Should I buy the most popular FTSE 100 stock on AJ Bell?

It’s always interesting to keep an eye on the most bought FTSE 100 shares over at the major investment platforms. Sometimes — but not always — there can be wisdom in crowds.

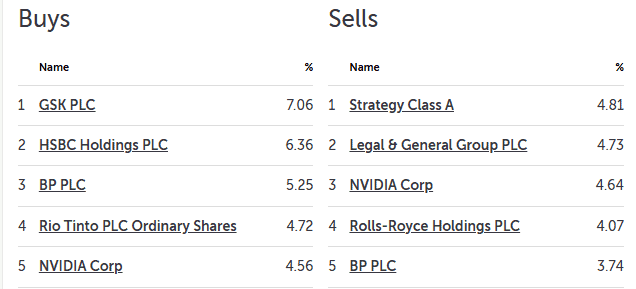

According to AJ Bell, the most purchased stock based on the number of deals placed by its customers in the past month was GSK (LSE: GSK).

Here, I’ll ask whether I should follow the crowd and also buy this FTSE 100 healthcare share.

A serial underperformer

GSK is a biopharmaceutical giant focused on areas such as respiratory, oncology, and infectious diseases. It’s a leader in vaccines.

I say ‘giant’, but GSK’s £56bn market cap isn’t that big when compared to some peers. For example, AstraZeneca is more than £100bn larger, while Novo Nordisk ($218bn) and Eli Lilly ($708bn) both tower above GSK these days.

The reason for this is that the share price performance has been disappointing for a very long time. Indeed, it’s the same level as it was decades ago!

Over five years, it’s dropped 18%. Not great then.

Why is this?

GSK has missed out on many blockbuster opportunities over the years, whether in oncology (which has boosted AstraZeneca) or GLP-1 weight-loss drugs (dominated by Novo Nordisk and Eli Lilly).

That said, it was first to market with Arexvy, a vaccine for RSV (respiratory syncytial virus). This looked like a slam-dunk blockbuster for years to come…until it didn’t. In Q1, Arexvy sales crashed 57% due to US guidance changes around who can have the jab.

To be fair, GSK has paid out a fair few dividends over the years, and carried out spin-offs. So investors have enjoyed some returns. But the pipeline hasn’t been very exciting and long-term growth has been sluggish.

What about the valuation?

Looking at the forecasts, I’m seeing a modest bit of top-line growth (3%-5%) over the next couple of years. Better still, earnings are expected to tick up at a faster rate (6%-8%).

AJ Bell investors buying GSK can comfort themselves with the fact that they’re not overpaying for the stock. It’s trading at just 8.4 times forward earnings, dropping as low as 7.5 by 2026.

It also offers a 4.6% dividend yield, potentially rising to 5% next year. These payouts also look very well-covered by forecast earnings.

The firm is aiming for £40bn in revenue by 2031, up from £31.4bn last year, as its pipeline starts to bear fruit.

My move

Stepping back, I can see why investors have been scooping up cheap GSK shares. They can hope to collect market-beating dividends while waiting for the share price to go up as GSK grows.

But my worry here is that I’d be investing in a classic value trap. In other words, GSK looks great value on paper, but growth could falter, as it has in the past.

Moreover, President Trump’s promise to lower drug prices for American citizens is casting a shadow over the sector. And US health secretary Robert Kennedy Jr is a wildcard with plans to shake things up, especially around vaccine policies.

I already have shares in Novo Nordisk (not great recently), AstraZeneca (plodding) and Moderna (disaster). Due to the ongoing risks and uncertainty, I don’t feel a desire to increase my exposure to the healthcare space right now.

The post Should I buy the most popular FTSE 100 stock on AJ Bell? appeared first on The Motley Fool UK.

But there may be an even bigger investment opportunity that’s caught my eye:

Investing in AI: 3 Stocks with Huge Potential!

🤖 Are you fascinated by the potential of AI? 🤖

Imagine investing in cutting-edge technology just once, then watching as it evolves and grows, transforming industries and potentially even yielding substantial returns.

If the idea of being part of the AI revolution excites you, along with the prospect of significant potential gains on your initial investment…

Then you won’t want to miss this special report inside Motley Fool Share Advisor – ‘AI Front Runners: 3 Surprising Stocks Riding The AI Wave’!

And today, we’re giving you exclusive access to ONE of these top AI stock picks, absolutely free!

More reading

- Does the GSK or AstraZeneca share price currently offer the best value?

- Down 20% over the year, is GSK’s share price a stunning bargain after its Q1 results?

- What’s going on with the GSK share price now?

- Up 7.5% in a week! Is the GSK share price about to do an AstraZeneca?

- As the GSK share price bounces back, Q1 results raise hopes for more to come

HSBC Holdings is an advertising partner of Motley Fool Money. Ben McPoland has positions in AstraZeneca Plc, HSBC Holdings, Legal & General Group Plc, Moderna, Novo Nordisk, Nvidia, and Rolls-Royce Plc. The Motley Fool UK has recommended Aj Bell Plc, AstraZeneca Plc, GSK, HSBC Holdings, Moderna, Novo Nordisk, Nvidia, and Rolls-Royce Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.