This Nvidia-backed stock just reported 420% growth! Should I buy it?

Nvidia stock has been charging higher in recent weeks. Indeed, since plummeting to a 52-week low in early April, it’s rocketed 43%!

However, one that’s up even more is CoreWeave (NASDAQ: CRWV), whose shares have increased by 109% in May. It partly has Nvidia to thank for that, as recent regulatory filings show that the AI chip juggernaut raised its existing stake in CoreWeave just after its IPO in March.

Should I buy any CoreWeave shares for my ISA? Let’s take a closer look.

Sizzling-hot growth

Founded in 2017, CoreWeave is a cloud computing company that provides infrastructure for AI and machine learning workloads. It offers on-demand access to powerful GPU hardware (mainly Nvidia’s), enabling organisations to train AI models and process large datasets.

In other words, its data centres are purpose-built for AI, which companies rent access to.

The company is no minnow, as it was valued at $23bn at its IPO. Its market cap has since shot up to $41.5bn. This means CoreWeave is already more highly valued than FTSE 100 blue-chips like Tesco and Standard Chartered, despite being less than a decade old.

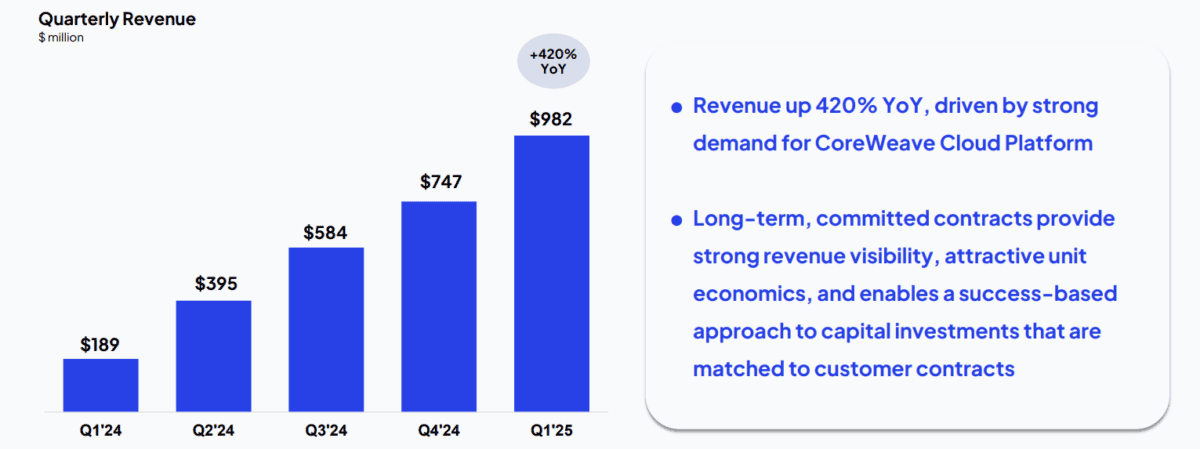

As it only went public in late March, the Q1 report CoreWeave dropped on 14 May was its first as a public company. Growth was outstanding, with revenue skyrocketing 420% year on year to $982m. That was well above market expectations for $860m.

Back in March, the company signed a five-year contract worth $11.9bn with ChatGPT maker OpenAI to provide it with AI infrastructure. As part of the deal, OpenAI also took a stake in CoreWeave.

With this $11.9bn in the bag, the firm’s revenue backlog jumped to $25.9bn at the end of March. And management now anticipates annual revenue of $4.9bn to $5.1bn, up from previous expectations of approximately $4.6bn.

Looking ahead, Wall Street sees revenue topping $16bn by 2027!

High customer concentration

A risk here is potential overreliance on a key customer, namely Microsoft. Last year, the software giant was responsible for a whopping 62% of CoreWeave’s revenue. While the firm plans to diversify its customer base, any slowdown in AI spending from Microsoft might significantly impact growth.

Also, CoreWeave plans to spend $20bn-$23bn this year in order to meet growing AI infrastructure demand from OpenAI and Microsoft.

Understandably, it’s still not profitable, and the adjusted net loss for Q1 was $149m. Given the capital-intensive nature of building out AI data centres, profits might not materialise for a while.

Should I buy CoreWeave stock?

The fact that Nvidia has been adding to its stake is a strong endorsement of CoreWeave’s cloud infrastructure platform. Blue-chip customers like Microsoft and OpenAI add significant weight to the bull case.

Weighing things up, this looks like a top-notch AI company with a long potential runway of growth ahead of it. However, the stock is trading at 15 times sales, which is pretty pricey.

As a rule of thumb, I don’t invest so soon after an IPO, no matter how glittering and exciting it is. I wait until the company finds its feet, making sure quarterly growth targets are hit. Then, once I’ve learned more about the firm, I wait for a dip that I think looks attractive.

Therefore, I’ll just keep CoreWeave stock on my watchlist for now.

The post This Nvidia-backed stock just reported 420% growth! Should I buy it? appeared first on The Motley Fool UK.

5 Shares for the Future of Energy

Investors who don’t own energy shares need to see this now.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — sees 2 key reasons why energy is set to soar.

While sanctions slam Russian supplies, nations are also racing to achieve net zero emissions,

he says. Mark believes 5 companies in particular are poised for spectacular profits.

Open this new report — 5 Shares for the Future of Energy

— and discover:

- Britain’s Energy Fort Knox, now controlling 30% of UK energy storage

- How to potentially get paid by the weather

- Electric Vehicles’ secret

backdoor

opportunity - One dead simple stock for the new nuclear boom

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

Ben McPoland has positions in Nvidia. The Motley Fool UK has recommended Microsoft, Nvidia, Standard Chartered Plc, and Tesco Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.