Here’s the dividend forecast for BAE Systems shares through to 2027!

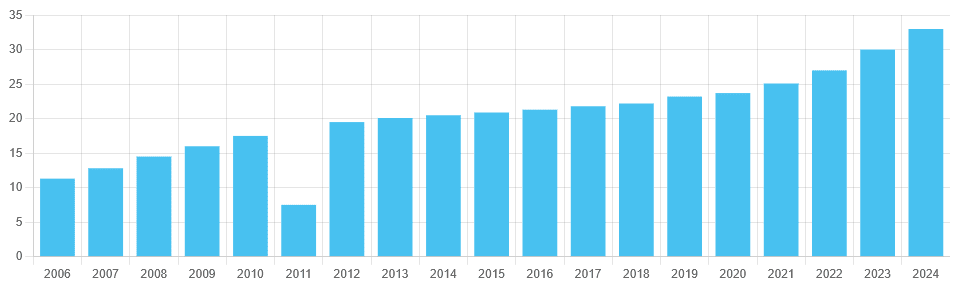

Defence stocks like BAE Systems (LSE:BA.) often prove to be solid dividend shares to hold over time. Supported by the resilience of global weapons spending, dividends at this FTSE 100 contractor have risen every year since the early 2010s:

Last year, the dividend on BAE shares rose 10% year on year, to 33p per share. With European defence spending rising at its fastest rate for decades, further weighty hikes could be in the pipeline as well.

That said, the prospect of falling US arms budgets could pose an obstacle to more significant annual dividend growth. So what are City analysts predicting? And how robust are their current forecasts?

Solid forecasts

As you can see, City analysts are expecting dividends to continue rising at approximately the same rate as last year’s cash payout:

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2025 | 35.9p | 9% | 2.1% |

| 2026 | 39.3p | 9% | 2.3% |

| 2027 | 43.2p | 10% | 2.6% |

This makes it one of the FTSE 100‘s hottest dividend growth shares in my book. To put payout increases on BAE Systems shares into context, short-term dividend growth across the broader index is pegged at 1.5% to 2%.

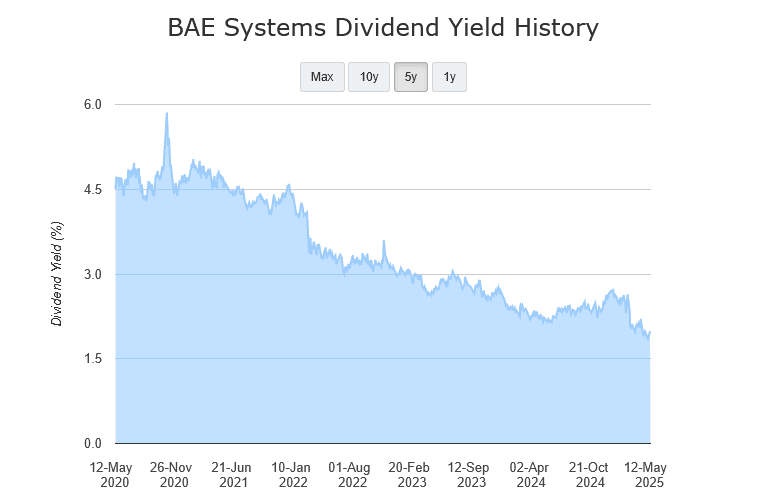

You will notice, however, that this defence share doesn’t offer the largest dividend yields out there. For the next three years, they lag the FTSE’s historical average (of 3% to 4%) by a large distance.

The lower yields on BAE shares reflect its substantial share price gains after Russia invaded Ukraine in early 2022. Before then, yields stood in or around the UK blue chip average:

On the plus side, though, the company appears in good shape to meet these projected dividends, and not just because of the profits stability that its non-cyclical operations provide.

For the next three years, annual dividends are covered more than twice over by anticipated earnings. Exact dividend cover of 2.1 times provides a wide margin of safety in case the bottom line underwhelms.

On top of this, BAE Systems also has a robust balance sheet it can use to support dividends. This is underlined by its decision to repurchase £1.5bn of its shares (due for completion next year).

Are BAE Systems shares a buy?

On balance, I think the FTSE company is a great share to consider for dividends. But this is not all, as I also believe it’s a great share to think about in a portfolio targeting robust capital gains.

BAE Systems’ share price has rocketed 202% in value since the start of 2022. I’m tipping it to continue soaring as arms spending ratchets up across the globe.

Latest data from the Stockholm International Peace Research Institute (SIPRI) showed worldwide military expenditure hit £2.72trn last year. This was up 9.4% year on year, and represented the steepest annual rise since 1988.

This increase was in large part due to surging European spending, SIPRI said. And it’s a trend I expect to continue as Europe’s armed forces rebuild after decades of underinvestment following the Cold War.

As I described earlier, falling US defence spending could be a possible obstacle for global operators like BAE Systems. Yet strength in Europe and the firm’s other markets (like Saudi Arabia, Australia, and India) may compensate for this.

On balance, I think BAE Systems is worth serious consideration right now.

The post Here’s the dividend forecast for BAE Systems shares through to 2027! appeared first on The Motley Fool UK.

But this isn’t the only opportunity that’s caught my attention this week. Here are:

5 Shares for the Future of Energy

Investors who don’t own energy shares need to see this now.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — sees 2 key reasons why energy is set to soar.

While sanctions slam Russian supplies, nations are also racing to achieve net zero emissions,

he says. Mark believes 5 companies in particular are poised for spectacular profits.

Open this new report — 5 Shares for the Future of Energy

— and discover:

- Britain’s Energy Fort Knox, now controlling 30% of UK energy storage

- How to potentially get paid by the weather

- Electric Vehicles’ secret

backdoor

opportunity - One dead simple stock for the new nuclear boom

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

- Down 7%, is BAE Systems’ share price an unmissable bargain for me, especially after its Q1 trading update?

- 5 FTSE 100 shares driving wealth in my Stocks and Shares ISA

- Here’s the growth forecast for BAE Systems shares through to 2027!

- The BAE share price has soared 51% this year! Could it go even higher?

- £10k invested in BAE Systems shares just 3 months ago is already worth…

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has recommended BAE Systems. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.