Will AstraZeneca be the next FTSE 100 stock to move to the US?

The AstraZeneca (LSE:AZN) share price rose 2.5% yesterday (1 July) on news that the company is considering moving its shares to the US. That’s been a popular theme for UK stocks recently.

CEO Pascal Soriot has been critical of the UK’s approach to drug companies. But I’m not sure moving to the US would be an improvement.

Price controls

Developing new treatments is a risky and expensive business. And there’s an interesting question as to how firms that do this successfully – like AstraZeneca – should be compensated.

One of the things Soriot has objected to is the UK’s price controls, which limit how much the NHS pays for treatments. But it’s hard to see how things are much more favourable in the US.

In the UK, the National Institute for Health and Care Excellence (NICE) assesses drugs – such as Astrazeneca’s – for cost-effectiveness. This limits what the NHS is prepared to pay for them.

NICE’s decision to classify metastatic breast cancer as ‘moderately severe’ rather than ‘severe’ has been negative for AstraZeneca. But is the US likely to be more lucrative?

Robert F Kennedy – the current US Health Secretary – has announced plans to limit drug prices. The stated aim is to stop the US paying more than other countries for the same treatments.

This makes it look a lot like the US is moving towards the UK-style price controls. And that would seem to limit the extent to which it’s a more attractive place for AstraZeneca to be listed.

Valuation

Of course, another major reason UK stocks have been moving their listings across the Atlantic is valuation. The S&P 500 trades at much higher valuations than the FTSE 100 and that’s not an accident.

Listing in the US therefore makes a lot of sense for companies that are looking to give their share prices a boost. But AstraZeneca is a strange candidate from this perspective.

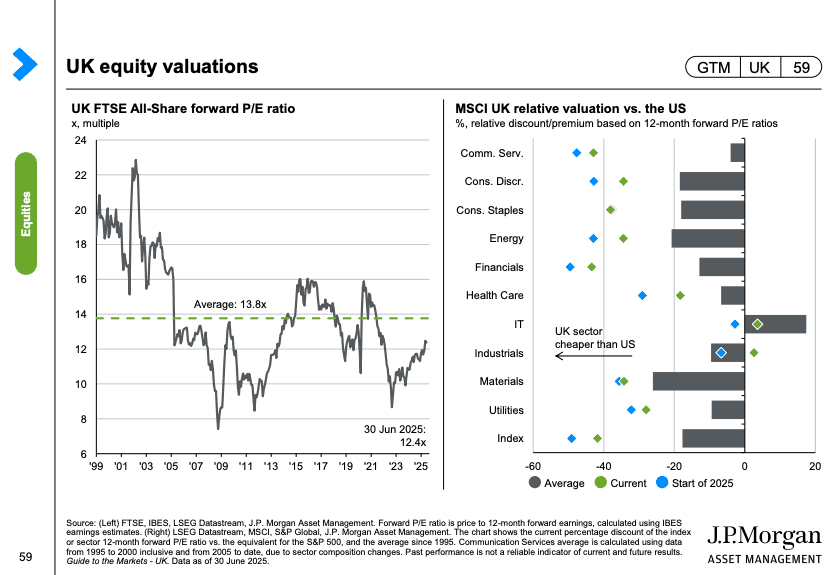

Source: JP Morgan Guide to the Markets UK Q3 2025

According to data from JP Morgan, healthcare is one of the sectors where the difference in valuation is the most narrow. And the gap has closed significantly since the start of the year.

Over the last 12 months, healthcare has been the single worst-performing sector for the S&P 500. And this has been showing up in the multiples that US stocks have been trading at.

Pfizer, Merck, and Bristol-Myers Squibb all currently trade at unusually low price-to-earnings (P/E) ratios. A good amount of this is the result of the changing regulatory environment in the US.

By contrast, AstraZeneca shares currently trade at a P/E ratio of 27. That’s high by just about any standard and makes it unlikely that moving to the US would attract a much higher multiple.

I’m not convinced

Lower multiples and a notably hostile regulatory environment mean I’m not convinced AstraZeneca has much to gain by moving to the US. But that might not be the plan.

Given the frustration Soriot has expressed at UK price controls, talk of leaving might just be a negotiating tactic to try and improve things. That seems to be the fashion at the moment.

In any event, I don’t think AstraZeneca is about to unlock meaningful value for shareholders by shifting its listing. This doesn’t look like much of an opportunity to consider to me.

The post Will AstraZeneca be the next FTSE 100 stock to move to the US? appeared first on The Motley Fool UK.

5 Shares for the Future of Energy

Investors who don’t own energy shares need to see this now.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — sees 2 key reasons why energy is set to soar.

While sanctions slam Russian supplies, nations are also racing to achieve net zero emissions,

he says. Mark believes 5 companies in particular are poised for spectacular profits.

Open this new report — 5 Shares for the Future of Energy

— and discover:

- Britain’s Energy Fort Knox, now controlling 30% of UK energy storage

- How to potentially get paid by the weather

- Electric Vehicles’ secret

backdoor

opportunity - One dead simple stock for the new nuclear boom

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

- 5 top FTSE 100 stocks offering plenty of global growth for an ISA

- At a bargain-basement valuation now, is AstraZeneca’s share price impossible for me to ignore?

- These 5 UK shares could supercharge investors’ pension savings by 21.7% in just 1 year

- FTSE 100 shares to consider buying for a well balanced Stocks and Shares ISA

JPMorgan Chase is an advertising partner of Motley Fool Money. Stephen Wright has no position in any of the shares mentioned. The Motley Fool UK has recommended AstraZeneca Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.