vs Ferrari: which stock is leading the race in 2025? appeared first on The Motley Fool UK.

5 stocks for trying to build wealth after 50

The cost of living crisis shows no signs of slowing… the conflict in the Middle East and Ukraine shows no sign of resolution, while the global economy could be teetering on the brink of recession.

Whether you’re a newbie investor or a seasoned pro, deciding which stocks to add to your shopping list can be a daunting prospect during such unprecedented times. Yet despite the stock market’s recent gains, we think many shares still trade at a discount to their true value.

Fortunately, The Motley Fool UK analyst team have short-listed five companies that they believe STILL boast significant long-term growth prospects despite the global upheaval…

We’re sharing the names in a special FREE investing report that you can download today. We believe these stocks could be a great fit for any well-diversified portfolio with the goal of building wealth in your 50’s.

More reading

- Are Tesla shares now a brilliant long-term opportunity?

- Here’s why 2025 could be a make or break year for Tesla stock

- After crashing in 2025, is Tesla one of the best stocks to consider buying now?

- Tesla stock may not look like a bargain. But it could well be one!

- £10,000 invested in Tesla shares on ‘Liberation Day’ is now worth…

Ben McPoland has positions in Ferrari. The Motley Fool UK has recommended Tesla. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.