2 amazing UK stocks I wish I’d bought for my ISA!

It’s impossible to know which growth stocks are going to massively outperform the UK market. That said, there are some I certainly wish I’d bought for my Stocks and Shares ISA three years ago.

Here are two of them.

SpaceX-fuelled growth

Filtronic (LSE: FTC) has been on fire in 2025 – it’s up 105%. Over three years, it’s rocketed by 1,367%!

Speaking of rockets, Filtronic signed a strategic partnership with SpaceX in 2024 to supply radio-frequency modules for the US firm’s satellite internet constellation (Starlink).

This relationship has gone from strength to strength, and earlier this month Filtronic received a follow-on order from SpaceX worth $32.5m (£24m). This was the largest deal in value so far, and it’s expected to be fulfilled in FY26 (which has just started).

Consequently, management is confident it “will exceed current revenue expectations” for this fiscal year. That previous expectation was for roughly £52m, up from £16.3m in FY2023.

Meanwhile, Filtronic says it’s continuing to invest in its technology roadmap to capitalise on “the sizeable market opportunity”.

This opportunity does look large. With SpaceX continuing to deploy more satellites, additional ground infrastructure will be needed, thereby presumably driving further demand for the Filtronic’s modules.

Additionally, there should be growth opportunities in the defence market, to which Filtronic supplies components for military communication and radar systems. Customers include BAE Systems.

What could go wrong? Well, the importance of the SpaceX partnership can’t be overstated. It already made up the bulk of the firm’s sales prior to this latest order. In other words, there’s now significant customer concentration risk.

The stock also looks pricey. According to the latest forecasts, the forward price-to-earnings (P/E) ratio is nearly 54. So investors today are having to cough up to invest in this SpaceX-related growth story.

Fintech disruptor

A second UK stock I wish I’d bought earlier is Wise (LSE: WISE). It’s up 43% in the past 12 months and 173% over three years.

Wise is a global fintech firm that specialises in low-cost international money transfers. Its fees are dramatically lower than those of traditional banks and it continues to attract consumers and business.

For the year ended 31 March, it moved £145.2bn across borders for 15.6m people and businesses, a 23% year-on-year increase. Roughly 65% of transactions were completed in under 20 seconds!

Revenue jumped 15% to £1.2bn, while underlying pre-tax profit climbed 17% to £282m. That was equivalent to an underlying pre-tax margin of 21%. Earnings per share rose 18% to 40.4p.

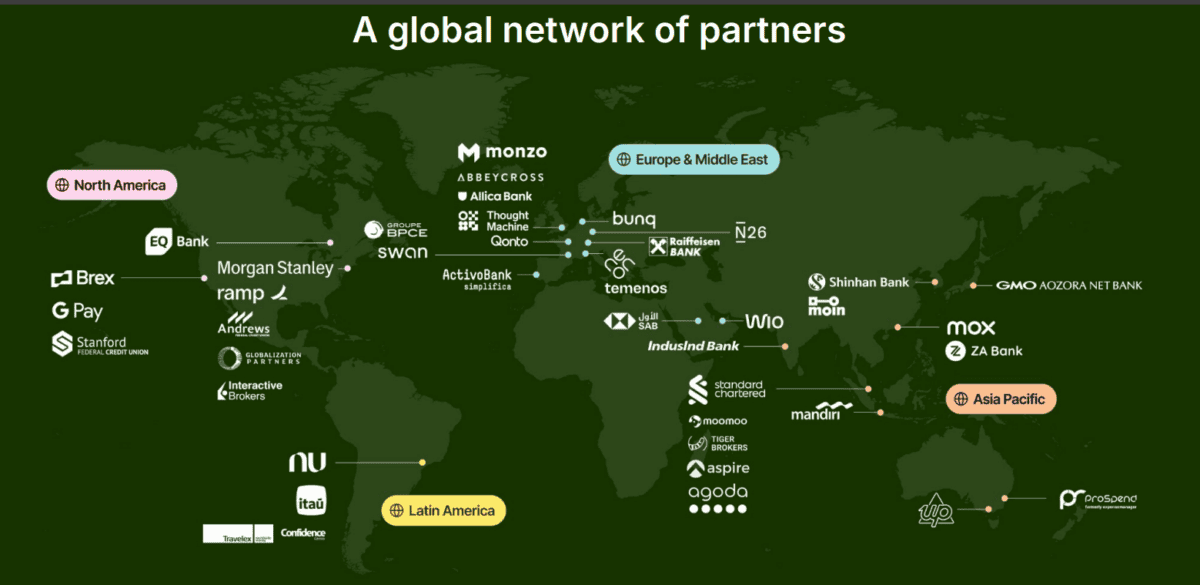

Meanwhile, Wise expanded its global reach by connecting to new domestic payment systems in the Philippines, Japan, and Brazil. And it signed major new partnerships with Morgan Stanley, Standard Chartered, and Nubank.

I’d say the biggest risk is the uncertain economic backdrop. Were a global recession to occur, cross-border activity could quickly slow down.

Interestingly though, Wise is now the 11th-largest holding for FTSE 100 investment trust Scottish Mortgage. It says: “Multiple growth avenues are open to Wise…these opportunities give Wise the ability to grow many times from its current base.”

Looking ahead, the firm sees a $32trn market for its infrastructure. So the long-term growth opportunity remains very large indeed.

Of the two stocks here, I prefer Wise. It’s trading at 28.3 times forward earnings, and I think it’s well worth considering.

The post 2 amazing UK stocks I wish I’d bought for my ISA! appeared first on The Motley Fool UK.

Should you buy Filtronic Plc now?

Don’t make any big decisions yet.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — has revealed 5 Shares for the Future of Energy.

And he believes they could bring spectacular returns over the next decade.

Since the war in Ukraine, nations everywhere are scrambling for energy independence,

he says. Meanwhile, they’re hellbent on achieving net zero emissions.

No guarantees, but history shows…

When such enormous changes hit a big industry, informed investors can potentially get rich.

So, with his new report, Mark’s aiming to put more investors in this enviable position.

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

- Over the last 3 years, this British investment fund has delivered nearly double the return of the FTSE 100

- This former penny stock fell 10% after the Musk-Trump clash! Time to buy?

- This popular UK stock is shifting to the US. Here’s what I think it means for the share price

- The Wise share price jumps 12% on US primary listing news

- How I’m using Warren Buffett’s winning formula to grow my retirement savings

Ben McPoland has positions in BAE Systems, Nu Holdings, and Scottish Mortgage Investment Trust Plc. The Motley Fool UK has recommended BAE Systems, Nu Holdings, Standard Chartered Plc, and Wise Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.