1 of the UK’s best growth stocks to consider buying in July

With the FTSE 100 close to all-time highs, investors need to look carefully for opportunities. And this is especially true when it comes to growth stocks.

There is, however, one UK stock that I think growth investors should pay attention to at the moment. Despite trading at a high multiple, itâs better value than it looks.

Safety first

Halma (LSE:HLMA) is a collection of technology businesses focused on safety. And itâs been one of the FTSE 100âs best-performing stocks over the last 10 years.

This is partly the result of the firmâs impressive sales growth. Over the last decade, revenues have increased by an average of 12% per year â thatâs faster than Apple (8%) or Microsoft (11%).

Buying other businesses has been a key part of Halmaâs growth strategy. It looks to acquire companies that have leading positions in niche industries, making them difficult to disrupt.

This is an inherently risky strategy â paying too much for a business is always a possibility and it can destroy value for shareholders. But the FTSE 100 firm has done very well recently.

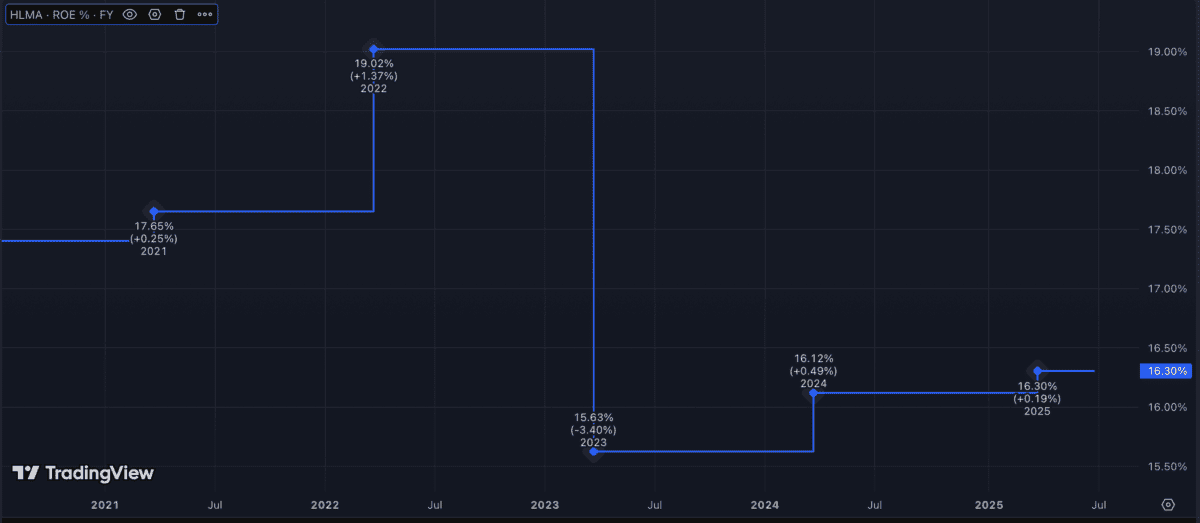

Over the last five years, Halmaâs returns on equity have been very stable at around 17%. Thatâs a very good sign the company is managing to avoid overpaying for its acquisitions.

Source: TradingView

Source: TradingView

This is very encouraging, but â as Warren Buffett points out â itâs possible to pay too much even for shares in an outstanding business. Fortunately, I think the stock is actually unusually cheap.

Valuation

At first sight, Halma doesnât look cheap. The stock trades at a price-to-earnings (P/E) ratio of 41, which is extremely high compared to the FTSE 100 average of just below 18.

Appearances, however, can be deceptive. The companyâs acquisition-based growth strategy means the amortisation costs on its income statement are unusually high.

As a result, the firmâs net income doesnât always give a good indication of the cash the business generates. This is something investors need to take note of.

Source: TradingView

In terms of free cash flow, Halma shares are actually trading at an unusually low multiple at the moment. This is why I think the stock is worth considering at todayâs prices.

Looking further ahead, management expects to be able to generate revenue growth of around 7% per year. And thatâs from existing operations â without factoring in acquisitions.

If it achieves this while finding opportunities to buy businesses at attractive prices, the stock could be a great investment. The companyâs winning formula could still have a way to go.

Growth investing

Over the long term, a companyâs shares go up for one of two reasons. Either the underlying business makes more money, or the multiple the stock trades at increases.

Obviously, the best investment opportunities are those where thereâs scope for both. And I think Halma might fit the bill for UK investors.

The underlying business continues to grow strongly, driven by disciplined acquisitions. So while the shares trade at an unusually low multiple, investors should at least take a look.

The post 1 of the UK’s best growth stocks to consider buying in July appeared first on The Motley Fool UK.

Investing in AI: 3 Stocks with Huge Potential!

🤖 Are you fascinated by the potential of AI? 🤖

Imagine investing in cutting-edge technology just once, then watching as it evolves and grows, transforming industries and potentially even yielding substantial returns.

If the idea of being part of the AI revolution excites you, along with the prospect of significant potential gains on your initial investmentâ¦

Then you won’t want to miss this special report inside Motley Fool Share Advisor – ‘AI Front Runners: 3 Surprising Stocks Riding The AI Wave’!

And today, we’re giving you exclusive access to ONE of these top AI stock picks, absolutely free!

More reading

- Is it time for me to buy this FTSE 100 investment darling after its strong 2024/25 results?

- Halma shares surge on outstanding results. But is there trouble ahead?

- 1 FTSE 100 stock to watch this week

Stephen Wright has positions in Apple. The Motley Fool UK has recommended Apple, Halma Plc, and Microsoft. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.