£8,800 in savings? Here’s how investors could turn that into a £20,000 second income… with time

Turning an initial £8,800 in savings into a £20,000 annual second income is an ambitious but achievable goal. Like anything in life, it requires commitment, learning, and a level-headed approach.

So, let’s find out how it can be done.

There’s a formula for success

There are several parts to the formula, and central to it is harnessing the power of compounding effectively over time. Compounding occurs when investment returns generate their own returns, creating a snowball effect that accelerates portfolio growth. This process is fundamental for building wealth, especially when combined with regular contributions and a disciplined investment approach.

Consider an investor who starts with £8,800 and adds £250 monthly into a diversified portfolio targeting an average annual return of 7%. After 31 years, this portfolio would be worth in excess of £400,000.

At that point, withdrawing 5% annually would provide a second income of around £20,000. Increasing monthly contributions or achieving slightly higher returns could significantly impact the size of the portfolio over the long run.

Regular contributions are crucial because they boost the investment base, allowing compounding to work on a larger amount. Even modest monthly additions accumulate significantly over decades.

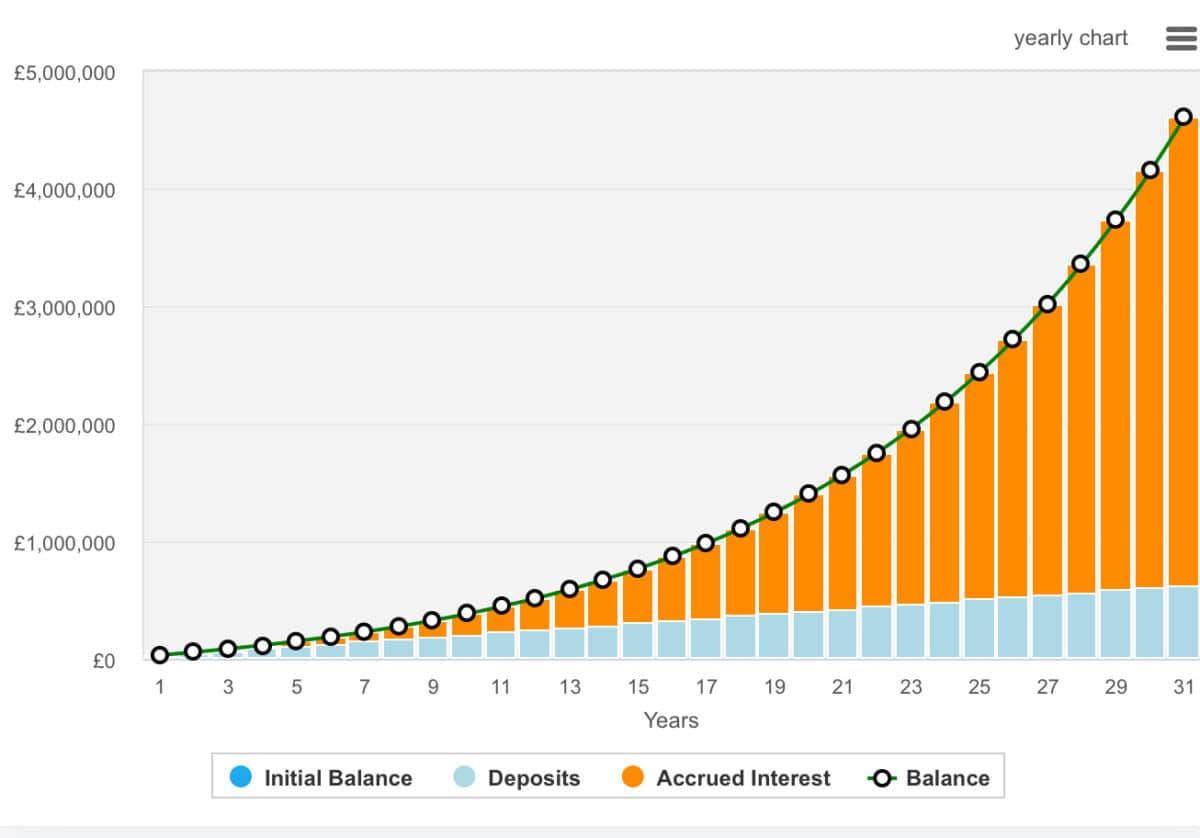

It’s also worth noting what can be achieved if an investor maxes out their ISA (£20,000 per year of contributions) and achieves a higher but achievable 10% annualised growth rate. Using 31 years as a comparison point, the below chart shows £8,800 transform into £4.6m.

Of course, this is just an example. Many novice investors lose money chasing get-rich-quick dreams. And I appreciate that I could fall short of 10% annualised returns.

A stock for the job

While I have a diversified portfolio of individual stocks, a core part of my portfolio is an investment trust called Scottish Mortgage Investment Trust (LSE:SMT). I believe it’s an opportunity investors should consider for the long run.

Scottish Mortgage offers access to a portfolio of global growth companies, with major holdings including MercadoLibre, Amazon, and Meta Platforms, as well as private companies like SpaceX.

The trust’s long-term approach has delivered strong returns. It recently outperformed its benchmark thanks to exposure to artificial intelligence and technology leaders.

However, there are risks. The trust employs gearing — currently around 9% — which can amplify both gains and losses, making it more volatile in turbulent markets.

Another consideration is the persistent discount to net asset value (NAV), which stands at about 10%–11%, despite significant share buybacks aimed at narrowing this gap. This may reflect investor concerns about getting their hands burned twice after the stock slumped in 2021. It may also reflect concerns about the valuation of private companies within the portfolio.

As such, Scottish Mortgage is higher-risk choice for patient, long-term investors. In the long run, I believe it’s likely to outperform the market. But in the near term, I’m braced for volatility. In fact, I typically use pullbacks as an opportunity to top up my position.

The post £8,800 in savings? Here’s how investors could turn that into a £20,000 second income… with time appeared first on The Motley Fool UK.

5 stocks for trying to build wealth after 50

The cost of living crisis shows no signs of slowing… the conflict in the Middle East and Ukraine shows no sign of resolution, while the global economy could be teetering on the brink of recession.

Whether you’re a newbie investor or a seasoned pro, deciding which stocks to add to your shopping list can be a daunting prospect during such unprecedented times. Yet despite the stock market’s recent gains, we think many shares still trade at a discount to their true value.

Fortunately, The Motley Fool UK analyst team have short-listed five companies that they believe STILL boast significant long-term growth prospects despite the global upheaval…

We’re sharing the names in a special FREE investing report that you can download today. We believe these stocks could be a great fit for any well-diversified portfolio with the goal of building wealth in your 50’s.

More reading

- Want to turn a £20k ISA into a £1m portfolio? Here’s how

- £20,000 in savings? Here’s how that could be the start of a £1m Stocks & Shares ISA

- 3 reasons I’m bullish on Scottish Mortgage shares

- With a spare £200, here’s how someone in their 20s could start buying shares today

- The Trump-Musk spat could have implications for the Scottish Mortgage share price

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. James Fox has positions in Scottish Mortgage Investment Trust Plc. The Motley Fool UK has recommended Amazon, MercadoLibre, and Meta Platforms. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.