Has the death of the FTSE 100’s tobacco stocks been greatly exaggerated?

Yesterday (31 July), British American Tobacco (LSE:BATS), one of the FTSE 100âs two tobacco stocks, unveiled its results for the six months ended 30 June. And even though it’s undeniable that consumers are abandoning traditional cigarettes, the numbers were pretty good. For example, compared to the same period in 2024, adjusted earnings per share rose 1.6%.

A changing landscape

But in response to concerns about the health impact of nicotine, the groupâs transitioning to a smokeless world. Although it acknowledges that âthese products are not risk-free and are addictiveâ, it hopes to become a âpredominantlyâ smokeless business by 2035. That may well succeed and guarantee profitability long into the future.

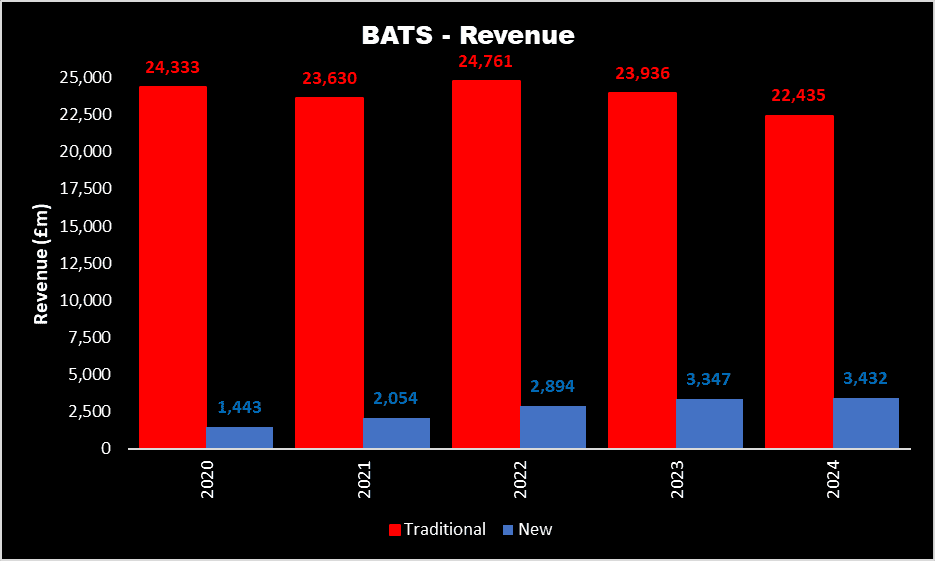

But thereâs still a long way to go. In 2021, it said it was âon a path to deliver £5bn of revenue and profitability from New Categories by 2025â.

From what I can see, that doesnât look like happening. However, the divisionâs expected to break even. Even so, in my opinion, itâs going to take a very long time (if ever) before these New Categories replicate the success of more traditional products.

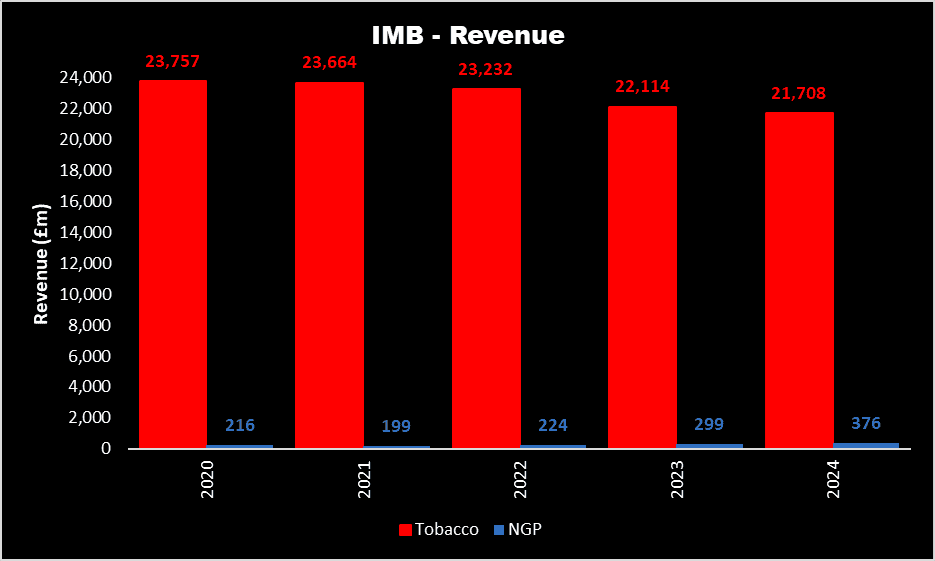

Itâs a similar story for Imperial Brands (LSE:IMB). During the year ended 30 September 2024, its Next Generation Products (NGPs) made an operating loss of £83m. By contrast, the groupâs tobacco business reported a profit of £3.3bn.

Overall, it generated £3.3bn of cash from its operations. However, British American Tobacco did better. In 2024, it produced over £10bn.

Enormous payouts

And these huge numbers mean the two stocks can pay generous dividends. Both companies are comfortably in the top 20% of FTSE 100 dividend payers.

| Stock | Share price (pence) | Dividends – last 12 months (pence) | Yield (%) |

|---|---|---|---|

| British American Tobacco | 4,039 | 237.88 | 5.9 |

| Imperial Brands Group | 2,948 | 188.68 | 6.4 |

But I canât see this lasting for three reasons. Firstly, these new products will cost more to develop. The basic design of cigarettes has remained unchanged for decades meaning very little has been spent on product development.

But New Categories and NGPs are more complex and are likely to require significant levels of capital expenditure to keep them fresh and relevant.

However, both companies already have relatively high levels of debt. I suspect they will be reluctant to increase their borrowings significantly. Instead, they might opt to use some of their operating free cash flow, which would leave less to return to shareholders.

Secondly, I suspect vapes and the like are more expensive to make. Thinner margins equals less spare cash. But even if Iâm wrong about their higher manufacturing cost, I canât see them matching the sales volumes of traditional products. Therefore, earnings are likely to be lower.

Finally, bans and restrictions could be imposed by increasingly health-conscious governments. Or they might seek to replace declining tobacco duties with higher taxes on these newer products. This would make them more expensive to buy and adversely impact sales.

Despite the attractive dividends on offer, I donât want to invest in tobacco stocks. Savvy investors usually take a long-term view. And in doing this, over the next decade or so, I canât see the industry being as profitable as it has been. But although I don’t believe their death’s imminent, I think tobacco stocks are probably in slow terminal decline. I reckon there are better opportunities for me elsewhere.

The post Has the death of the FTSE 100’s tobacco stocks been greatly exaggerated? appeared first on The Motley Fool UK.

More reading

- Can the British American Tobacco dividend keep growing?

- Up 15% in July! Is this FTSE 100 dividend growth superstar the best share to buy in August?

- 3 income-rich UK shares I’m comfortable to hold until 2035

- What investors need to save in an ISA to target a passive income of £1,500 a month

- 3 shares to consider for long-term passive income

James Beard has no position in any of the shares mentioned. The Motley Fool UK has recommended British American Tobacco P.l.c. and Imperial Brands Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.