Are these 2 of the best high-yield dividend growth shares to consider today?

I don’t think there’s a better way for me to source a passive income than by buying UK dividend shares. London’s stock market is packed with high-yield income stocks with strong balance sheets and robust market positions, of which many are also reliable dividend growth shares.

Here are two such dividend heavyweights I think deserve serious consideration. As you can see, their dividend yields comfortably beat the FTSE 100‘s prospective average of 3.4%.

| Dividend stock | Dividend growth | Dividend yield |

|---|---|---|

| Primary Health Properties (LSE:PHP) | 1.7% | 7.2% |

| Tritax Big Box (LSE:BBOX) | 4.4% | 5.6% |

Here’s why I think they could be among the best dividend shares for investors to consider right now.

Top trust

Under real estate investment trust (REIT) regulations, Primary Health Properties has to pay at least nine-tenths of yearly profits from its rental operations out in dividends.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

This can make REITs more dependable than other UK shares for a large and consistent dividend income. But it doesn’t guarantee it, as occupancy and rent collection issues can still strike shareholder returns.

However, Primary Health’s focus on an ultra-defensive industry greatly reduces such risks. It owns and operates first-contact properties like GP surgeries and community health centres, sites that remain busy at all points of the economic cycle.

Furthermore, almost all of its rental agreements are underpinned by NHS and government bodies, providing added stability over time.

Don’t be mistaken in thinking this sector is just brilliantly boring, however. It also has substantial opportunity for growth under the government’s new 10-year Health Plan to “[move] care from hospitals to the community“.

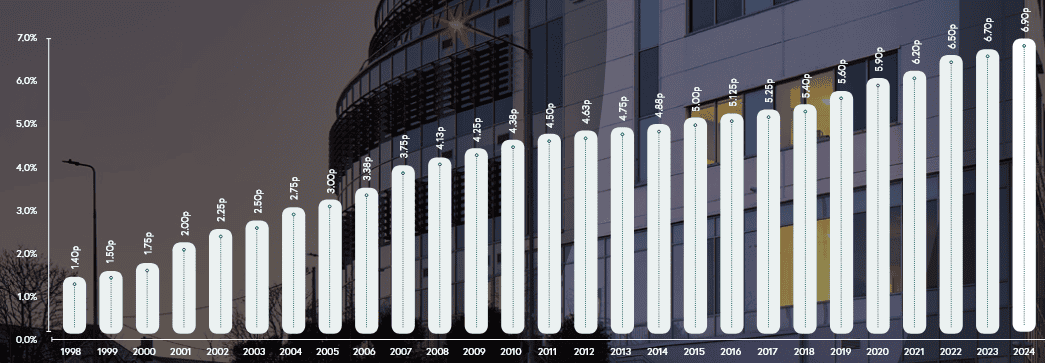

Primary Health has grown annual dividends each year since the mid-to-late 1990s. Threats to future growth include future changes to NHS policy and sector oversupply than dents rental rolls.

But on balance, I think it’s a great stock to consider, and one I hold in my own Stocks and Shares ISA.

Boxing clever

Tritax Big Box’s dividend growth policy isn’t quite as impressive as that of its FTSE 250 counterpart. One reason is that it’s only been in existence since 2013. Another reason is that the annual dividend fell for the first time during the height of the pandemic five years ago.

But this REIT has grown shareholder payouts steadily since then, and is tipped to continue through to 2027 at least. In fact, predicted dividend growth for this year is more than double the rate predicted for the broader UK share complex.

Tritax Big Box doesn’t operate in defensive sectors, which can leave profits vulnerable during lean periods. But its portfolio composition helps to reduce (if not totally eliminate) the threat to dividends and its share price.

It has more than 128 tenants on its books spread across 102 properties. These cover multiple industries and include blue-chip companies like Amazon and Ocado, providing strength through diversification.

With online shopping still growing, supply chains being onshored, and data centre demand increasing, I expect demand for its big box assets to rise over time. This could in turn deliver sustained long-term dividend growth.

The post Are these 2 of the best high-yield dividend growth shares to consider today? appeared first on The Motley Fool UK.

AI Revolution Awaits: Uncover Top Stock Picks for Massive Potential Gains!

Buckle up because we’re about to dive headfirst into the electrifying world of AI.

Imagine this: you make a single savvy investment in some cutting-edge technology, then kick back and watch as it revolutionises entire industries and potentially even lines your pockets.

If the mere thought of riding this AI wave excites you and the prospect of massive potential returns gets your pulse racing, then you’ve got to check out this Motley Fool Share Advisor report – ‘AI Front Runners: 3 Surprising Stocks Riding The AI Wave’!

And here’s the kicker – we’re giving you an exclusive peek at ONE of these top AI stock picks, absolutely free! How’s that for a bit of brilliance?

More reading

- 2 Strong Buy dividend shares to consider in July

- 3 high-yield dividend stocks, investment trusts and ETFs to target a long-term passive income!

- 3 potentially hot UK stocks to consider buying in July

- Back below £1, is this FTSE 250 stock an unmissable passive income opportunity?

- 2 cheap FTSE 250 shares I think investors MUST consider right now

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Royston Wild has positions in Primary Health Properties Plc and Target Healthcare REIT Plc. The Motley Fool UK has recommended Amazon and Primary Health Properties Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.