How investors can aim to get rich and retire early by following Warren Buffett

Warren Buffett’s path to wealth is defined by a deceptively simple mantra: “Rule No. 1: Never lose money. Rule No. 2: Never forget Rule No. 1.” This principle isn’t about eliminating all risk, but about preserving capital and avoiding the kind of large, permanent losses that can devastate long-term returns.

The mathematics are punishing: lose 50% on an investment, and you’ll need a 100% gain just to break even. Buffett’s focus on capital preservation — through buying quality businesses, insisting on a margin of safety, and steering clear of speculation — has allowed him to generate above-average returns for decades.

How can I ‘get rich’?

But what does ‘getting rich’ mean? For some, it’s financial independence or the freedom to retire early; for others, it’s simply security and peace of mind. Whatever your definition, Buffett’s approach offers a blueprint.

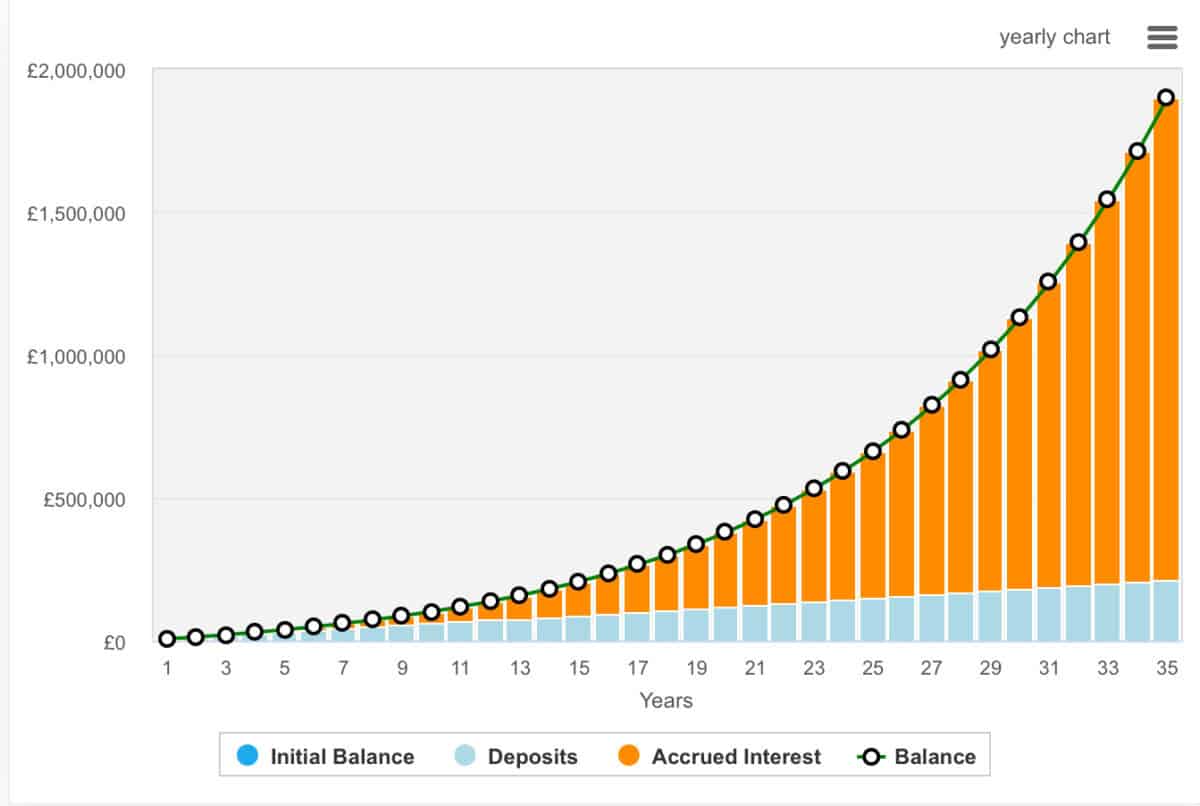

Consider an investor who puts away £500 per month for 35 years, compounding at 10% annually. The result is astonishing. By year 35, their portfolio could grow to nearly £1.9m, with the majority of that growth coming from compounding returns rather than contributions.

The key is not just chasing high returns, but avoiding big mistakes and letting time and discipline work their magic. Buffett’s strategy is a lesson in patience, research, and risk management. By focusing on quality, understanding what you own, and refusing to let losses spiral, investors can steadily build wealth and, potentially, retire far earlier than they ever imagined.

The above graph shows the path to £1.9m in 35 years. This would be enough to comfortably deliver around £90,000 annually (tax-free in an ISA) without touching the principal.

However, it’s worth noting that £90,000 in 35 years is worth approximately £37,923 in today’s money. That’s assuming an average annual inflation rate of 2.5%. This calculation uses the present value formula, which discounts the future sum by the cumulative effect of inflation over 35 years.

Where to invest?

Pinterest (NYSE:PINS) isn’t a Buffett investment, but I’d argue that it has a margin of safety and this is highlighted by its low forward price-to-earnings-to-growth (PEG) ratio of 0.6, suggesting the stock is undervalued relative to its impressive earnings growth outlook. This metric is well below the sector average (1.46), suggesting that Pinterest’s strong projected profit expansion isn’t fully priced in.

The company continues to deliver double-digit revenue growth, record user engagement, and expanding margins, all supported by AI-driven innovation and strategic partnerships.

However, it’s not risk-free. Pinterest operates in a fiercely competitive digital advertising market, facing giants like Meta and Google. Investors are likely concerned that its peers could enhance their visual discovery or shopping features and eat away at Pinterest’s position.

I’d argue, however, that there’s no evidence of that yet, and that Pinterest’s niche might just be its greatest strength. It’s one of my favourite investments of 2025 and I believe it deserves wider consideration.

The post How investors can aim to get rich and retire early by following Warren Buffett appeared first on The Motley Fool UK.

But what does the head of The Motley Fool’s investing team think?

Should you invest £1,000 in Pinterest right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Pinterest made the list?

More reading

- 2 US stocks to consider buying in July!

- Strong pound, weak dollar: an unmissable opportunity to buy US stocks?

- Are these the best American stocks for my ISA?

- £10,000 invested in Pinterest shares 1 month ago is now worth…

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. James Fox has positions in Alphabet and Pinterest. The Motley Fool UK has recommended Alphabet, Meta Platforms, and Pinterest. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.