Over the last 3 years, this British investment fund has delivered nearly double the return of the FTSE 100

Actively-managed investment funds sometimes get a bad rap. And thatâs fair enough â many are pretty average. Yet there are great products out there that could be worth considering as part of a diversified portfolio. Hereâs one British fund that has returned nearly twice that of the FTSE 100 index over the last three years.

An under-the-radar fund

The product in focus today is the VT Holland Advisors Equity Fund. Itâs run by Andrew Hollingworth whose firm, Holland Advisors, is based in Surrey.

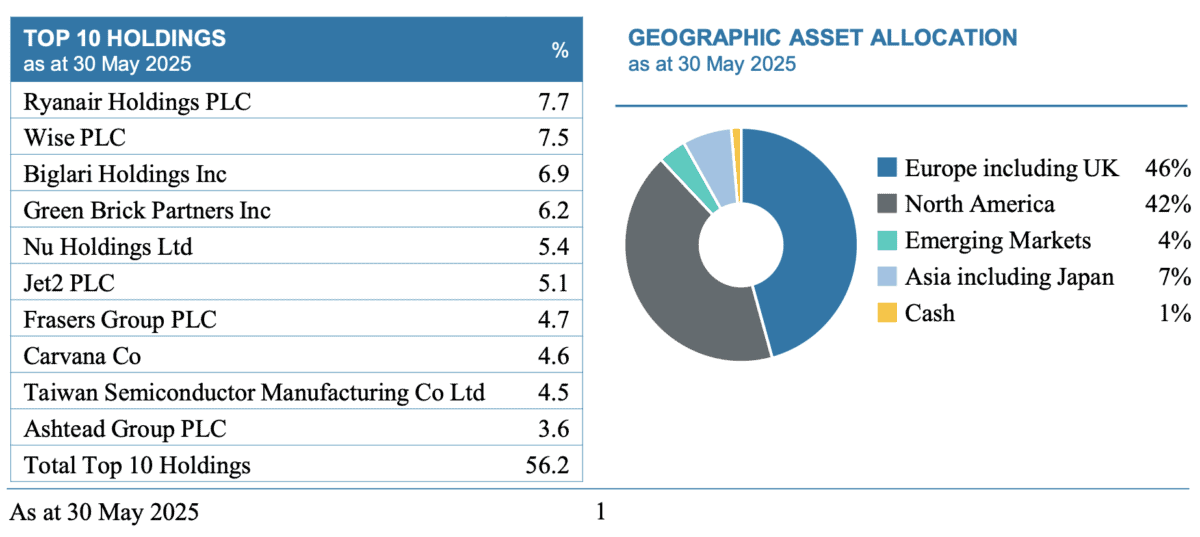

This is a global equity fund, meaning that it can invest in stocks listed internationally. However, it has a strong focus on the UK market today â the latest factsheet (for May) showed a 46% allocation to Europe including the UK.

In terms of performance, the fund returned 54.6% for the three-year period to the end of May. That compares to a return of 29.4% for the FTSE 100.

A unique strategy

What I like about this fund is that it offers something unique. When you look at the investment style and holdings, you quickly realise that this is very different to your average investment fund.

For a start, itâs unconstrained. In other words, the fund manager has the freedom to invest wherever he sees an opportunity and make big bets on individual companies if he wants to.

Itâs also a high-conviction âconcentratedâ fund. At the end of May, it only held 27 stocks.

Where things get really interesting, however, is Hollingworth’s specific area of focus. Essentially, heâs trying to identify powerful compounding businesses that are run by aligned owner-managers, and invest in them (for the long term) when theyâre unloved and undervalued.

In many ways, itâs a similar approach to that of Warren Buffett. Ultimately, you could say the style combines growth, quality, and value investing.

A winning business model

One particular business model the fund manager is attracted to is whatâs known as âscale economies sharedâ. This is where a company reduces fees for customers as it grows in size.

A stock in the fund at present (7.5% of the portfolio at the end of May) that has this kind of business model is Wise (LSE: WISE). Itâs one of the worldâs top international money transfer businesses.

As this founder-led company has become bigger over the years it has reduced its fees for customers. As a result, those fees are significantly lower than those of a lot of competitors today.

This provides a competitive advantage and keeps customers locked in. And it has helped the company generate huge growth in recent years (revenues have nearly tripled over the last three years).

Itâs worth noting that Hollingworth first invested in Wise a few years ago when it was unloved and trading at much lower levels. So, heâs done well from the stock.

Personally, I believe Wise is still worth considering at current levels. A global economic slowdown is a risk in the short term but I think it will do well in the long run.

Worth a look?

What about the VT Holland Advisors Equity Fund though? Is it worth considering?

I believe so. The unconstrained and concentrated nature of the fund is a major risk (it could perform very differently to a big index), but I really like the investment approach here.

The post Over the last 3 years, this British investment fund has delivered nearly double the return of the FTSE 100 appeared first on The Motley Fool UK.

Of course, there are plenty of other passive income opportunities to explore. And these may be even more lucrative:

We think earning passive income has never been easier

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

More reading

- This popular UK stock is shifting to the US. Here’s what I think it means for the share price

- The Wise share price jumps 12% on US primary listing news

- How Iâm using Warren Buffettâs winning formula to grow my retirement savings

- What the £2.9bn Deliveroo acquisition says about UK shares — and who’s next?

Edward Sheldon has positions in Wise. The Motley Fool UK has recommended Wise Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.