3 high-yield dividend stocks, investment trusts and ETFs to target a long-term passive income!

History shows that owning a wide range of dividend stocks, investment trusts and exchange-traded funds (ETFs) can be an effective method of making passive income over time. Doing so reduces the impact of dividend trouble among one or two shares on overall shareholder returns.

I think the following mini-portfolio — offering exposure to a total of 346 companies — could be a great way to target a large, reliable and growing second income over time. Here’s why I think they’re worth serious consideration.

The dividend stock

FTSE 100 company M&G‘s (LSE:MNG) been lifting dividends consistently since it was spun off from Prudential in 2019. Though profits have been up and down due to rising interest rates and weak economic growth, payouts have kept rising thanks to the firm’s robust balance sheet.

With a Solvency II ratio of 223%, it looks in good shape to keep this record going.

Recent share price strength has pulled its dividend yield away from double-digit percentage territory. But at 8.1%, it still packs the third-largest yield on the Footsie today.

This is also more than double the blue-chip index’s broader average of 3.4%.

M&G’s share price could reverse if economic conditions worsen. But the long-term outlook here is robust, in my opinion, as an ageing population drives demand for its investment and retirement products.

The ETF

At 8.8%, the forward yield on the iShares World Equity High Income ETF (LSE:WINC) also leaves the FTSE 100’s corresponding average in the dust. And with holdings in 344 different companies, it’s capital allocation effectively protects investor returns if a handful of shares deliver disappointing dividends.

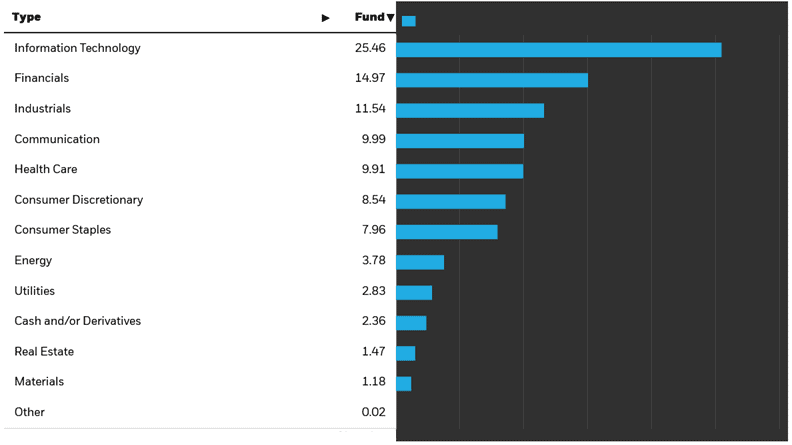

As the chart above shows, this fund invests in a wide range of sectors, reducing risk and providing a smooth return across the economic cycle. It also holds money in US goverment bonds and cash for added robustness.

What’s more, as its name implies, the product invests in shares from across the globe, including the US (67.8% of the portfolio), Japan (6.9%), France (2.9%) and the UK (2.2%).

This high weighting of US shares could impact performance if investors rotate away from North America. But I think it balances risk and return pretty effectively.

The investment trust

Primary Health Properties (LSE:PHP) is a real estate investment trust (REIT) which can make it ideal for dividend income. Sector rules dictate that a minimum of 90% of annual rental profits must be paid out in cash to investors.

This REIT has specifically proven one of the best dividend-paying REITs in recent decades. Shareholder rewards have risen each year since the mid-1990s.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

It’s a record that also reflects its supreme earnings stability. By renting out primary healthcare facilities, it benefits from an ultra-defensive sector where around 90% of rents are funded by government bodies.

Higher interest rates have weighed on Primary Health’s share price in recent years. While this remains a risk, signs of falling inflation suggests better times could be ahead.

The dividend yield here is a big 7%.

The post 3 high-yield dividend stocks, investment trusts and ETFs to target a long-term passive income! appeared first on The Motley Fool UK.

Investing in AI: 3 Stocks with Huge Potential!

🤖 Are you fascinated by the potential of AI? 🤖

Imagine investing in cutting-edge technology just once, then watching as it evolves and grows, transforming industries and potentially even yielding substantial returns.

If the idea of being part of the AI revolution excites you, along with the prospect of significant potential gains on your initial investment…

Then you won’t want to miss this special report inside Motley Fool Share Advisor – ‘AI Front Runners: 3 Surprising Stocks Riding The AI Wave’!

And today, we’re giving you exclusive access to ONE of these top AI stock picks, absolutely free!

More reading

- 3 potentially hot UK stocks to consider buying in July

- Back below £1, is this FTSE 250 stock an unmissable passive income opportunity?

- 3 FTSE 100 stocks with low P/E ratios to consider buying right now

- See how much an investor needs in an ISA to fund an £888 monthly passive income

- £20,000 in savings? Here’s how it could be used to target passive income of £913 each month

Royston Wild has positions in Primary Health Properties Plc and Prudential Plc. The Motley Fool UK has recommended M&g Plc, Primary Health Properties Plc, and Prudential Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.