The FTSE 100’s worst stock for passive income could be a long-term growth opportunity to consider!

Founded in 1996, Polar Capital Technology Trust‘s (LSE:PCT) a stock that won’t appeal to those on the lookout for passive income opportunities. That’s because it doesn’t pay a dividend. In fact, it never has. And it’s the only current member of the FTSE 100 that adopts this approach to shareholder distributions.

Instead, it focuses on capital growth.

Recent performance

During the five years to 31 May, the trust’s share price has increased 71% and its net asset value’s risen 119%.

This compares favourably to another FTSE 100 technology-focused trust – Scottish Mortgage Investment Trust – that’s seen its share price rise by 38% during this period. However, this fund invests heavily in unquoted companies, which can be difficult to value.

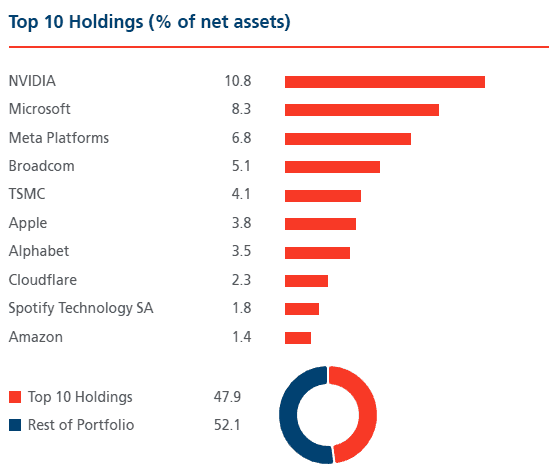

By contrast, much of Polar Capital’s growth can be attributed to having positions in each of the ‘Magnificent 7’. At the end of May, six of these stocks were in the trust’s top 10 holdings. However, it should be pointed out that an equal investment in all seven would have generated a return of over 300% since June 2020.

Diversification’s key

But it’s wise to have a diversified portfolio. By spreading risk across multiple positions, it’s possible to mitigate some of the volatility that arises from investing in the stock market.

And that’s one of the advantages of an investment trust. By owning one stock, an investor will have exposure to multiple companies often in different jurisdictions.

However, although Polar Capital has positions in 98 stocks, they’re all in the same sector. Its manager is particularly keen on artificial intelligence (AI). Indeed, it describes itself as an “AI maximalist”.

Also, over 30% of its exposure is to the semiconductor industry. This could be a concern because history tells us that these types of stocks can be volatile. The tech-heavy Nasdaq dropped 75% between March 2000 and October 2002.

My view

But the trust’s currently (27 June) trading at a near-10% discount to its net asset value. In theory, this means it’s possible to gain exposure to the world’s biggest tech stocks for less than their market value.

However, over 70% of its value comes from North American stocks. Here, there’s still a significant degree of uncertainty as to how President Trump’s approach to tariffs will affect the economy. According to JP Morgan, there’s a 40% chance of a recession this year. And due to their lofty valuations, a downturn’s likely to affect the tech sector — and the Magnificent 7 in particular — more than most.

For those who believe technology stocks will continue to deliver over the long term, I think Polar Capital Technology Trust’s a share to consider. But only as part of a well-diversified portfolio. And anyone taking a position shouldn’t expect to receive a dividend any time soon.

The post The FTSE 100’s worst stock for passive income could be a long-term growth opportunity to consider! appeared first on The Motley Fool UK.

But this isn’t the only opportunity that’s caught my attention this week. Here are:

5 Shares for the Future of Energy

Investors who don’t own energy shares need to see this now.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — sees 2 key reasons why energy is set to soar.

While sanctions slam Russian supplies, nations are also racing to achieve net zero emissions,

he says. Mark believes 5 companies in particular are poised for spectacular profits.

Open this new report — 5 Shares for the Future of Energy

— and discover:

- Britain’s Energy Fort Knox, now controlling 30% of UK energy storage

- How to potentially get paid by the weather

- Electric Vehicles’ secret

backdoor

opportunity - One dead simple stock for the new nuclear boom

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

- Is the stock market about to crash?

- The FTSE 100 may be soaring, but these two trusts still look heavily undervalued

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. JPMorgan Chase is an advertising partner of Motley Fool Money. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. James Beard has no position in any of the shares mentioned. The Motley Fool UK has recommended Amazon, Apple, Cloudflare, Meta Platforms, Microsoft, and Nvidia. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.