Here’s where analysts expect the Lloyds share price to be a year from now

Analyst price targets for Lloyds Banking Group (LSE:LLOY) shares aren’t especially ambitious at the moment. But there are some clear ways things could turn out better than expected.

Interest rates, an ongoing legal case (yes, really), and a healthy dividend are all positive signs for the bank. So is there a buying opportunity for investors?

Price targets

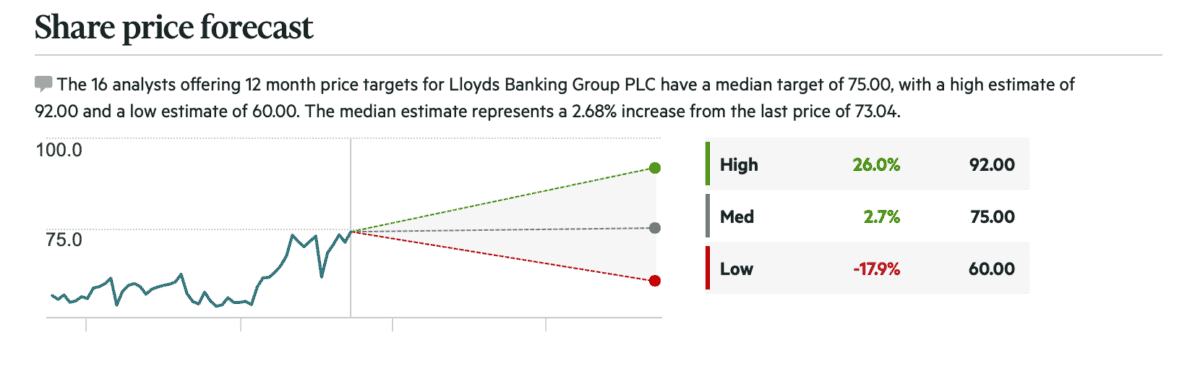

It’s fair to say analysts are pretty divided on the outlook for Lloyds Banking Group shares. The median price target is 75p – about 3% higher than the level the stock currently trades at.

Source: Financial Times

There is, however, quite a big range. The highest estimate is 26% higher than the current share price and the lowest implies a drop of 18%.

Investors should note, though, that the dividend yield is around 4.5%. If that continues, it could provide a return in line with a 10-year government bond even if the stock goes nowhere.

The company also has an ongoing share buyback programme, which should help boost the value of the stock. And I think there are more reasons for optimism going forward.

Interest rates

I always see it as a bit of risk when a company’s profitability depends on something beyond its control. And that’s the case with Lloyds and what the Bank of England does with interest rates.

The UK’s central bank decided to bring rates down earlier this month and that is likely to be bad for lending margins. But I think investors have a couple of reasons for optimism.

One is that the Bank of England has indicated it intends to be cautious with future decisions. So it’s far from automatic that interest rates are going to fall further in the near future.

Another is that cuts have more impact when rates are already low – 1% to 0.75% is more significant than 3% to 2.75%. So a reduction from 4.5% to 4.25% might not be a big problem.

Motor loans

The other major ongoing issue is the legal case concerning motor loans. Lenders including – but not limited to – Lloyds are appealing the verdict from the Court of Appeal in October 2024.

A verdict is expected on this in the next few months. And this could have a big impact on the company’s share price one way or another.

Lloyds has set aside around £1.2bn to cover potential liabilities. That’s around 66% of what the company distributed in dividends in 2024.

Analysts estimate that the worst-case scenario for the bank could be liabilities of around four times this level. But if things go well, shareholders could be in line for a strong return.

A stock to consider buying?

The average analyst price target for Lloyds shares is close to the current level. But there’s a big range and this reflects a lot of uncertainty at the moment.

No company ever has total control over its profits. In the case of Lloyds, though, an unusually large amount of its future returns comes down to things it can’t do anything about.

At the right price, that’s a risk I think investors could justifiably consider taking. But I think there are more attractive opportunities in UK stocks at the moment.

The post Here’s where analysts expect the Lloyds share price to be a year from now appeared first on The Motley Fool UK.

Of course, there are plenty of other passive income opportunities to explore. And these may be even more lucrative:

We think earning passive income has never been easier

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

More reading

- Prediction: in the next 12 months, the Lloyds share price could climb to…

- Does the Barclays or Lloyds share price offer best value?

- £10,000 invested in the FTSE 100 at the start of 2025 is now worth…

- £11,000 invested in Lloyds shares a year ago is now worth…

- £10,000 invested in Lloyds shares 1 month ago is now worth…

Stephen Wright has no position in any of the shares mentioned. The Motley Fool UK has recommended Lloyds Banking Group Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.